Trump’s newborn nest egg accounts

Photo Credit: Getty

In the face of recurring economic shocks—we’ve suffered 9/11, the 2008 financial crisis, and COVID-19 in the 21st century alone—the reflex to throw hundreds of billions in taxpayer-funded stimulus at every single crisis has proven costly and inefficient.

Yet we remain thoroughly vulnerable to it happening all over again. No fixes were made.

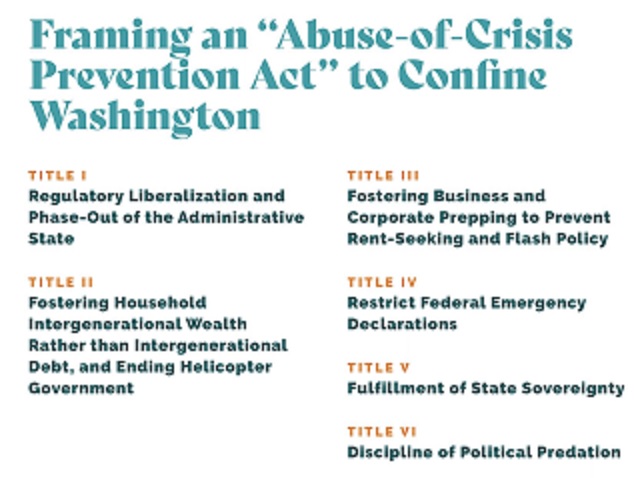

My earlier work on an “Abuse-of-Crisis Prevention Act” (AOC Prevention Act) proposed a radical shift to implement precisely such fixes: Among advancing business and lower-level government resilience with such measures as conventional but sweeping regulatory liberalization, the broader need is to replace dependence on government programs like Social Security with policies that foster individual and household financial resilience. The progressives’ vision, by contrast, is the complete opposite—the universal basic income-driven custodial state.

The White House today showcased a new proposal for “Trump Accounts,” to provide for the establishment and seeding of $1,000 investment accounts for newborns in a tax-deferred, low-cost index fund. While it isn’t government’s job to fund these—rather to facilitate them—the concept aligns with the AOC Prevention vision, marking a modest but meaningful step toward empowering families to build wealth independent of the state. As it stands, newborns are assigned Social Security Numbers at birth.

The Trump Accounts are part of the House-passed version of the One Big Beautiful Bill Act. The initiative, though limited in scope, captures the essence of intergenerational wealth-building, recognizing a need for wealth accumulation begun early in life that compounds over time, out of the government’s reach.

The core idea behind the AOC Prevention Act is to preempt economic vulnerability by enabling Americans to amass personal wealth that can weather future storms. As noted in an early writeup of the proposal, over 70 percent of Americans had less than $1,000 in savings before COVID-19, leaving them ill-equipped for unexpected disruptions. Instead of relying on massive federal spending to paper over (and inflate) crises, policies must create conditions for households to build and retain wealth on their own. The business sector was also ill-equipped, and a similar stance toward boosting business resilience—as noted in the image above and the earlier AOC Prevention writings—is vital.

If enacted, the Trump Accounts could break a logjam, serving as one element of a broader resilience framework to replace stimulus/deficit spending of hundreds of billions (or trillions) per crisis. As I’ve argued, in addition to newborn accounts, the federal tax code should incentivize saving several years’ worth of median income, accessible during emergencies and convertible to retirement funds if unused (with business corollaries). The Trump Accounts’ structure—invested funds for future needs like education or housing—mirrors this concept, prioritizing long-term financial security over short-term personal use, and of course over government handouts. By starting at birth, these accounts leverage the time value of money—compounding wealth—and even set the stage for replacing programs like Social Security that politicians otherwise refuse to touch. That is, if Trump Accounts are expanded to allow even greater family and benefactor contributions than already proposed, then tax-free growth in these newfangled personal assets could reduce reliance on government retirement systems entirely as generations pass, aligning with a libertarian vision of weaning the able-bodied off the state and minimizing government.

The Trump Accounts also open the door to privatizing aspects of poverty alleviation. My AOC Prevention work suggested allowing the wealthy to establish custodial accounts for the needy, a nod to the private generosity witnessed during COVID-19 when individuals and businesses, like Airbnb hosts, stepped up to help their countrymen. By encouraging private contributions to these newborn accounts, a culture of community-driven support could be fostered, reducing the need for the flash-policy stimulus programs we will inevitably get.

While the Trump Accounts are a provocative start—assuming they make it through the Senate—they necessarily fall short of the sweeping reforms needed for true resilience. The last step, of course, cannot be first. A comprehensive approach would eliminate personal income taxes until households accumulate liquid, invested savings for personal use and shock situations, complementing the accounts that start at birth and grow through family and community contributions. The Trump Accounts, if scaled up (and most importantly, privatized), could evolve into this model, empowering individuals to prepare for crises and retirement without government overreach, and end the curse of bailout and even of big government itself.

Properly construed, the Trump Accounts proposal is a step toward the right kind of “reset”—a deliberate shift from government dependency to the primacy of the free individual and household. By respecting autonomy and maximizing private efforts, we can build a society that’s not just secure but capable of thriving through the next inevitable crises that come our way.

For more, see:

The Case for Letting Crises Go to Waste: How an ‘Abuse-of-Crisis Prevention Act’ Can Help Rein in Runaway Government Growth, Competitive Enterprise Institute, June 2022, Available at SSRN: https://ssrn.com/abstract=4151917 or http://dx.doi.org/10.2139/ssrn.4151917.

“The Greater Reset: An “Abuse-Of-Crisis Prevention Act” To Restore Limited Government,” Forbes.

“A One-Pager on an “Abuse-of-Crisis Prevention Act,” Competitive Enterprise Institute.

“Trump Reforms Die Without An Abuse-Of-Crisis Prevention Act,” Forbes