Don’t Depower Crypto

Biden’s electricity tax would harm conservation, innovation

Introduction

In President Biden’s Fiscal Year 2024 budget blueprint,1 the president proposed a new tax aimed at the electricity use caused by cryptocurrency mining.

Known as the Digital Asset Mining Energy (DAME) tax, the proposal would phase in a 30 percent tax over three years on the cost of the electricity used in crypto mining.2 The Biden administration estimates that, if enacted, the tax would raise $3.5 billion in revenue over 10 years.3

Biden’s proposal is intended to be “pro-environment” by discouraging emissions of carbon dioxide. In that sense, it can be viewed as a kind of a backdoor carbon tax—one targeted at a specific industry and focused on electricity use rather than emissions.

It is also part of Biden’s “whole-of-government” tax and regulatory agenda – through which agencies such as the Securities and Exchange Commission (SEC) are trying to address climate change while simultaneously relegating the crypto sector to the economic fringes4—as well as part of a broader effort to force the wealthy and corporations to pay more in taxes. While Biden’s initial proposal has so far failed to gain support in Congress, his administration is likely to make additional pushes for the DAME tax in future budget negotiations.

Details of how exactly the DAME tax would work remain scarce. The crypto electricity tax theoretically serves to lessen externalities imposed on third parties by the pollution associated with cryptocurrency mining activities. In the rapidly-evolving world of cryptocurrencies, the discourse around energy consumption has become particularly heated in recent years but it is also often misleading. Critics point to the extensive power use by networks that rely on the proof-of-work model for transaction validation, painting a seemingly alarming picture of the environmental implications.5 But this narrative about a wasteful and environmentally-ruinous crypto industry, typically fueled by politicians and sensationalist media, views the crypto sector myopically.

This paper is not the place to discuss wider federal attempts to reduce the public’s energy usage, but it may be that the attack on crypto companies is just the beginning of a larger government agenda to punish electricity use.6 Cryptocurrencies, most notably Bitcoin, do consume a significant amount of energy, and they are also relative newcomers on the financial scene. These factors make cryptocurrencies an easy target. However, it is also important to place this consumption in the broader context of energy use across the economy as a whole as well as in the context of the benefits consumers derive in this marketplace.

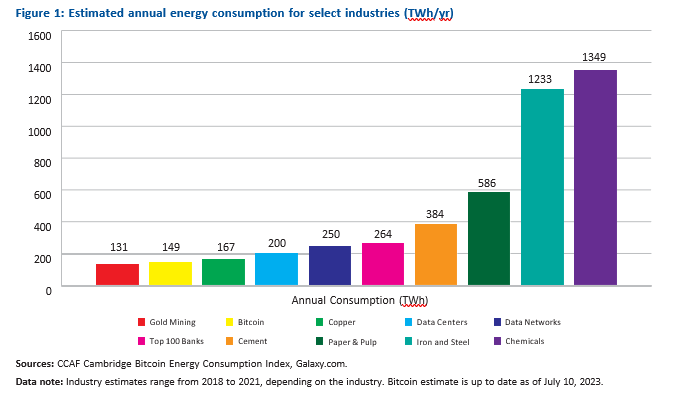

A comparative analysis across industries reveals that the energy footprint of the crypto industry is not disproportionately large compared to many other sectors. The environmental impact from the gold or copper mining industries,7 or the energy use of aspects of the traditional payments system, including bank data centers and bank branches, exceeds that of Bitcoin, the dominant crypto electricity user, by most reasonable measures.

Furthermore, the electricity use resulting from crypto mining is not without purpose. Crypto mining is instrumental in maintaining the security and integrity of decentralized networks. This energy is not wasted but invested in creating a new, potentially more secure financial ecosystem. While there has been considerable media attention on crypto scandals, such as the collapse of the exchange FTX or remittances flowing to various nefarious actors abroad, the industry continues to provide a variety of benefits that often go overlooked, ranging from increased financial inclusion to decentralization and enhanced privacy. Thus, there are benefits that must be understood before governments consider whether to limit the crypto industry’s electricity use through taxation or other means.

The analysis that follows will show that while cryptocurrency mining does require significant electricity, its energy footprint is on par with many mainstream industries when viewed in context. At the same time, the crypto industry is already taking steps on its own to utilize renewable energy and reduce its carbon dioxide emissions. Meanwhile, there are many reasons why an electricity tax targeted specifically at crypto sets a terrible precedent, could have unintended consequences, and could stifle beneficial innovation, including innovation that makes crypto mining more energy efficient. For these reasons, we conclude that policymakers should let this nascent market continue to mature rather than restrict its growth and development through discriminatory taxation.

How cryptocurrency is validated

Cryptocurrency validation is a process that serves two core functions. First, the validation process verifies financial transactions. Second, that process introduces new “coins”– or units of cryptocurrency– into the existing circulating supply. There are two competing mechanisms that cryptocurrencies primarily use to accomplish these outcomes.

