No, electricity markets are not free markets: A Q&A with Cato’s Travis Fisher

Photo Credit: Getty

The following is a Q&A with Travis Fisher, director of Energy and Environmental Policy Studies at the Cato Institute

Q: Could you briefly explain the current structure of the electricity marketplace in the United States?

A: I should start with a warning—electricity markets are so complicated that most people choose not to dive into the details (probably for good reason!). But their complexity also makes them fascinating, and there’s always more to learn because technologies and policies change all the time.

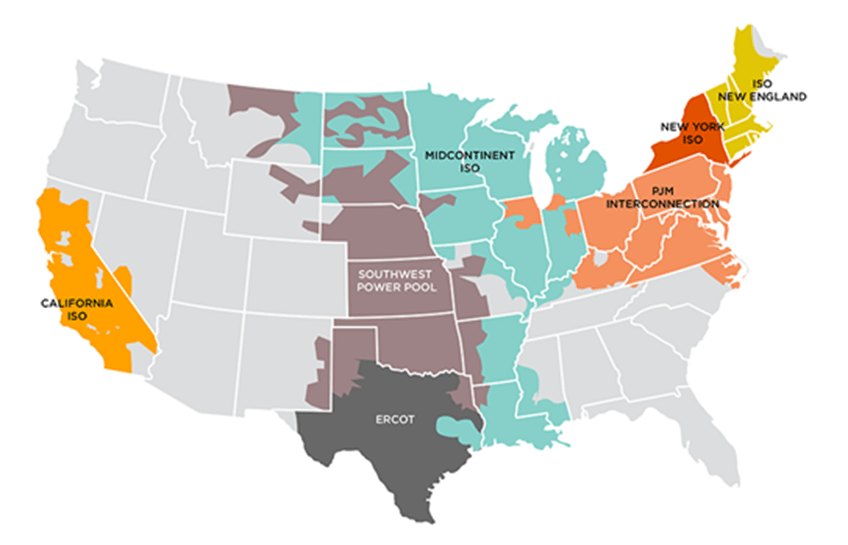

In the United States, there is an endless number of different market structures because each state and many regions have different sets of rules for electric utilities. The federal government and the states have complementary and sometimes overlapping jurisdictions. For example, the Federal Energy Regulatory Commission (FERC) regulates electricity markets at the wholesale level (sales for resale at the high-voltage transmission level), and there are several wholesale markets in different parts of the country. At the same time, each state has a similar regulatory body that oversees retail markets (sales to final customers at the lower-voltage distribution level). Those agencies are typically called State Public Utility Commissions or “PUCs.”

One state in the lower 48—Texas—operates a high-voltage electric grid that is not synchronized with other states, meaning it has an electricity island within the state that is not subject to federal jurisdiction. Texas has avoided FERC jurisdiction by keeping its alternating current (AC) grid separate from the other two large, synchronous AC grids (one to the East of Texas and one to the West). Hence, the US power grid is really three different AC networks or “interconnections”—the Eastern Interconnection, the Western Interconnection, and the Electric Reliability Council of Texas (ERCOT) Interconnection.

A charitable way to depict electricity markets is that they are a “patchwork quilt” of diverse approaches to providing electricity service. After all, each state and region has its own laws, demographics, policy priorities, geography, and natural resources. The more cynical take is that electricity markets have always been the subject of heavy government intervention, and such intervention has been difficult to lighten. For example, the efforts to restructure the industry (some call the industry “deregulated,” but a more accurate term is “reregulated”) starting in the 1990s have added significant complexity without delivering the benefits to consumers that were initially promised. Specifically, competition in electricity generation was supposed to ensure adequate electric reliability at least cost to consumers, yet it has been difficult to prove that retail rates are lower in areas with wholesale markets than they would otherwise be. Some researchers point to different ways of regulating retail markets as the main culprit for the lack of consumer savings from restructuring.

Q: What are the top five reasons why electricity markets are not free markets?

A:

- Economic regulations. In electricity, the closest we’ve come to free markets is the mandatory open access model. Even in those “markets,” each state still has an electricity regulator in addition to the federal government. In many cases, state regulations dictate that no one can legally compete with the incumbent monopoly utility. Even in restructured states, economic regulators can dictate price caps and the terms and conditions of electricity services. For those who advocate for direct access to wholesale markets by anyone (including individual residents), the Texas experiment offers a cautionary tale. Although ERCOT is arguably the most open electricity market in the country, it features strict oversight by the Public Utility Commission of Texas and things like price caps in the wholesale market.

