Chapter 12: Federal Regulations Affecting Small Business

Given discrepancies seen in the final rule counts, the overall counts of both small business rules and significant small business rules could also be understated. Congress should inquire into counting practices as part of its needed regulatory reforms.

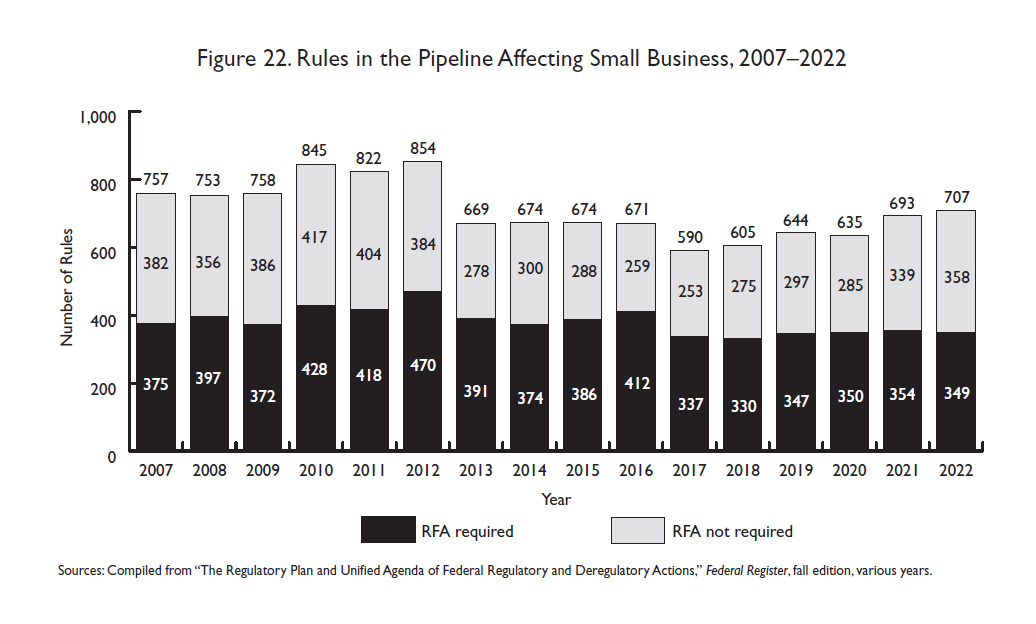

Assessment of small business burdens are rooted in the Regulatory Flexibility Act (RFA), which directs federal agencies to consider their rules’ effects on small entities. Figure 22 depicts the number of rules requiring such annual regulatory flexibility analysis that are acknowledged in the Unified Agenda. Figure 22 also depicts the number of other rules anticipated by agencies to affect small businesses, but that presumably do not rise to the level of requiring a regulatory flexibility analysis.

The overall number of rules acknowledged to significantly affect small business dropped substantially between 2012 and 2013 during the Obama administration, likely reflecting election-related reporting changes. They dropped substantially again under Trump, despite the count being amplified by some rules aimed at rollback. Under Biden, the tally has topped 700 again in 2022, but with no deregulatory designation mitigating the rise.

As Figure 22 shows, according to the fall 2022 Unified Agenda, at the end of 2022, of the 707 rules affecting small business, 349 required RFA analysis and another 358 were deemed by agencies to affect small business but not rise to the level of requiring RFA analysis. Under Trump in 2020, there were 635 rules affecting small business, of which 83 were deemed deregulatory. Earlier deregulatory counts for small business rules under Trump were 102 in both 2019 and 2018, and 83 in 2017. Biden’s increase in small business rules over Trump in 2020 was 11 percent. Netting out Trump’s deregulatory rules affecting small business, Biden’s increase in rules affecting small business since Trump is 28 percent.

There had been 671 rules affecting small business in Obama’s final year of 2016. The number of rules with small-business impacts during the Obama administration in some years exceeded 800. The average number of rules affecting small business during Obama’s eight years and requiring an RFA was 406, exceeding George W. Bush’s eight-year average of 377. Trump’s average annual number of rules affecting small business was lower than either at 341, dozens of which were also deemed deregulatory each year. Biden’s two-year average is 351.5.

