CEI Comments on NERA Petition Concerning Unlawful Wholesale Sales

Docket ID: EL20-42

Photo Credit: Getty

The Competitive Enterprise Institute (CEI) is a public policy and analysis organization committed to advancing the principles of free markets and limited government. We are particularly concerned about government interventions in the marketplace that may potentially result in serious harm to consumers, are fundamentally unfair, or exceed the legal authority of federal or state agencies. For all those reasons, we strongly support the New England Ratepayers Association’s (NERA) April 14, 2020 petition to the Federal Energy Regulatory Commission (FERC).[1] NERA asks that FERC exercise its jurisdiction over wholesale electricity sales to eliminate unlawful ratepayer subsidies to distributed generation from rooftop solar units.

Fundamental Unfairness

Both the federal government and many state governments offer tax incentives to encourage residential rooftop solar panels for electricity generation. For example, the Solar Investment Tax Credit, originally established by the 2005 Energy Policy Act, allows homeowners to deduct 30 percent of the cost of installing a solar power system during 2016-2019, 26 percent in 2020, and 22 percent in 2021, after which it expires (unless Congress again decides to renew it).[2]

The amount and structure of state tax incentives vary from state to state. As one pro-solar Web site explains:

South Carolina offers a solar income tax credit worth 25 percent of the cost of a solar installation, up to $3,500 of which may be claimed per year; by contrast, Iowa’s solar income tax credit is worth 15 percent of the cost of an installation, but a maximum of $5,000 can be claimed.

Other states have different types of tax incentives. Many states have exempted solar energy equipment from state sales and use taxes, such as New Jersey, Florida, and others. Alternately, some states have exempted the value of rooftop solar installations from residential property taxes, including Texas and Connecticut.

That’s not all. Some state and municipal governments, and even some utilities may offer direct cash rebates or grants for solar installations . . .[3]

In addition, 45 states have net metering laws applicable to such distributed generation, which require electric utilities to purchase any excess power above and beyond that needed by the homeowner.[4] Most problematically, many of these state laws mandate that this electricity be purchased at the retail rather than wholesale rate. The surplus electricity is then added to the grid and used by other customers, assuming demand for it exists at the particular point in time that it is generated.

The sale of a good for subsequent resale is the very definition of a wholesale transaction and not a retail one. Thus, the pricing of excess distributed generation at retail makes little sense and doing so potentially creates serious problems.

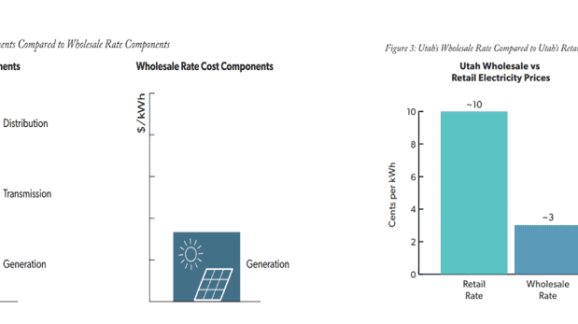

The retail rate for electricity is usually several times higher than the wholesale rate, and for good reason—it also supports the substantial infrastructure costs associated with delivering electricity (transmission and distribution) to end users, along with other costs such as investment in backup fossil generation to maintain grid reliability in states where renewable electricity mandates and other incentives increase the market penetration of non-dispatchable wind and solar power. In contrast, the wholesale price reflects the cost of generation alone.

The figures below, from a recent study of Utah’s net metering program, makes the inequity of compensating wholesale power at retail rates crystal clear.[5]

Paying homeowners retail prices for electricity sold to utilities hands net metering participants a windfall. When the meter “runs backwards,” participating homeowners pay nothing for grid construction and maintenance, not even for the technology upgrades required to handle two-way power flows. The shortfall must be made up elsewhere, ultimately in the form of higher rates for all other customers.

