Happy Tax Freedom Day

Tax Freedom Day is the first day in the calendar year when the nation has paid enough to fund its annual debt burden. Everything you’ve earned up to this point goes directly to the government. A free sandwich is as good a way as any to celebrate finally arriving at the point in the year when you can spend what you earn on things you actually care about.

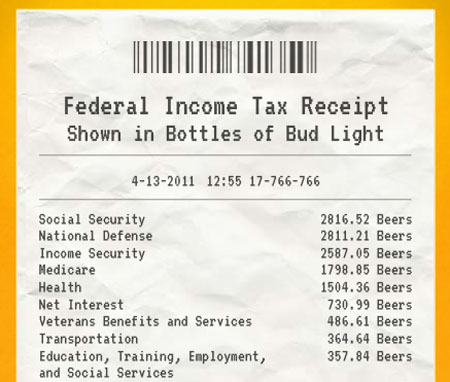

Mother Jones created a great visual of the national tax burden, represented in beers and burritos:

And here’s the explanation, also from Mother Jones:

The 2010 tax bill for a typical American family earning $50,000 comes out to about 1,752 Chipotle burritos. From that, the feds spent about 2,811 bottles of Bud Light on defense, 244 packs of cigarettes on Medicare, and 13 Red Bulls on energy spending. Unfortunately, it does not show how many decaf soy lattes went to NPR.

Tax Freedom Day is particularly touchy this year as the powers that be struggle to establish “adult talk” over heavy partisan budget negotiations in the midst of continuing resolution after continuing resolution.

Here’s my illustration of the tax burden at The Washington Examiner:

The average effective tax rate for American households is 26.9 percent. To put that in real-world perspective, let’s see what that actually costs a farily average worker earning a $50,000 salary. Having worked these first 15 weeks of the year, every penny of the $13,450 that worker has earned goes directly to the government.

But that’s not all. Those tax dollars contribute to keeping the price of that sandwich higher than it should be. How does that work? When you pay Subway for a sandwich, embedded in the price are costs from agricultural subsidies that have been passed on to consumers. Consider wheat subsidies, which are price floors. Under the 2002 Farm Bill, for every bushel of wheat sold the government gave farmers an extra 52 cents and guaranteed a price of $3.86 per bushel during 2002–2003 and $3.92 during 2004–2007.

That means that if the price of wheat is $3.80 per bushel, the government gives farmers an extra 58 cents — the subsidy plus the difference between market price and the guaranteed price floor. For sandwich-craving Americans, that means that they are paying twice for that soft bun — once at the Subway cashier and once through the complicated web of subsidy dollars.

Happy Tax Freedom Day everyone — now get back to work so you can put some money in your own pocket, instead of Uncle Sam’s.