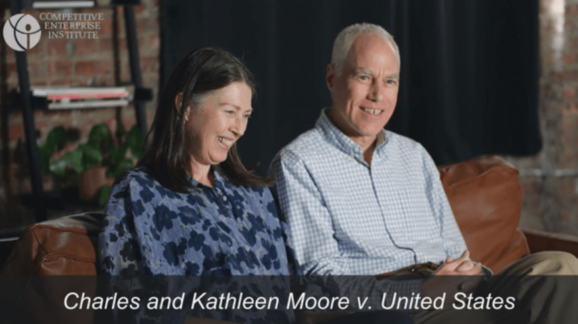

Kathleen and Charles Moore Prepare to take their Fight Against Taxing Unrealized Gains to Supreme Court

Photo Credit: Getty

In 2017, Congress passed the Tax Cuts and Jobs Act. The new law was a reform of the federal tax code, but also included a provision called the Mandatory Repatriation Tax or the Section 965 Transition Tax. This provision taxes U.S. citizens on certain accumulated foreign earnings of foreign corporations going back 30 years, even if the earnings have not been distributed. This means taxing people on income they never received and never owned.

Enter Kathleen and Charles Moore, a married couple from Washington state, who made a relatively small investment in an India-based company founded by a friend. The company, called KisanKraft, supplies power tools to small-scale, individual Indian farmers with the aim of making their operations more productive. The Moores had owned their shares in KisanKraft for more than a decade, but never received any income from the shares, because the company reinvested all its profits back into the business.

Help CEI fight against this unlawful tax law.

As the Moores explained in a recent CEI video, following passage of the Tax Cuts and Jobs Act, the IRS presented the couple with a bill for almost $15,000 in additional income tax owed despite never having received a dime from KisanKraft. Normally, such profits are not considered income unless shareholders either receive dividends or sell the shares for a capital gain. The Mandatory Repatriation Tax attempts to tax these funds as income through a legal fiction, by simply declaring them to be taxable income.

The Moores decided the law violated the Constitution’s requirement that direct federal taxes must be apportioned among the states, so the couple sued in District Court in Washington state. The district court sided with the federal government and upheld the tax. Next, the Moores appealed that decision to the Ninth Circuit Court of Appeals where a three-judge panel decided to affirm the decision of the district court. The Moores appealed for an en banc hearing of the full Ninth Circuit, but that appeal was denied.

Help CEI’s efforts to fight for the Moore family against this unlawful tax law.

Judge Bumatay, joined by judges Ikuta, Callahan, and VanDyke, thought the panel decision should be reconsidered because the Ninth Circuit had “become the first court in the country to state that an ‘income tax’ doesn’t require that a ‘taxpayer has realized income’ under the Sixteenth Amendment.” And that the panel decision “open[s] the door to expansion of the federal taxing power beyond the limits placed by the Constitution,” including “taxes on all sorts of wealth and property without the constitutional requirement of apportionment.”

The Moores, represented by CEI and Andrew Grossman of BakerHostetler, plan to petition the Supreme Court in February 2023 to see if the highest court in the land will hear their argument and reconsider the constitutionality of this tax.

WATCH the Moores discuss why they are challenging the Mandatory Repatriation Tax:

READ Co-Counsel Andrew Grossman and Attorney David Rivkin explain in The Wall Street Journal why properly finding the Mandatory Repatriation Tax unconstitutional could forestall an Elizabeth Warren-style wealth tax:

https://www.wsj.com/articles/congress-tax-wealth-courts-constitution-moore-agrawal-kisankraft-elizabeth-warren-11630529642

READ former SEC Chairman Christopher Cox and Chapman University Professor Hank Adler argue in The Wall Street Journal that the Supreme Court should accept a cert petition in Moore v. U.S.:

https://www.wsj.com/articles/the-ninth-circuit-upholds-a-wealth-tax-congress-income-supreme-court-unconstitutional-mandatory-repatriation-11674667850

READ CEI’s blog posts on the Moore Case:

https://cei.org/blog/ninth-circuit-refuses-to-reconsider-allowing-wealth-taxes/

https://cei.org/blog/more-on-moore-a-history-of-direct-taxes-and-their-application-to-moore-v-united-states/

VISIT CEI’s Moore v. U.S. case page to read proceedings and orders:

https://cei.org/court_case/charles-and-kathleen-moore-v-united-states/