Two studies, cited by the Edison Electric Institute in its October 30, 2017 comments FERC on net energy metering (NEM) programs, leave no doubt that NEM participants on average are substantially wealthier than non-participants.[6] In an October 2013 study conducted for the California Public Utilities Commission, Energy and Environmental Economics, Inc. (E3) found that households participating in net energy metering (NEM) programs since 1999 had a median income of $91,210—nearly double the California median income of $54,283.[7] Similarly, a 2015 study by the Acadian Consulting Group found a median household income of $60,460 for participants in Louisiana’s NEM program compared to a statewide median household income of $44,673.

Since solar panel-owning homeowners are on average much wealthier than ratepayers in general, retail price net energy metering entails a regressive redistribution of wealth. In the words of one critic, it is a solar subsidy from those who can least afford it to those who least need it.

In a 2014 report for the American Legislative Exchange Council, technology analyst Tom Tanton describes retail net metering as “doubly regressive.” Most low-income households cannot afford to invest in rooftop solar, net metering shifts grid construction and maintenance costs from wealthier to poorer households, and higher retail rates impose a larger relative burden on poorer households.[8]

Tanton uses a simple analogy to clarify how retail net metering unfairly subsidizes residential solar producers even apart from its potential regressive impacts:

Imagine you have a home vegetable garden and have had a very good year and a bumper crop of tomatoes. Do you consider it somehow appropriate for you to send those tomatoes down to your local grocery store and expect to sell them to the grocer at the same price that he sells to the public? How would that help him pay his rent, and maintenance and heating bills for the store? The taxpayer has already paid you to grow tomatoes. Why, you have even made the grocer pay to have the tomatoes carried from your house to his store. Won’t this arrangement raise the cost of tomatoes and other groceries to other shoppers? Well, that’s exactly what net metering does. It forces the grocer—the utility—to buy a wholesale product at retail prices.[9]

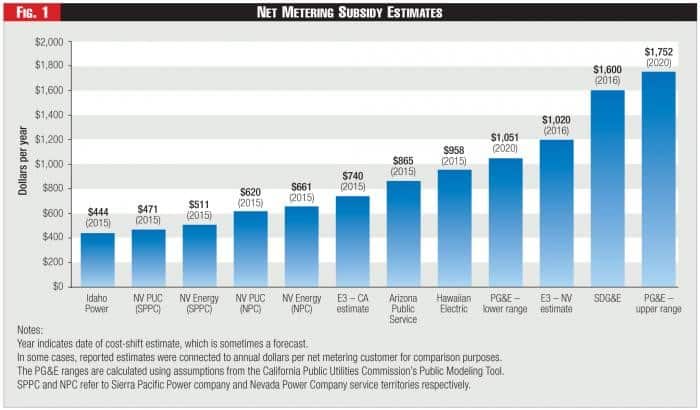

The amount of the windfall varies from state to state. Based on estimates by Southern California Edison and the New York Public Utilities Commission, a 2016 study estimated that, depending on service area and year, net metering transfers $444 to $1,752 annually from general taxpayers to the average residential solar power producer.[10]

