Rising small business regs may spur Senate to pass REINS Act

Photo Credit: Getty

In a bid to restore congressional accountability over the regulatory enterprise, the 118th Congress this week is set to vote on the so-called REINS Act, which stands for “Regulations from the Executive In Need of Scrutiny.” It was introduced by Rep. Kat Cammack (R-Florida). The Senate version (S. 184) comes from Rand Paul (R-Kentucky).

Bottom line, the REINS Act would require Congress to approve major federal agency regulations before they are effective. While it has never been a priority of Senate leadership, the REINS Act has passed in multiple Congresses.

For convoluted reasons involving the debt limit package, the 118th Congress will enjoy the curious distinction of having passed the REINS Act twice.

What might make priorities different over on the Senate side, and at long last propel REINS to the president’s desk?

Bottom-up agitation is what it will take. That’s what happened a generation ago when the “Small Business Regulatory Enforcement Fairness Act” passed, as well as the Congressional Review Act (CRA), both in 1996.

The CRA is helpful but is limited in its effects. Rather than allowing a major rule to simply evaporate if Congress does not actively approve it as REINS would do, the CRA requires legislators to get up on their hind legs to actively revoke a rule. The president has to also approve the resolution of disapproval. That’s a tall order. The CRA has only been successfully deployed 20 times since the 1990s.

Previous reform measures were overwhelmingly bipartisan. We have contended elsewhere (such as in recent House Budget Committee testimony) that recent major legislative packages since COVID are highly likely to spur unforeseen mandates on small business and state and local governments; and when they do, the mobilization for regulatory relief could happen again.

The pandemic and the accompanying surge in the Federal government (which “never lets a crisis go to waste”) are still close in the rear-view mirror. But already, we may be seeing their effects in the form of upticks in proposed and final rules affecting small business (and state and local governments, too, which we’ll look at later).

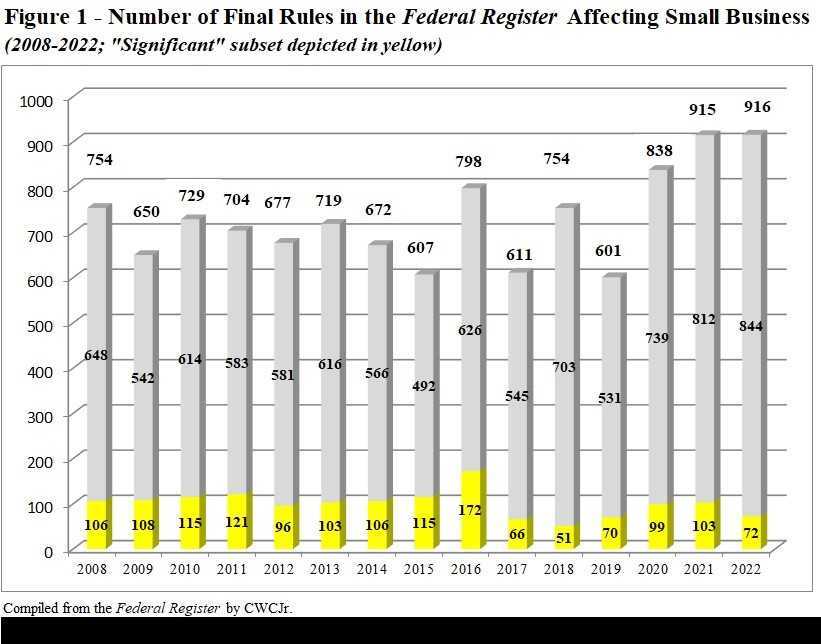

Figure 1 just below depicts completed final rules and the so-called “significant” subset of them deemed to affect small business over the past few years. While the acknowledged “significant” subset has not quite attained heights that would cause alarm at this juncture, the Biden administration’s overall counts for 2021 and 2022 clearly stand well above both Trump and Obama administrations.

As of today’s date (June 7), the tally of rules in the Federal Register affecting small business is 333. The trajectory bears close scrutiny as the rulemakings that derive from infrastructure, inflation and tech investment legislation unfold over the coming months.

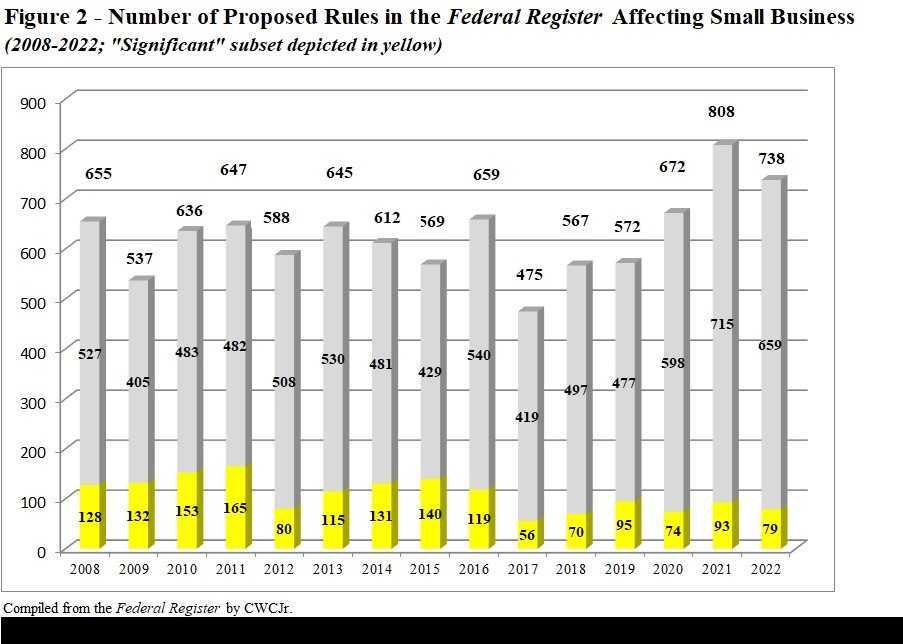

The closest thing we have to a crystal ball at this juncture might be to look at proposed rules in the Federal Register pipeline (in contrast to the final rules just covered), since some of the ones from the most recent couple years will become part of tomorrow’s final tallies.

As Figure 2 shows, proposed rules in the Federal Register affecting small business hit a recent peak of 808 in 2021. Despite dropping in 738 under Biden in 2022, this still exceeds Obama levels

The “significant” subset has not yet risen to Obama-era, levels but may be poised to do so. There were 79 last year, and the count stands at 39 as of today. While the Trump years indeed boasted some significant rules, a number of them were officially deemed “Deregulatory.”

One other concern with respect to rules affecting small business is the recent move by the Biden administration in his Executive Order 14,094 (“Modernizing Regulatory Review”) and directive to the Office of Management and Budget to rewrite so-called “Circular A-4” guidance on the preparation of regulatory analyses.

Rather than agencies giving extra scrutiny to rules costing an anticipated $100 million or more annually, Biden’s directives raise the threshold to $200 million. That means future Figures like 1 and 2 above will reveal artificially fewer significant rules compared to prior years. Presumably, the new threshold has already been in effect since April 11, perhaps “undercounting” 2023.

Actions have consequences, and the legislative enactments of the past three years have been some of the most substantial the nation has ever undertaken.

As legislative ambitions percolate through the administrative state and find their final form in rules and regulations, they will be noticed by those they burden. Congress has noticed, it seems; now the Senate needs to act. The REINS Act is one of the best tools to restore congressional accountability and help to prepare for a regulatory torrent that could well be coming our way.