- Environmental regulations. These days, many decisions regarding which types of generation assets to build (e.g., a natural gas power plant versus a solar photovoltaic project) are influenced not just by state and FERC policies but also by regulations issued by the federal Environmental Protection Agency (EPA). This year, EPA proposed a power plant rule that would make it illegal to build a new baseload natural gas plant or coal plant without capturing and storing the vast majority of carbon dioxide emissions.

- Resource mandates. Most US states (30 states plus DC) have laws that require certain amounts or percentages of electricity generation to come from specific sources. Historically, a typical example was for a given state to generate 20 percent of its electricity using renewable resources by the year 2020. As those initial goals were met and often exceeded, several states are now mandating “net zero,” 100 percent clean, or 100 percent renewable energy in the coming years. The state of Virginia, for example, has mandated that its investor-owned utilities must be 100 percent carbon-free in about 20 years (2045 for one and 2050 for the other).

- Federal subsidies. The Inflation Reduction Act includes subsidies for electricity generation that could total $2.5 or $3 trillion over the coming decades. These subsidies are large enough to badly distort electricity markets and inhibit them from achieving the goal of reliability at least cost. Earlier this year, FERC Commissioner James Danly described the situation in stark terms, stating “markets have become something closer to a mechanism by which to harvest these subsidies, rather than what they were intended to do, which is ensure least cost dispatch of available resources and to incentivize new investment.”

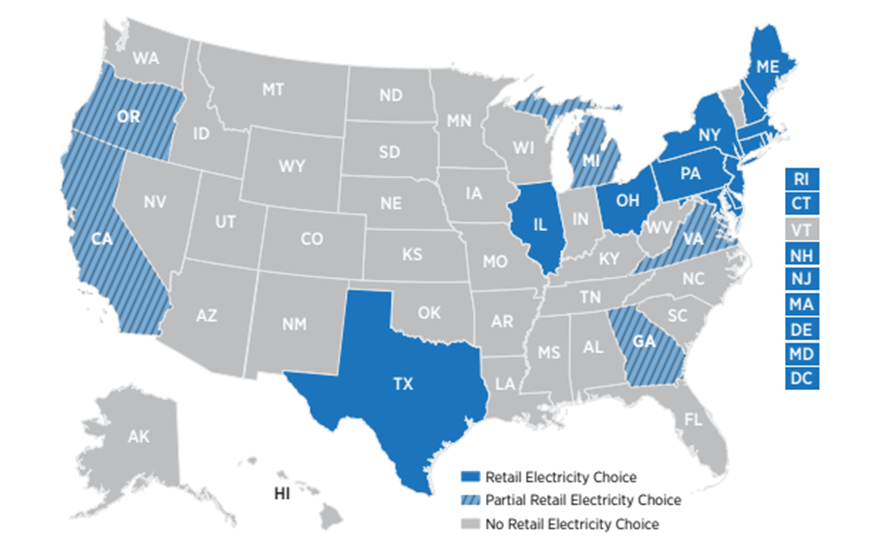

- Lack of choice regarding retail suppliers. In most states, consumers cannot shop around for the best deals from a variety of electricity suppliers. That is clearly a barrier to a free-market approach to electricity, as consumer sovereignty is a basic premise for well-functioning markets. The map below shows the status of retail restructuring in the states. Retail choice offers end-use customers with a wider variety of options for paying for electric service and working with different retail suppliers (different fixed/variable rate structures, off-peak discounts, access to wholesale market prices, etc.). However, even in states that allow retail choice, electricity customers are still served by a single distribution network under the same mandatory open access model the federal government implemented at the wholesale level.

Although there are elements of competition and market-based pricing in today’s wholesale and retail electricity markets, they are not free markets due to the presence of significant regulations and public policy interventions at the federal, regional, and state levels.

Q: Do you have any recommendations for policymakers on how they can actually free up electricity markets?

Given the problematic starting point at which we find ourselves, one of the most impactful ways to free up electricity markets is to reform the decidedly non-market features listed above. Once those regulatory and policy intervention barriers are removed, policymakers should discuss ways to fully liberate electricity markets. Specifically, policymakers should allow the market process to devise alternatives to the current natural monopoly model. In my opinion, technological changes such as low-cost distributed energy resources and the “internet of things” have weakened the natural monopoly argument and enabled new ways of approaching competition in the electricity industry.