EPA’s new coal rule: Still unlawful after all these years

Photo Credit: Getty

The Environmental Protection Agency (EPA) last week posted the pre-publication draft of its proposed carbon dioxide (CO2) emission performance standards for fossil-fuel power plants under Section 111 of the Clean Air Act (CAA). EPA watchers had been waiting almost one year to see what the agency would propose to replace the so-called Clean Power Plan (CPP), which the Supreme Court vacated in West Virginia v. EPA. How does the proposed rule, which so far has no name, compare to the CPP? Does it pass muster under the major-questions doctrine as articulated by the Court in West Virginia? Is it vulnerable to legal challenge on statutory grounds?

Background

The CPP’s chief legal flaw was its assertion that “generation shifting”—reallocating electricity production and market share from coal to gas generation, and from both to renewables—is a permissible best system of emission reduction (BSER) under CAA Section 111.

The CPP set CO2 emission performance standards (calibrated in pounds of CO2 per megawatt hour) that no existing coal powerplant could affordably meet by installing emission-control technologies. A coal powerplant could comply only by averaging its emission rate with that of lower- or non-emitting facilities elsewhere on the grid to which it cedes output and market share. Coal plants on average would produce less power and many would retire, the EPA projected.

In short, the Court explained, the CPP was a plan to “substantially restructure the American energy market.” As such, the CPP entailed a “transformative expansion” of the EPA’s regulatory authority. Under the major questions doctrine, “a clear statement” is necessary for a court to conclude that Congress intended to “delegate authority of this breadth to regulate a fundamental sector of the economy.” CAA Section 111 does not come “close to the sort of clear authorization required,” the Court concluded.

Accordingly, the EPA’s CPP-replacement rule was widely expected to propose a BSER consisting of technologies applicable to and by the regulated facility. I also expected that the technology-based standards would be onerous enough to compel market restructuring anyway. As such, I reasoned, the new rule would still run afoul of the major-questions doctrine.

Turns out, the EPA is proposing four BSERs for coal generation, which collectively form a plan to ensure coal powerplants produce less and exit the market as soon as possible—the CPP’s objective all over again. The four BSERs vary depending on the powerplant’s remaining years of service:

- If a coal electric generating unit expects to operate after Dec. 31, 2039, it must install 90 percent carbon capture and storage (CCS)—a burden few if any utility-scale coal powerplants today would choose to incur rather be converted to burn natural gas or simply shut down.

- If the unit commits to cease operation by Dec. 31, 2039, then it must co-fire with 40 percent natural gas—i.e., generate significantly less electricity from coal.

- If the unit commits to cease operation by Dec. 31, 2034, it may operate at only 20 percent capacity, presumably to back up renewables—another CPP-like “perform less” performance standard.

- If the unit commits to cease operation by Dec. 31, 2031, it need only maintain its current CO2/MWh emission rate. Such a deal! The owner of a coal powerplant does not have to retrofit the facility or reduce its output if he commits to eliminate it within four years of the rule taking effect.

What is surprising is that, in the EPA’s Regulatory Impact Analysis (RIA), the proposed standards backstop rather than drive coal’s rapid elimination. The RIA credits the Inflation Reduction Act (IRA), with its massive subsidies for “clean energy” technologies and infrastructure (estimated at anywhere from $369 billion to $1.2 trillion by 2032) for coal’s precipitous decline. The RIA says nothing about the role of state renewable electricity quota in rigging power markets against coal, presumably because the EPA wants courts to see only congressional intent when they examine this rulemaking.

Here’s how reporter Jean Chemnick put it in yesterday’s Climatewire:

It’s last year’s climate law—not this year’s carbon rules—that will end U.S. power generation as it exists today. That’s the takeaway from EPA’s own projections for the future of power generation and capacity, as reflected in supporting documents EPA put out last week alongside standards it has proposed for gas and coal plant pollution. The White House pressured EPA to make those standards stronger (see related story). The modeling shows that EPA’s Clean Air Act rules would have a limited impact on the U.S. generation mix: They’ll play only a minor role in ushering coal power off the grid and virtually no role in boosting renewable power.

Let’s look at the EPA’s projections of coal and gas generation and market share under current policy and under the proposed standards.

