Champagne Regulations on a Beer Budget

The disproportionate burden on small businesses

Regulation is often regarded as akin to a tax, albeit one that takes place off of the government’s books. Similar to a value-added tax, it is a tax that is largely hidden, since the cost of regulation is built into the prices of the products and services consumers and producers buy and sell. However, these costs do not fall equally across society. Rather, they tend to affect some people and businesses more than others. Lower-income individuals and small businesses, it turns out, tend to be burdened disproportionately.

Regressive regulatory costs

Regulatory costs are often regressive, meaning they fall disproportionally on lower-income groups of people. Several factors contribute to the regressive nature of regulation.

First, academic research suggests regulatory costs are often regressive in their final incidence. Costs initially imposed on businesses will be partially passed on to customers. These absolute price increases tend to represent a larger relative share of a lower-income person’s budget compared to a higher-income person. In this way, regulatory costs disproportionately burden poorer citizens.

Additionally, businesses typically aren’t able to pass all of the costs of regulation on to their customers, leaving some costs to be absorbed by workers in the form of lower wages as well as by shareholders through lower returns. Assuming lower-skilled workers have less bargaining power than higher-skilled workers, one can expect wage reductions to disproportionately fall on lower-skilled workers as well. Regulation also often requires firms to make certain expenditures or investments irrespective of their output or sales level. When such mandatory costs do not vary with the quantity of output produced, they become part of the fixed cost of doing business. Smaller firms, with less revenue and lower output, tend to have a harder time absorbing these fixed costs compared to large firms, that can more easily spread regulatory costs across their more sizable revenue base.

Finally, the benefits of regulation often accrue disproportionately to higher income individuals as well. The affluent exhibit a greater willingness to pay for regulatory outcomes like safety, environmental quality, carbon reduction, and consumer protections. This higher willingness to pay tends to skew regulatory benefits in their favor, both through the political process as well as when evaluated in a cost-benefit analysis. Meeting these preferences comes at a cost that is very often imposed regressively. Thus, regulations often have the effect of redistributing purchasing power from the relatively less well-off to the rich. The poor disproportionately bear the costs of regulation while the rich disproportionately enjoy the benefits.

Regulators pop the champagne

In testimony before the House Oversight Committee in Washington DC, University of Chicago economist Casey Mulligan explained how the tendency of regulations to force low-income households to bear costs that only high- income households would be willing to bear voluntarily given the benefits they achieve is akin to forcing low- income households to have “champagne tastes on a beer budget.”

Analysis by Mulligan sheds light on how regulatory costs impact Americans. In a 2023 report, Mulligan compared the regulatory records of the Biden, Trump, and Obama administrations. He found that, as of the end of 2022, the Biden administration was imposing new regulatory costs at a rate faster than the Obama administration did during a comparable period. Biden’s regulations were estimated to impose costs on Americans of almost $10,000 per household.

Mulligan’s report relies on cost estimates from federal agencies, who themselves tend to understate regulatory costs by overlooking opportunity and resource costs, according to the author. Compounding matters, the Biden White House recently moved to further downplay consideration of the opportunity costs of investment in federal regulatory impact analysis. Mulligan concludes that the Biden administration is adding regulatory costs at a rate of over $600 billion per year.

If regulatory costs rise at the rate seen under Obama, Biden’s regulations would create almost $60,000 per household in added costs over eight years. To many, that will be a crushing burden. By contrast, the Trump administration’s deregulation efforts worked in the opposite direction, reducing regulatory costs by about $11,000 per household over four years.

Burdening economic growth

A review of recent academic literature indicates that regulations substantially reduce economic growth, though estimates vary on how much they drag down growth. According to a 2021 survey of cross-country research conducted by Robert Hahn and me, a consensus exists that economic regulations like price controls and barriers to entry hamper growth, while the effects of social regulations are more ambiguous largely because they haven’t been studied to the same extent.

A 2020 study estimates that the accumulation of federal regulations since 1980 lowered US GDP growth by around 0.8 percentage points per year, reducing 2012 GDP by $4 trillion or 25 percent below what it would otherwise have been. A study by my CEI colleague Wayne Crews estimates the annual cost of federal regulations at around $1.9 trillion. A published paper by John Dawson and John Seater estimates that the total accumulation of federal regulations from 1949 to 2005 reduced US output growth by 2 percentage points annually, lowering GDP to just 28 percent of what it would have been by 2005 – a $38.8 trillion loss.

Meanwhile, a 2023 study by Shikhar Singla estimates that annual regulatory costs faced by US firms increased by $1 trillion from 1970 to 2018. The paper finds that regulatory costs have disproportionately impacted small firms, with an average cost per employee of $9,093 compared to $5,246 for large firms. These figures are broadly consistent with other studies exploring how regulatory costs differ on a per-employee basis across small and large firms.