The two main transaction validation procedures are known as Proof of Work (PoW) and Proof of Stake (PoS). PoW, the system utilized by Bitcoin, Dogecoin, and many other cryptocurrencies, is traditionally referred to as mining. Under PoW, miners compete to solve a cryptographic hash function (an equation that is used to verify data validity), with the successful miner adding the latest block to the blockchain and receiving a reward in the form of new coins.8 PoS, on the other hand, chooses the creator of a new block based on their stake, i.e., ownership in the cryptocurrency. The selection process varies, but a validator is selected from a pool of cryptocurrency owners who have staked some of their currency as collateral. A validator is then given the privilege of verifying the transaction, receiving some new coins in the process. Malicious actions are disincentivized in this process as this can result in validators losing staked coins.

The primary advantages of PoW are security and decentralization. Altering the transaction history is extraordinarily difficult, thus making the blockchain highly secure. Anyone can compete in the mining competition, so long as they possess the necessary hardware. A cost of PoW is it is energy-intensive, since the competition among miners to solve puzzles uses a lot of energy. This electricity use has led to environmental concerns.

Conversely, PoS is much less energy-intensive and is supposed to provide faster validation of crypto transactions for purposes of storing a record on the blockchain.9 However, PoS is much more centralized than PoW. Larger holders of cryptocurrency tend to be the ones who stake collateral, thereby enabling them more chances to validate transactions. This might lead to a concentration of power and potential security risks. Solana is a cryptocurrency that relies on the PoS consensus mechanism. The shift of Ethereum10 from PoW to PoS in 2022 through the Ethereum 2.0 upgrade has also brought these discussions to the fore.

Many see Ethereum’s transition as a move toward environmentally sustainable and scalable blockchain technology. The Merge, as the Ethereum transition is colloquially known, has cut energy use by the Ethereum network dramatically,11 but the jury is still out on whether PoS is superior along other dimensions. The debate over PoW and PoS is far from settled, as the market continues to explore and experiment with these and other consensus mechanisms.12 From a policy standpoint, it is important not to prematurely pick winners and losers but instead to allow free competition that enables the industry to discover more efficient solutions. As the sector matures, we can anticipate a continued evolution and refinement of these protocols. Developers will learn from their successes as well as their failures.

Powering crypto vs. other industries

While data for crypto energy use are hard to come by, websites like Statista and Digiconomist do present estimates of Bitcoin’s energy consumption.13 We focus here on Bitcoin, since it is the largest player in this market, estimated before the Ethereum merge to account for between 60 and 77 percent of total global crypto-asset electricity use.14 Its share has probably increased since then.15

According to Digiconomist, as of mid-2023, Bitcoin’s total energy use is around 101.75 terawatt-hours (TWh) per year,16 which is more electricity than the entire nation of Belgium or the Czech Republic uses annually. A report from the Cambridge Centre for Alternative Finance (CCAF) estimates that the Bitcoin network consumes slightly more energy than estimated by Digiconomist, approximately 149 TWh per year as of mid-2023.17

Cryptocurrency critics constantly hammer away at Bitcoin’s energy use exceeding that of some countries. However, this appears to be true of many domestic industries, and should not be surprising given that many nations have small populations relative to the U.S. If we compare Bitcoin to other industry sectors, Bitcoin’s energy use is nothing out of the ordinary.

For example, compare cryptocurrency’s electricity use to that of the traditional banking sector. According to a 2021 analysis from the website Galaxy.com,18 the card networks, ATMs, and the data centers of the largest 100 banks consume about 264 TWh per year, which is considerably more electricity than Bitcoin.

Furthermore, according to the CCAF data, Bitcoin’s energy consumption of perhaps 149 TWh is less than that of not only data centers and networks, but also various manufacturing industries, including paper, iron, and chemicals.19 In other words, when compared to other industries that contribute significantly to global economies, some of which also engage in real- world and not just digital forms of mining,20 Bitcoin’s energy and environmental footprint does not appear to be so outsized. For example, the copper industry is estimated to utilize approximately 167 TWh/yr of electricity, which is more than Bitcoin.21 Meanwhile, the gold industry consumes approximately 131 TWh/yr, roughly in line with Bitcoin (see Figure 1).

Meanwhile, energy consumption for mineral production is expected to increase significantly under the types of climate policies the Biden administration is pursuing. For example, global copper consumption for electricity networks doubles between 2020 and 2040 in the International Energy Agency’s “sustainable development scenario.”22

On the other hand, the energy consumed by 100,000 Visa transactions is only about 148.63 kilowatt- hours (kWh), or considerably less than one TWh per year.23 Some might argue these transactions are what should be compared to Bitcoin’s electricity use, since Bitcoin, like Visa or Mastercard, also facilitates financial transactions. Based on this method of comparison, the average energy consumption of a single Bitcoin transaction is about 700 kWh, which far exceeds that of 100,000 Visa transactions.24

This comparison of “transactions” may be unfair, however.25 For example, banks and credit card companies like Visa employ a variety of methods for imposing security and guaranteeing the integrity of their network. These likely do not show up in estimates of the electricity use associated with, for example, a credit card swipe, whereas the mining verification process Bitcoin employs is included in its transaction electricity data. Furthermore, Visa must work with cooperating banks, whereas Bitcoin is a self-sufficient network, intended to work around mainstream financial institutions. Thus, Visa is dependent on external electricity use in the banking sector in a way that Bitcoin is not.