EPA’s proposal by the numbers

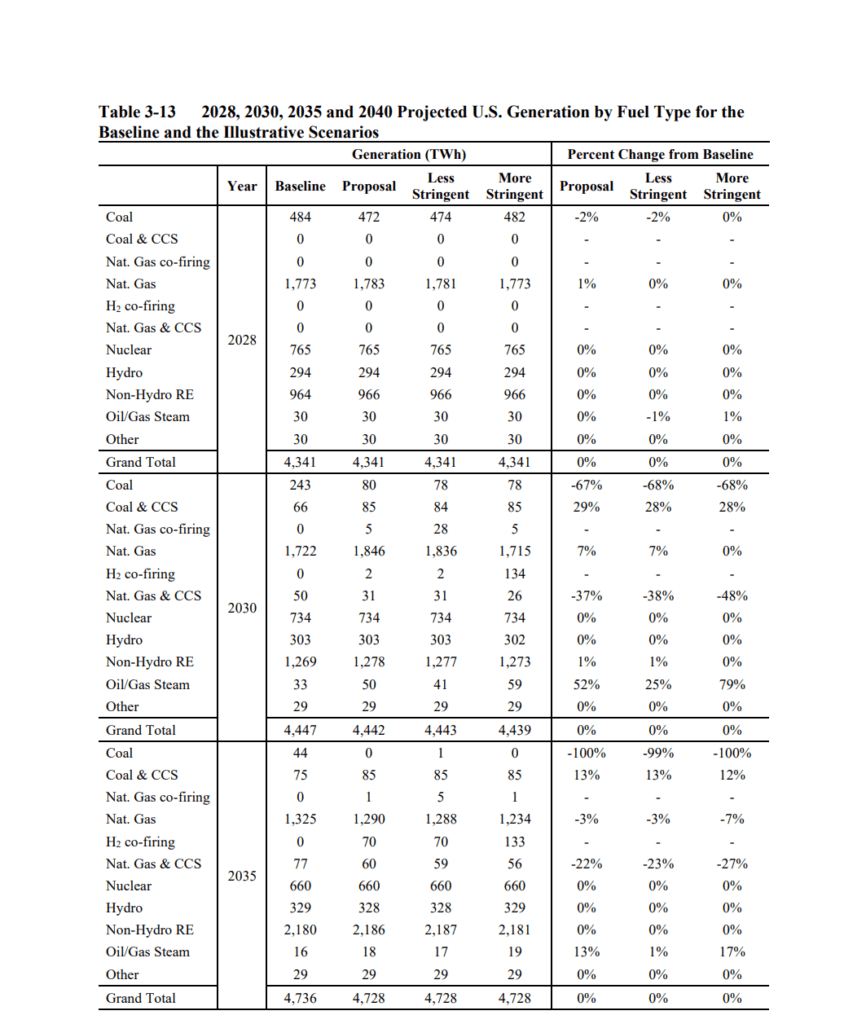

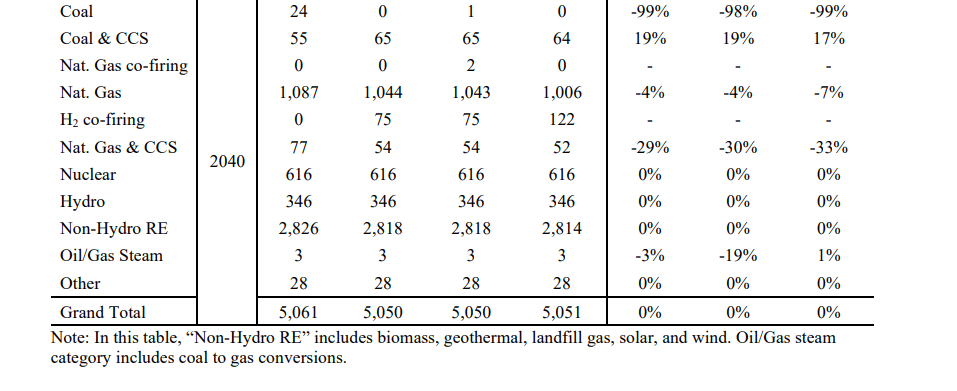

In 2028—year one of the compliance period—coal generation without CCS is 484 terawatt hours (TWh) in the baseline and 472 TWh in the proposal. In 2030, a big gap emerges with 243 TWh in the baseline and 80 TWh in the proposal. By 2035, coal generation without CCS in the proposal is 0. However, even in the baseline, coal generation is only 44 TWh—9 percent of what it was in 2028.