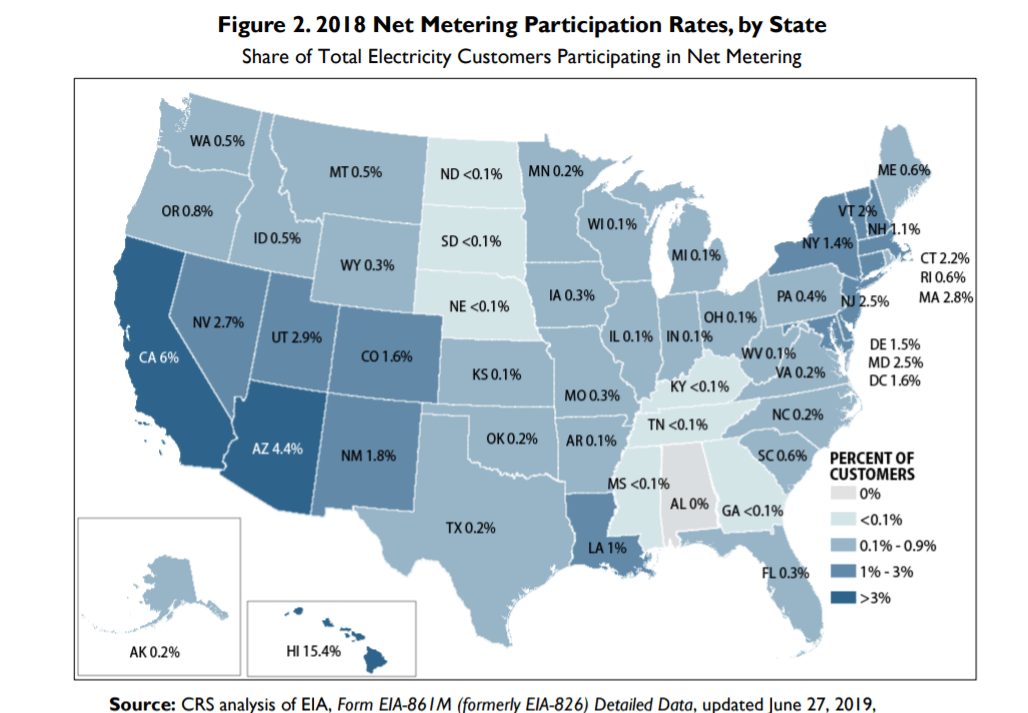

Estimating the impact of such windfalls on state retail electric rates is difficult, chiefly because in most states the percentage of households participating in retail net metering programs is still small (see figure below).[11] Accordingly, one study estimates that rate increases due to net metering programs range from 0.03 cents/kWh to 0.2 cents/kWh.[12]

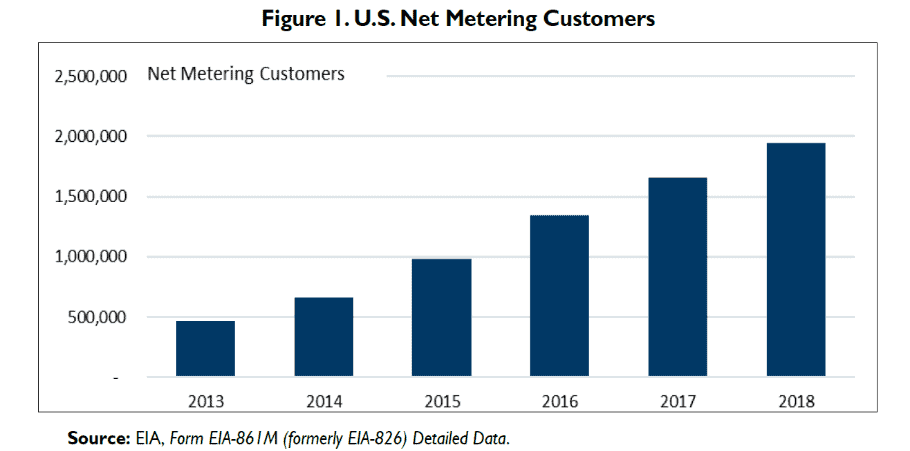

However, the potential for large impacts is obvious. A September 2013 California Public Utilities Commission study estimated that customers without net metering could be paying an extra $1.1 billion annually by 2020.[13] Lured by the prospect of free lunches, the net metering customer count has quadrupled since 2013.[14]

As the number of participants grows, so does the size of the wealth transfer, the implicit penalty imposed on non-participating ratepayers, and the incentive of non-beneficiaries

to join the program. In other words, retail price net metering has the makings of a monster that grows with feeding, as American Enterprise Institute economist Ben Zycher cautions:

Consumers without such solar installations have to finance the payments for excessively expensive rooftop electricity, and for the components of the system for which solar PV customers do not pay fully. Accordingly, overall power prices are forced above the level that would prevail in the absence of the net metering system. This problem is exacerbated by the array of tax and other incentives to install solar systems: The combination of the installation subsidies and the excessive prices paid for the power fed into the grid means that more solar capacity is installed than otherwise would be the case, more and more expensive power is fed into the grid, and prices are forced up, in principle in a sort of upward spiral process.[15]

The upward spiral is all the more likely if Congress renews the tax credit for investment in residential solar power, as it has done repeatedly since the late 1970s.[16] The ITC is scheduled to expire in 2022. A budget deal restoring the ITC to full strength (30 percent) is easily imagined, especially if Green New Dealers win big in November. Juiced by a renewed ITC, net metering could attract enough new customers to significantly increase the rates of non-participants.

