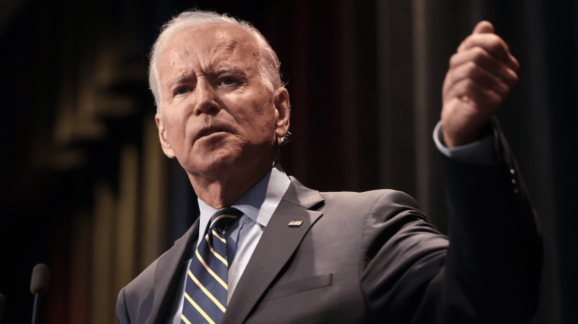

Biden Budget ‘Billionaire Tax’ Constitutionally Troubling

The newly released details of the White House budget for fiscal year 2023 marks a failure in spending restraint and regulatory accountability, say CEI experts.

Kent Lassman, CEI President, argues that not only is the envisioned wealth tax at odds with the Constitution, it’s wrong to tax people on income they don’t have:

“Such a wealth tax would allow bureaucrats to determine … whether an increase in value of something you own is now income. People would be forced to pay taxes on something called income even though they don’t actually have additional income at their disposal. More than two and a half years ago, CEI challenged this principle in a lawsuit called Moore v. United States. We are passionate about this issue because we know the Constitution’s limits on the federal taxing power must be zealously protected, for everyone’s sake.” > View the full statement on cei.org

Wayne Crews, CEI Vice President for Policy, criticizes President Biden’s runaway tax-and-spend agenda and argues it’s a missed opportunity to overhaul federal regulations that hinder economic opportunity:

“Federal spending has always entailed the erection of new regulatory edifices, economic intervention, displacement of private activity and behavior-altering transfers. Over-regulation costs the economy hundreds of billions in addition to the yearly spending and deficits, so boosting growth should incorporate the reduction of federal red tape and economic regulation as well. Capping what the federal government spends matters, as does capping what the government can force the private sector to spend on regulatory sprees caused by the spending and expansion of the administrative state. But it is difficult to effect reform of D.C.’s extravagance while stuck in today’s progressive ditch.” > View the full analysis on Forbes.com

Related analysis: Inflation and the Biden Budget