Table 8 breaks out the 2022 fall Unified Agenda’s 707 rules affecting small business by department, agency, and commission. The top five—the Federal Communications Commission; the departments of Commerce, Health and Human Services, and the Treasury; and the multiagency federal acquisition rules—are the standouts, accounting for 334 rules, or 42 percent of the total 707 rules affecting small business. The FCC alone contributes 67 long-term rules deemed to require RFA analysis, whereas the IRS’s contributions to Treasury rules is a noticeable component. The overall proportion of total rules affecting small business in Table 8 stands at 19 percent but varies widely among agencies. (For the numbers of rules in the Unified Agenda affecting small business broken down by department and agency for fall Agenda editions since 1999–2020, see Appendix: Historical Tables, Part H.)

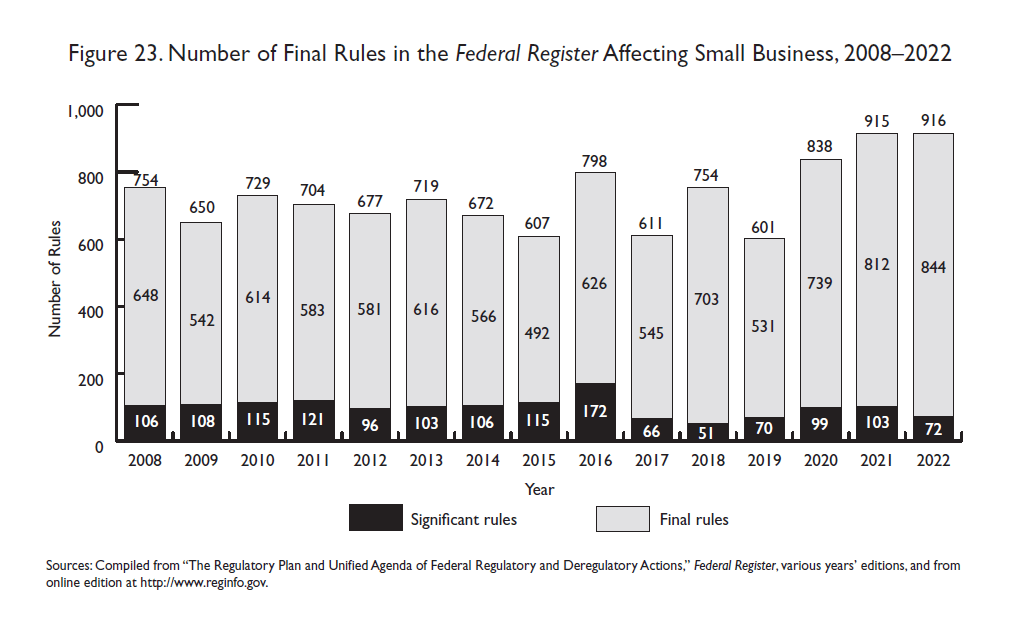

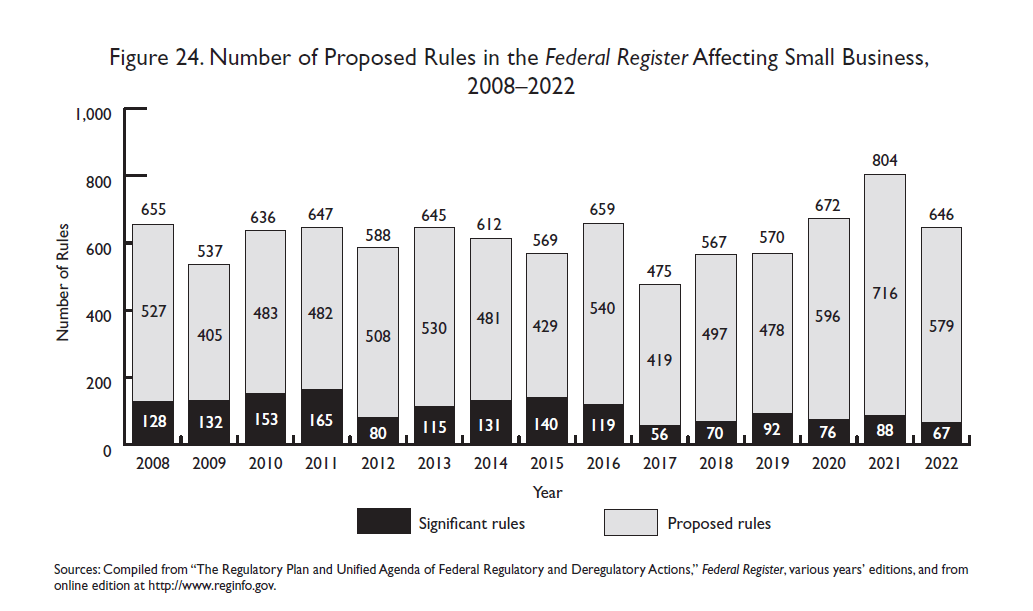