Retail Net Metering Is Unlawful under FPA and PURPA

Under the Federal Power Act, FERC has jurisdiction over electric transmission and wholesale power sales in interstate commerce, not retail sales within state boundaries. Because utilities compensate NEM participants at retail prices, the transactions appear to fall within the jurisdiction of state legislatures and public utility commissions. Consequently, FERC has thus far chosen to stay out of the debate over state net metering laws. That is what NERA’s petition seeks to change.

Compensating wholesale sales at retail prices does not change the nature of the transaction. NERA correctly argues that the sale of electricity from a homeowner to a utility, which in turn resells the electricity to other customers, is, by definition, a wholesale sale. Thus, such sales are within FERC’s regulatory jurisdiction.

FERC has jurisdiction for an even more fundamental reason—the inherently interstate nature of any electric energy “delivered to a utility that merges and comingles the energy with other energy sources on the interstate electric grid.”[17]

The Public Utility Regulatory Policies Act (PURPA) also prohibits utilities from paying retail prices for solar electricity generated from behind the meter. Under PURPA, electric energy sold to utilities by qualifying facilities (QFs)—generators whose primary energy source is biomass, waste, renewable, geothermal, or any combination thereof—may not be compensated at a rate higher than what the utility would pay to generate the energy itself or purchase it from another source.[18] As NERA explains, “PURPA was designed to create a market for QF output but simultaneously prohibits QF sellers from imposing any economic burden on the utility or its other customers.” That means: “Avoided cost is the maximum rate a utility may be required to pay to a QF under PURPA.”[19]

In contrast, full net metering (FNM) pricing “produces a rate for QF-generated energy that substantially exceeds the purchasing utility’s avoided cost.” FNM generators are compensated at the “bundled retail rate,” which includes not just the cost of generation but also the costs of transmission and distribution and other investments utilities make to supply reliable (not intermittent) power to customers.

Such costs are not incurred by the FNM generator, who receives a subsidy equal to the difference between the utility’s avoided cost of generation and all its other costs. Utilities pay for the subsidy by recovering those other costs from other customers, that is, by raising their rates. The rate charged to other customers thus exceeds the utility’s avoided cost—a clear violation of PURPA.[20]

PURPA section 111(d) requires each state to “consider” establishing a “net metering service” whereby “electric energy” generated by consumer and delivered to a local distribution facility may be used to “offset” electric energy provided to the consumer by the electric utility.[21] Section 1251 of the 2005 Energy Policy Act amended PURPA section 111(d) by adding this definition of net metering:

NET METERING.—Each electric utility shall make available upon request net metering service to any electric consumer that the electric utility serves. For purposes of this paragraph, the term ‘net metering service’ means service to an electric consumer under which electric energy generated by that electric consumer from an eligible on-site generating facility and delivered to the local distribution facilities may be used to offset electric energy provided by the electric utility to the electric consumer during the applicable billing period.[22]

Under PURPA as amended, the net metered customer is entitled to an offset for “electric energy provided by the electric utility to the electric customer during the applicable billing period,” not for the full array of grid services. NERA draws the only reasonable conclusion: “By specifying that the energy the consumer delivered to the local distribution facilities may be used to offset energy provided by the electric utility, Congress appears to be saying that the supplier should receive an offset equal to the avoided cost of energy consistent with the other relevant provisions of PURPA.”[23]

To be clear, neither NERA nor CEI contends that net metering per se is unlawful, only that “full” net metering—the compensation of residential generation at retail prices—is unlawful. State policies under which utilities compensate homeowners at wholesale electricity prices, or the avoided cost of generation, do not conflict with the FPA and PURPA.

Conclusion

The Competitive Enterprise Institute strongly supports the NERA petition. Full net metering programs conflict with the FERC’s jurisdiction over wholesale power sales under the Federal Power Act and with PURPA’s requirement that compensation for qualified facilities may not exceed the avoided cost of generation. Further, FERC implementation of those legal requirements will repeal inequitable cost shifting from wealthier to poorer households and subsidies that distort energy investment and raise electricity prices for the general ratepayer.