The Singla paper shows that increases in regulatory costs can have harmful effects on competition, leading to small firms becoming smaller and large firms becoming larger. The study finds a 100 percent increase in regulatory costs leads to a 1.2 to 1.9 percent increase in establishments, employees and wages for large firms, while decreasing those metrics by 1.4 to 1.6 percent for small firms. The smaller the firm, the more competitively disadvantaged it becomes, according to this research. The highest regulatory costs are found to be from environmental and transportation regulations. Overall, the disproportionate impact of regulations on small firms explains 31 to 37 percent of the rise in industry concentration and markups during the study period.

One explanation for the decline in per-employee regulatory costs as firms grow larger may be that the costs of regulations are relatively fixed, and therefore that larger firms can spread these costs across a larger revenue base. Another explanation may be that as requirements become sufficiently complicated, workers are hired in government affairs and compliance roles and there may be efficiency gains from having specialists working on these topics. In a 2018 Price Waterhouse Coopers survey, over-regulation was the top concern among CEOs.

Distributional analysis to the rescue?

The empirical literature indicates regulations impose a significant drag on measurable economic growth, compounding to trillions of dollars in annual costs over time. Moreover, beyond burdening existing small businesses, regulations may also disproportionately hinder the creation of new small businesses. This has large implications for the economy, as there are about 33.3 million small businesses in the United States, comprising 99.9 percent of all American businesses. About half of all employees work for a small business, which combined contribute about 43.5 percent of US GDP.

Taken together, the evidence suggests more careful analysis of new regulations for their impacts on small businesses could yield sizable economic returns. Unfortunately, the current state of regulatory analysis leaves much to be desired. The history of federal regulatory agencies conducting distributional analysis is a case in point. Studies that have looked into the issue find that it is rarely done in agency regulatory impact analysis, especially in the context of evaluating the distribution of regulatory costs. This is despite numerous existing executive orders requiring the consideration of distributional impacts in regulatory analysis.

Distributional analysis could be helpful in identifying the number of small business affected by a regulation, as well as the incidence of regulatory costs on those firms. The Biden administration recently updated the federal government’s guidance to executive agencies on the production of regulatory impact analysis. While the update devolves vast analytical discretion to government analysts, the Biden administration’s update does put an increased focus on the distribution of benefits and costs.

More disaggregation of benefits and costs to focus on the parties impacted by regulation–done fairly and objectively–would be a welcome development. It is very likely that small businesses should be singled out for distributional analysis purposes, and, given the existing body of evidence, that such analyses would often uncover that small businesses are disproportionately impacted by regulations.

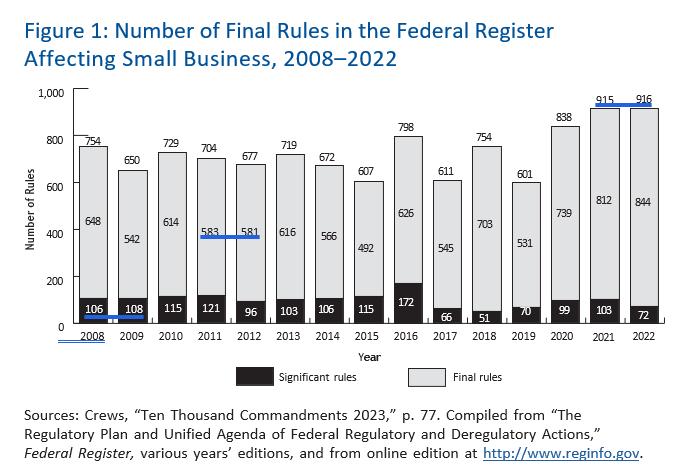

Wayne Crews in his annual 10,000 Commandments report documents the number of regulations identified as impacting small businesses. These numbers are reported in figure 1 below from 2008 onward. In recent years, more than 900 regulations were identified as affecting small businesses each year. In 2022, Crews identified 916 final rules affecting small business in the Federal Register, 72 of which were deemed significant. These counts suggest 18 to 29 percent of final regulations issued each year are rules affecting small businesses.

There is also some confusion about what constitutes a regulation affecting small business. For example, the Unified Agenda of Regulatory and Deregulatory Actions identifies rules that require a regulatory flexibility analysis, but also denotes rules that affect small entities. This is problematic given that regulations with a significant economic impact on a substantial number of small entities, or SEISNOSE, are supposed to be required to have a regulatory flexibility analysis.

Even while regulatory costs often fall disproportionately on small businesses, the regulatory code can also benefit small business through special privileges and furthermore, often incentivizes companies to stay small. This can occur, for example, through exemptions for small businesses, or, similarly, when requirements kick in as companies reach certain thresholds in terms of employees. Such exemptions create some advantages for small businesses relative to their larger rivals. However, these restrictions also act as a tax on their growth. For example, it is not uncommon to see companies bunch around staffing numbers just under levels where restrictions kick in.

