Climate Risk Disclosure Proposal Would Destroy, Not Protect, Shareholder Value

Sen. Elizabeth Warren (D-MA) on Wednesday introduced legislation (S. 2075) to require publicly-traded companies to disclose climate-related risks to the Securities and Exchange Commission.

The text of the legislation is available here. Axios Generate reports that the legislation will require SEC-regulated companies to report their:

- Greenhouse gas emissions, both direct and indirect

- Fossil fuel assets

- Physical risks from climate change and risks stemming from the global transition to a lower-carbon economy

The bill has 15 co-sponsors, all Democrats, including Sens. Kamala Harris (D-CA), Cory Booker (D-NJ), and Amy Klobuchar (D-MN).

In an article posted Wednesday on Medium, Sen. Warren says she wants to use “the power of public markets to accelerate the adoption of clean energy.” Publicly traded companies have an obligation to share important business information, but, she claims, they “don’t share much about how climate change might affect their business, their customers, and their investors.”

Sen. Warren describes two types of climate-related risks. First, floods, wildfires, storms and other environmental impacts induced by climate change may inflict “economic losses” exceeding “those experienced in the housing crisis and the Great Recession.” That is theoretically possible but current data do not support the narrative of a climate crisis.

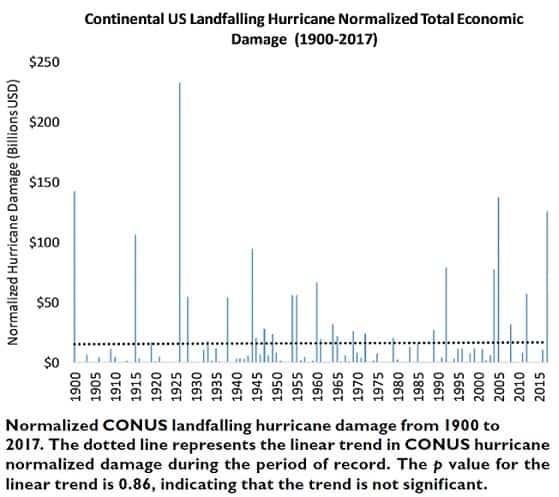

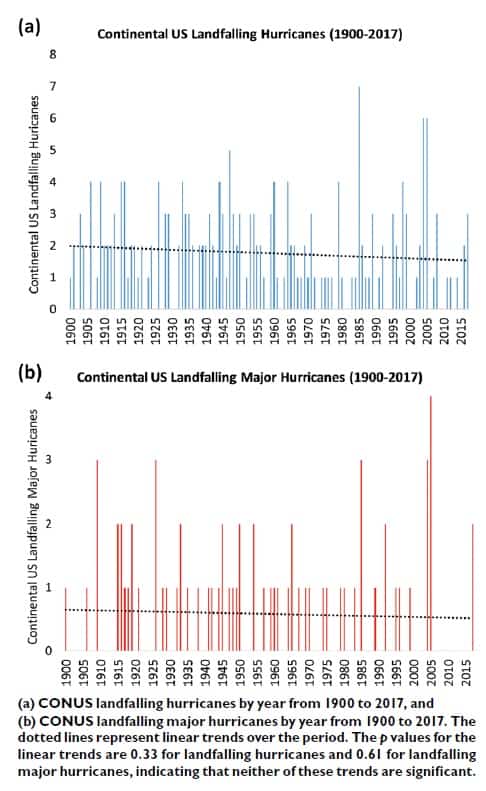

For example, when U.S. hurricane-related damages are adjusted for changes in population, wealth, and the consumer price index, there is no long-term increase in economic losses. That finding is consistent with meteorological data, which indicate no long-term increase in storm frequency or intensity.

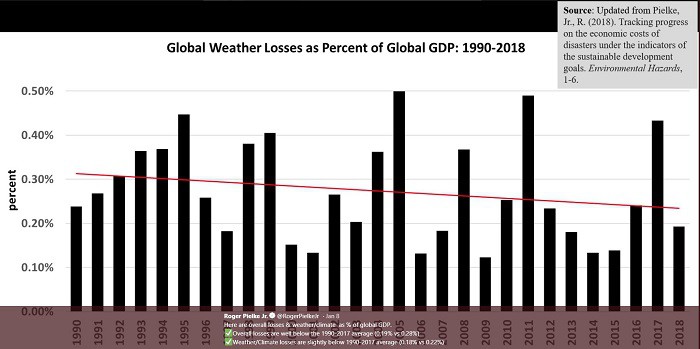

Global weather-related losses have increased in recent decades but that’s chiefly because there are more people and more stuff in harm’s way. Global population increased by 47 percent during 1990-2019 and global GDP increased by 111 percent during 1990-2017. Sen. Warren calls climate change an “existential threat” but economic losses related to natural disasters account for substantially less than 1 percent of global economic output, and the relative economic impact of extreme weather has declined since 1990. In other words, the global economy is growing faster than weather-related damages.