As a comparison with the fall Unified Agenda snapshots, Figure 23 depicts total completed final rules and the significant subset of them in the Federal Register deemed to affect small business by calendar year. The total count of 916 in 2022 stands well above both Trump’s and Obama’s. These tallies may fluctuate in the National Archives database, and subsequent editions of this report will reflect that, but these new heights are noteworthy and likewise indicative of overall regulation levels. If policymakers are attempting to look ahead, proposed rules in the Federal Register affecting small business also bear close scrutiny in 2023. Those peaked at 804 in 2021, and despite dropping in 2022 have reattained Obama levels (Figure 24).

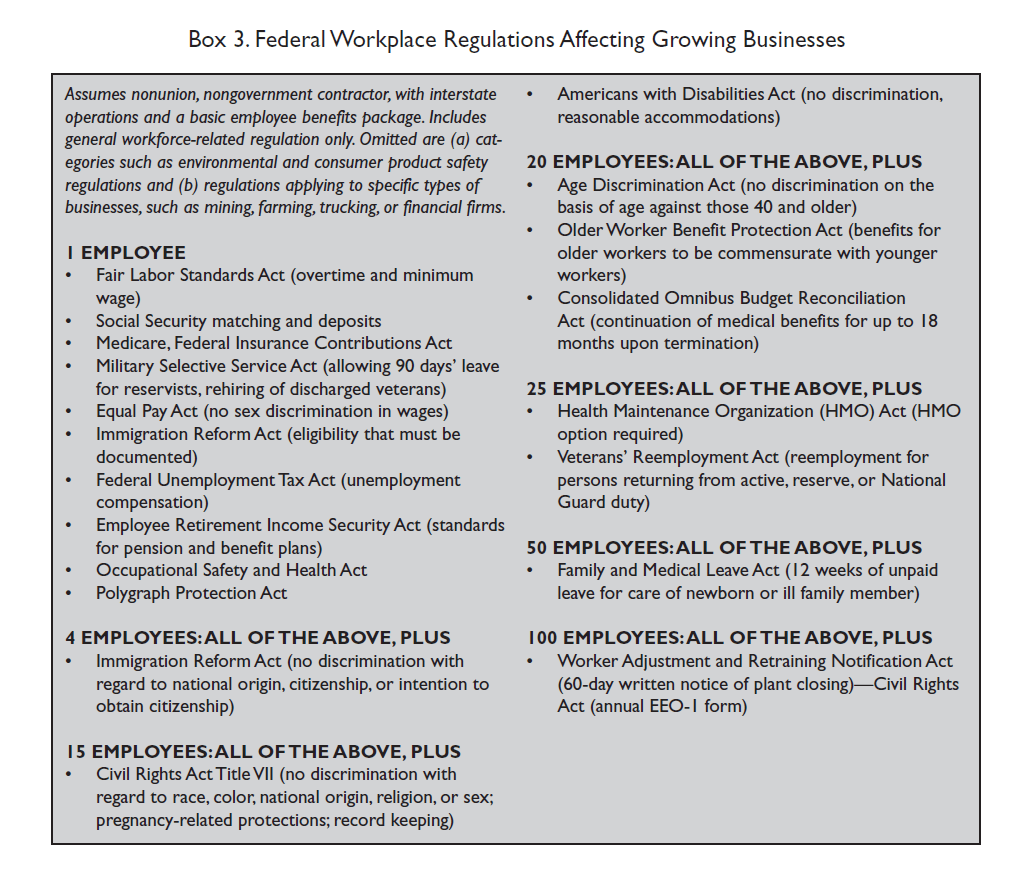

Box 3 depicts a partial list of the basic, non-sector-specific laws whose regulations affect small business, stacking as these firms grow. Post-COVID-19 legislation will play a role as well.