Regulatory Flexibility Act is too flexible

The Regulatory Flexibility Act (RFA) of 1980 requires agency heads to certify that particular regulations do not have a SEISNOSE. Otherwise, a regulatory flexibility analysis is required, which examines the impact of the regulation on small businesses specifically. The counts in figure 1 could well be underestimates, given inconsistent certifications by agencies.

Such certifications are well-known to be unreliable. One reason they are unreliable is that only direct costs are considered in the analysis. If small businesses are indirectly impacted, say, because their customers or suppliers bear the direct costs of regulation, there is no requirement the regulatory flexibility analysis take that into account. Furthermore, there is ambiguity and vagueness in the SEISNOSE standard, both surrounding the definition of “substantial” as well as what constitutes a “significant impact.” Neither term is defined by the RFA. The Small Business Administration sometimes assumes impacts greater than 5 percent of labor costs for a particular class of businesses would be considered significant, or more than 1 percent of annual revenues. However, there is no legal basis for these or similar definitions.

The RFA was updated in 1996 when Congress passed the Small Business Regulatory Enforcement Fairness Act (SBREFA). SBREFA requires that certain agencies like the Environmental Protection Agency, Occupational Safety and Health Administration, and (subsequently) the Consumer Financial Protection Bureau convene panels that meet with small business interests before proposing regulations likely to significantly impact small businesses. The law also strengthened accountability and oversight by entitling small entities to judicial review of agency compliance with the requirements in the RFA.

However, in practice such lawsuits are rare. This is likely due to a combination of factors. First is the esoteric nature of the RFA, in the sense that not that many small businesses know about or understand it. The second relates to the costs involved in suing. It may be that only larger industry groups with significant investments on the line have the resources or motivation level to challenge regulations. Third, there are risks associated with suing, especially since the law is somewhat ambiguous about what actions constitute violations of the RFA.

Even if a business wins a lawsuit, the benefit may be small since there is no requirement that the agencies base their regulatory approach on an RFA analysis. Thus, if an agency has a rule vacated because it failed to comply with the requirements of the RFA, that agency could likely redo the analysis but republish the same exact rule, regardless of what that analysis shows.

Also, suing an agency could create an antagonistic relationship between the business and its regulator. This can lead to future headaches for the business down the road.

The Office of Advocacy within the Small Business Administration can nevertheless be an important resource for small businesses. The Office of Advocacy is charged with ensuring compliance with the RFA. However, it has no real oversight power over regulatory agencies. Agencies often speak to Advocacy for feedback, and Advocacy can offer comments on agencies on their regulations. But Advocacy can not force agencies to take any actions, so agencies are usually free to ignore Advocacy’s feedback. Moreover, the office has not had a politically-appointed Chief Counsel since the Obama administration, which further weakens oversight.

Conclusion and policy recommendations

From an equity standpoint, the regulatory system we have today represents what may be the worst of all possible worlds. Within the current generation, regulations tend to redistribute from the poor to the rich, as low-income households and small businesses are forced to subsidize the policy preferences of the well-to-do. Across time, meanwhile, regulations slow economic growth, leaving future generations with lower living standards than they would enjoy otherwise. It follows that we are consuming resources through regulation today to serve the interests of the rich and large corporations. Those that pay the consequences are low-income citizens, small businesses, and future generations.

Federal agencies are able to avoid accountability for their inequitable actions in part because they decline to study the distributional impacts of their regulations, in spite of numerous requirements that they do so. Agencies also evade accountability when they certify regulations that actually have a SEISNOSE.

What is likely needed is fresh input from Congress. It is unlikely that further executive orders or guidance to federal agencies will lead to more or better distributional analysis, given agencies’ poor track records. There is some hope for bipartisanship in this area given the widespread support for small businesses, as well as the Biden administration’s recent emphasis on improving distributional analysis.

Several reforms could prove beneficial in these areas. Congress could more clearly define the SEISNOSE standard. It could give more oversight power to the Office of Advocacy within the Small Business Administration (such as by giving it authority to demand changes to regulations or reinstating a politically-appointed Chief Counsel). It could also create a system of third-party reviews of agency RFA certifications by an independent auditor, or allow the public to file petitions to force a review of certifications.

Finally, the RFA could be strengthened through an explicit requirement on agencies to minimize the costs of their rules to small businesses. Agencies are already supposed to consider alternatives that would reduce the cost to small businesses, but they can rather easily explain why they didn’t pick these alternatives. Requiring agencies to select the alternative that is least burdensome to small business would likely re-invigorate the RFA.

These examples highlight proactive steps Congress can take to alleviate burdens on small businesses. Such updates to existing law are desirable, given the academic evidence that lower-income groups, and especially small businesses, are disproportionately impacted by the burdens of federal regulations.