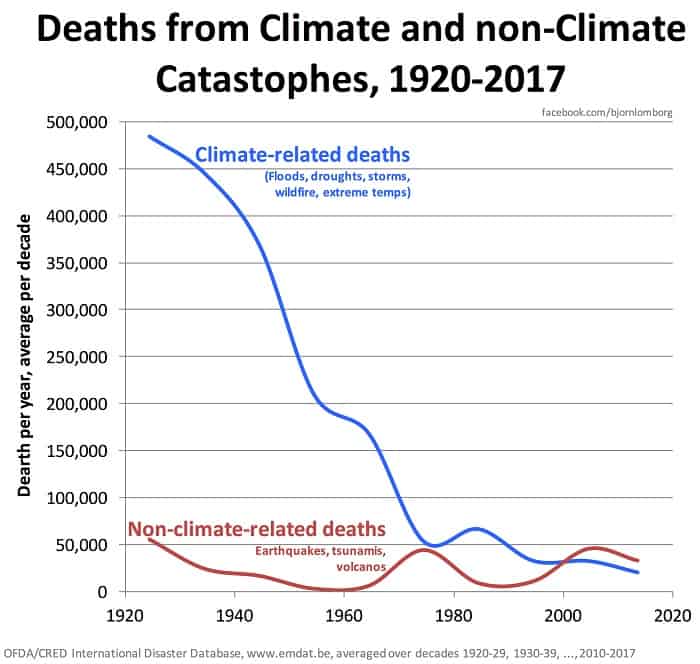

More importantly, despite the approximately 100 parts per million increase in atmospheric carbon dioxide concentrations, the global risk of anyone dying from extreme weather has declined by 99 percent since the 1920s.

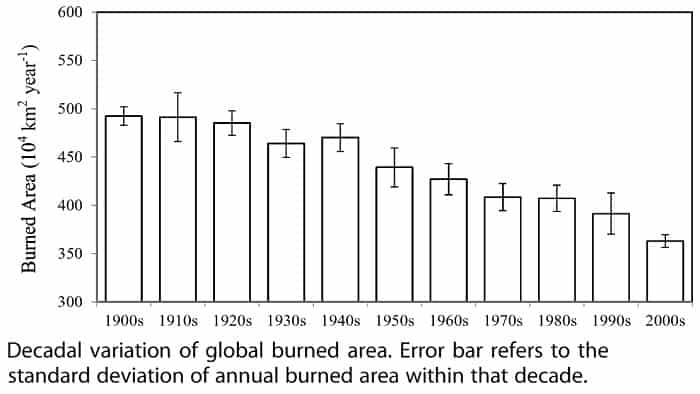

As for wildfires, total area burned is increasing in California. However, the role of global climate change is unclear because natural climatic factors, decades of forest mismanagement, and rapid population growth in the wildland-urban interface massively influence wildfire risk. Globally, total area burned in the 2000s was smaller than in any decade of the preceding hundred years.

Companies in hurricane-, flood- and fire-prone areas already have strong incentives—and legal obligations—to insure against such risks. The only value in requiring firms to report more information about extreme weather to the SEC is political. It will help institutionalize climate activism in corporate boardrooms and the investor community.

Sen. Warren’s legislation would also require SEC filings to disclose climate policy risks. She cheerfully explains that meeting the Paris Climate Agreement’s emissions goals could require that “at least 82 percent of global coal reserves, 49 percent of global gas reserves, and 33 percent of global oil reserves will have to go unused the next 30 years.”

She sums up:

My Climate Risk Disclosure plan addresses these problems by requiring companies to publicly disclose both of these types of climate-related risks. It directs the Securities and Exchange Commission to issue rules that make every public company disclose detailed information, including the likely effect on the company if climate change continues at its current pace and the likely effect on the company if the world successfully restricts greenhouse gas emissions to meet the targets of the Paris Agreement.

Lest anyone miss the point of the exercise, Sen. Warren elaborates:

My plan also requires the SEC to tailor these disclosure requirements for specific industries so that, for instance, fossil fuel companies will have to make even more detailed disclosures. . . . My plan will push more investors to move their money out of the fossil fuel industry, accelerating the transition to clean energy.

Sen. Warren’s legislation is part of a larger con. For years, progressive politicians and activists have campaigned for policies—carbon taxes, cap-and-trade, keep-it-in-the-ground prohibitions on drilling and mining—inimical to the survival of fossil energy companies. Then, through shareholder resolutions and legislation like the Warren bill, they demand that the companies report the financial risks those policies entail.

The chief point of requiring climate risk disclosure is to make fossil fuel companies confess that their business model is unsustainable in a carbon constrained world. Such confession would tend to scare away investors and depress stock prices. It would also set the stage for prosecution by progressive state attorneys general and trial lawyers. Comparing the updated filings to earlier iterations, prosecutors could claim the companies had defrauded shareholders by waiting until compelled to disclose climate risks. An increase in litigation risk would, of course, also tend to spur capital flight and hammer stock prices. As the targeted firms decline in wealth, market share, and number, so would their ability to fend off new climate taxes and regulations.

That’s the game Sen. Warren and shareholder activists are playing. I doubt they will succeed. First, it’s too clever by half. Disclosure activists claim they seek to “protect shareholder value” by ensuring stockholders know all the risks to which the company’s assets are exposed. Driving companies into bankruptcy destroys shareholder value. It should not be hard to expose this agenda as just another front in the war on affordable energy.

Second, the whole idea that Exxon stockholders need new SEC disclosure requirements to know that climate campaigners seek to tax and regulate their company out of existence is ridiculous.

Third, state attorneys general and trial lawyers have already launched several climate suits against fossil fuel companies under tort and investor fraud statutes. So far those efforts have been a bust.

The good news is Sen. Warren has all but blown the shareholder activists’ cover. As noted, her goal is to “push more investors to pull their money out of the fossil fuel industry.” Shareholders are harmed, not protected, when governments trigger capital flight from the industries in which they invest.