By 2040, the market share difference between baseline and proposal is tiny. In the baseline, coal with and without CCS is 79 TWh, or 1.5% of total generation. In the proposal, coal with CCS is 65 TWh, or 1.3% of total generation.

What about the rule’s impact on natural gas? Here, too, the market share difference between baseline and proposal is small.

In the baseline, natural gas generates 1,773 TWh in 2028, 1,722 TWh in 2030, 1,325 TWh in 2035, and 1,087 TWh in 2040.

In the proposal, natural gas generates 1,783 TWh in 2028, 1,846 TWh in 2030, 1,290 TWh in 2035, and 1,044 TWh in 2040.

So, by 2040, gas in the baseline is 1,087 TWh, or 21.5 percent of total generation. Gas in the proposal is 1,044 TWh, or 20.7 percent of total generation.

What to make of all this? First, the standards are blatantly calculated to squeeze coal out of the marketplace. Many of the lawmakers who passed the IRA on a party-line vote undoubtedly want to kill coal. However, the IRA is a spending bill, and as such does not amend any regulatory provision of the Clean Air Act, including CAA 111(d). The CAA did not authorize the EPA to reorganize power markets in 2015 when the CPP was finalized, and still doesn’t.

Second, the EPA has been telling us since 2014 that CCS is “adequately demonstrated” as an affordable technology. Currently, however, there is only one small (115-MW) commercial CCS power plant operating in North America, the Boundary Dam Project in Saskatchewan, Canada. It struggled for years with financial and technical problems. It would not have been built but for federal and provincial subsidies totaling $1.2 billion. Subsidizing an otherwise uneconomic technology does not make it “adequately demonstrated.”

The EPA’s vision for CCS is impractical and unaffordable, as my colleague Mario Loyola explains in National Review:

Ironies abound. As [Robert] Bryce writes in a recent newsletter, sequestering 600 million tons of CO2 per year (the EPA’s estimate of the rule’s impact) “would require creating an industry capable of handling a mass of CO2 that’s equal to about 12 million barrels of oil per day.” The prominent “Net-Zero America” study led by Princeton University estimates that sequestering 900 million tons of CO2 (its estimated requirement to achieve net zero) would require perhaps 68,000 miles of new pipelines and thousands of injection wells. As the Congressional Research Service points out, safety concerns are already a major problem for the roughly 4,000 miles of pipeline projects currently being developed to transport CO2 from ethanol plants in the Midwest to injection wells in the region. Local opposition has been both fierce and effective, given that CO2 pipeline permits and the relevant landowner rights and eminent-domain laws are all subject to state jurisdiction.

Another critical problem is that CCS in practice is not even a bona fide system of emission reduction. Central to Boundary Dam’s business model—and that of most other CCS power plants ever proposed—is an arrangement to sell the captured CO2 to companies engaged in enhanced oil recovery (EOR). Injecting CO2 into oil fields can boost production by increasing field pressure while decreasing oil viscosity. However, when the recovered oil is combusted, it emits more CO2 than the quantity sequestered underground. National Energy Technology Laboratory (NETL) data indicate that the combination of CCS and EOR emits 1.4-2.6 times more CO2 than a conventional coal power plant.

More importantly, the EPA’s baseline projection is pie in the sky. It assumes the Inflation Reduction Act foreordains a speedy transition to a “clean energy” future. It does not. The mining and processing infrastructure needed to build an all-renewable + battery storage electric supply system does not exist and probably will not for years to come. Backstopping renewable generation with battery storage rather than coal or gas powerplants would cost trillions of dollars, turning electricity into a luxury item for the rich and crippling U.S. industrial competitiveness. The nation’s litigation-prone permitting system blocks and delays the construction of energy infrastructure of every kind. Yet “green” politicians seem unwilling to curb the system’s litigation risk even though it slows the permitting of new “clean energy” projects to a crawl.

Finally, a significant segment of the population already opposes the IRA’s massive subsidies to favored industries as corporate welfare and a recipe for more inflation and taxpayer debt.

In short, the IRA may unravel long before 2040. If that happens, the EPA’s standards, like those in the CPP, will be the conspicuous driver of an energy market restructuring program for which the Clean Air Act provides no authority.