Respectfully submitted,

Marlo Lewis, Ph.D

Senior Fellow

Ben Lieberman, J.D.

Senior Fellow

Competitive Enterprise Institute

[1] FERC Online, Petition for Declaratory Order for New England Ratepayers Association under EL 20-42, https://elibrary.ferc.gov/idmws/file_list.asp?document_id=14851599 (hereafter cited as NERA Petition)

[2] Solar Energy Industries Association, Residential ITC Phasedown, https://www.seia.org/research-resources/residential-itc-phasedown

[3] RE-VOLV, Solar Tax Incentives 101, https://re-volv.org/get-involved/education/solartax/?gclid=CjwKCAjwlZf3BRABEiwA8Q0qq2WqmSlRkXpePTFyERLVClwCwK1wXojyvXKMZ15NyfEUZvB4X-f3SBoCyb0QAvD_BwE

[4] Ashley J. Lawson, Net Metering in Brief, Congressional Research Service, November 2019, p. 2 https://fas.org/sgp/crs/misc/R46010.pdf

[5] Josh T. Smith, Grant Patty, and Katie Colton, Net Metering in the States: A primer on reforms to avoid regressive effects and encourage competition, Center for Growth and Opportunity, Utah State University, August 2018, https://www.ourenergypolicy.org/wp-content/uploads/2018/10/net-metering.pdf

[6] Edison Electric Institute, Comment on the Energy Efficiency and Renewable Energy Costs and Benefits of Net Metering (Docket Number EERE-2017-OT-0056), October 30, 2017, p. 4, https://www.regulations.gov/document?D=EERE-2017-OT-0056-0059

[7] California Public Utilities Commission Energy Division, Introduction to the California Net Energy Metering Ratepayers Impact Evaluation, October 28, 2013, p. 11, cited by the

[8] Tom Tanton, Reforming Net Metering Providing a Bright and Equitable Future, American Legislative Exchange Council, 2014, pp. 7-8, https://www.alec.org/app/uploads/2015/12/2014-Net-Metering-reform-web.pdf

[9] Tanton, Ibid., Preface.

[10] Barbara Alexander, Ashley Brown, and Ahmad Faruqui, “Rethinking Rationale for Net Metering,” Fortnightly Magazine – October 2016, https://www.fortnightly.com/fortnightly/2016/10/rethinking-rationale-net-metering?page=0%2C4&authkey=2da80d85d34c100a798356a74f271dd824a0656fc9aab6a7dba6b4fe16350473

[11] Lawson, Ibid., p. 4

[12] Galen Barbose, Putting the Potential Rate Impacts of Distributed Solar into Context, Energy Analysis and Environmental Impacts Division Lawrence Berkeley Laboratory, January 2017, https://eta-publications.lbl.gov/sites/default/files/lbnl-1007060.pdf

[13] California Public Utilities Commission, California Net Energy Metering (NEM) Draft Cost-Effectiveness Evaluation, September 26, 2013, pp. 6-7, https://www.heartland.org/_template-assets/documents/publications/cpucnemdraftreport92613.pdf (cited by Tanton, Ibid., p. 7. fn. 23)

[14] Lawson, Ibid., p. 3

[15] Ben Zycher, “Missing the forest for the trees on solar net metering,” The Hill, August 1, 2016, https://thehill.com/blogs/pundits-blog/energy-environment/289981-missing-the-forest-for-the-trees-on-solar-net-metering

[16] Molly F. Sherlock, “The Energy Tax Credit: An Investment Tax Credit for Renewable Energy,” In Focus 7-5700, Congressional Research Service, November 2, 2018, https://fas.org/sgp/crs/misc/IF10479.pdf

[17] NERA Petition, p. 20

[18] 16 U.S. Code § 824a–3.Cogeneration and small power production, https://www.law.cornell.edu/uscode/text/16/824a-3

[19] NERA Petition, pp. 31-32

[20] NERA Petition, pp. 32-33

[23] NERA Petition, pp. 35-36