Record Federal Income Tax Receipts Still No Match for Cost of Regulation

The Treasury Department’s monthly statement of revenues and outlays came out today.

The big news, headlined on the Drudge Report, is that federal individual income tax collections have hit an all-time high.

The Treasury reported that fiscal year 2017 individual income tax revenues through July (or, 10 months of the fiscal year) stand at $1.313 trillion.

This is reported to be a record for this far along in a fiscal year.

Corporate income tax collections fell; they stand at $232 billion.

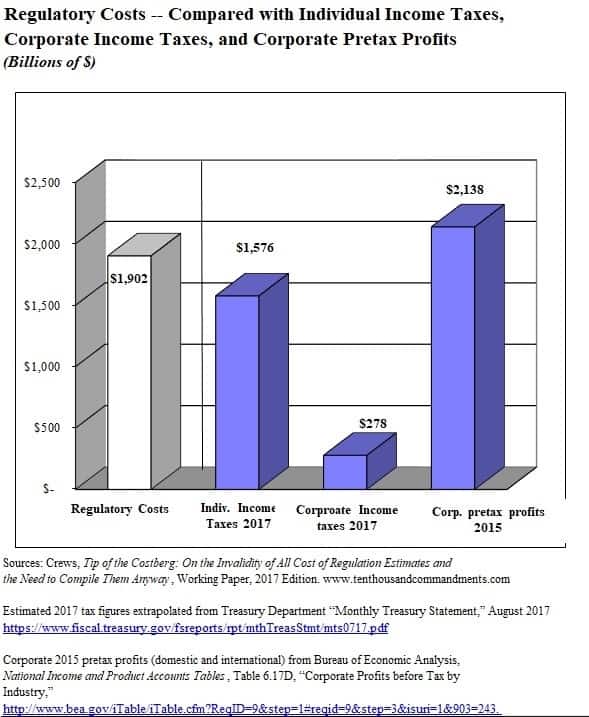

Projecting those individual income taxes though the remainder of the fiscal year will get us to about $1.576 trillion.

Similarly, I’d project corporate income taxes at about $278 billion, for a total of the two of about $1.854 trillion.

(Payroll taxes, not included here, stand at $976 billion as of July; a deficit of $566 billion accompanies all this.)

These costs are easy to see, but no one really knows or can know the “other” cost of government, that of interventions and regulatory mandates. Estimates range as high as $4 trillion in reduced annual GDP that the Mercatus Center calculates, to the idea that regulations all have net benefits, create jobs, and are costless on net at worst.

In my Costberg working paper (subtitle: “On the Invalidity of All Regulatory Cost Estimates and the Need to Compile Them Anyway”) I’ve settled on $1.9 trillion placeholder for annual costs of federal regulatory intervention, given largely government data and the limited amount of private sector compilations that exists. There are many gaps and much uncertainty, but the federal government itself was reckoning around a trillion at the turn of the century, even though it now steers clear (wrongly, unfairly) of making aggregate estimates at all (but you can’t steer clear of compliance, however).

In any event, regulatory costs on this basis just barely surpass revenues from individual income taxes and corporate taxes combined.

As the chart shows, regulatory costs stand well above estimated 2017 individual income tax revenues of $1.576 trillion.

Corporate income taxes collected by the U.S. government, estimated as noted at $278 billion for 2017, are dwarfed by regulatory costs. (Incidentally, corporate tax receipts had declined by half during the economic downturn after 2008).

So, despite record individual income tax collections, the combination of the two, $1.85 trillion, still falls short of our regulatory cost reckoning of $1.9 trillion.

Indeed, regulatory compliance costs are approaching the level of pretax corporate profits, which were $2.138 trillion in 2015.

This is all food for thought for policymakers who can’t seem to get their act together on any kind of regulatory liberalization in an effort to avoid being seen cooperating with President Trump at all costs.

The problem is that doing nothing costs us, not them. It isn’t just that government spending is high, the amount that the federal government requires the private sector to spend is high too, and they avoid assessing those costs.