It is also important to understand that a single Bitcoin mining verification involves more than one purchase. Multiple transactions are grouped into a single block on the blockchain. The exact number varies depending on factors such as transaction sizes.26

Part of the reason Bitcoin receives so much attention for its energy use is no doubt that the energy use of other sectors like the banking industry is less transparent.27 Energy Star’s 2015 report analyzed energy use in bank branches across the US.28 Based on the median energy use per square foot in a bank branch (266 kBtu/ft2), our calculations suggest that the total annual energy use of US bank branches is about 436 TWh.29 This is about three times the annual energy consumption of Bitcoin, which is a global network.

This back-of-the-envelope estimate–combined with the data on aggregate power use by banking data centers, bank branches, ATMs, and card network data centers—suggests the total energy consumption of the banking system is considerably in excess of Bitcoin’s global consumption annually.

Biden’s bad idea

While the environmental rationale for a cryptocurrency electricity tax is relatively straightforward—essentially it is a modified, and industry-specific, carbon tax—the implications of the tax are not straightforward for several reasons.

First, taxing the electricity use of a single industry sets a terrible precedent that suggests politicians should be free to make scapegoats of politically- disfavored industries. Moreover, the DAME tax’s core rationale that cryptominers do not “pay for the costs they impose on others”30 applies to all industrial, commercial, and residential consumers of electricity. This tax appears to just be a backdoor carbon tax that can start with one industry and then spread across the economy and society, from factories to homes.

However, discriminatory taxation is even more concerning in the crypto context given the public can often be prejudiced against speculative new technologies with unproven benefits and risks. A logical question is: After cryptocurrencies, what innovative industry will be singled out next? Two possible answers are cloud computing and artificial intelligence, both of which are driven by large data centers requiring growing electricity use.31

Second, while we acknowledge the crypto industry has had its share of struggles, there are distinct benefits offered by cryptocurrencies. These benefits range from facilitating faster and less expensive cross- border transactions to enhancing financial privacy and inclusion for those who lack access to traditional banking services.32 Cracking down on crypto energy may reduce emissions, but it will inevitably bring costs in other areas.

One of crypto’s more recent useful applications comes in the form of “stablecoins,” whose value is typically fixed to a fiat currency such as the US dollar. Stablecoins have reduced the costs of sending money internationally,33 and have offered crucial lifelines for citizens lacking access to stable traditional currencies in countries from Ukraine to Venezuela.34 While remittances can sometimes flow to nefarious actors, these entities might be able to find other ways of receiving money transfers if stablecoins were unavailable. For example, cash is one of the most commonly used means of funding illicit activities.35 Due to the significant humanitarian benefits of remittances, cracking down on stablecoins seems like a serious mistake.

Stablecoin issuers, including Circle (USDC) and Tether (USDT), utilize the blockchains of other cryptocurrencies when delivering their fiat-backed tokens, thereby providing additional benefits from those currencies’ PoW and PoS validation processes.36 Other benefits that blockchain technology currently provides include enabling the traceability of individual goods in a cargo shipment, and facilitating education certificate verification that can prevent fraud or enable faster processing of job applications.37 Blockchains cannot be easily separated from the cryptocurrencies they underlie, since payments in cryptocurrency tokens are essential to incentivize record keepers to maintain the blockchain-based ledgers.38 As blockchain technology spreads to other areas, the benefits of crypto will only grow larger. A tax on cryptocurrency validation could halt or dramatically slow these beneficial uses of blockchain, as well as any potential future beneficial uses.

A third problem with the proposed tax is that it could unintentionally favor the PoS model of transaction verification. That may sound desirable, given the greater environmental footprint of PoW today. However, it is not obvious PoS will generate the best overall outcomes in the future, including environmental outcomes. PoW has certain advantages in terms of security and decentralization, and the industry is already coming up with innovative ways to improve the energy efficiency of the PoW transaction verification process. One example is the “lightning network,” which is a second layer payment protocol that operates on top of the Bitcoin blockchain.39

Relatedly, electricity use can come from a number of different sources, including fossil fuel sources, renewables, and nuclear energy. If the goal is to reduce greenhouse gas emissions, then it makes little sense to tax the electricity consumption of an industry irrespective of the source of the electricity it consumes. Moreover, even without government intervention, companies engaged in cryptocurrency mining are moving toward renewable sources and nuclear energy on their own, as well as utilizing parts of the fossil fuel energy stream that would otherwise be wasted.

Aspen Creek is a crypto mining firm that has as a core principle that electricity used in company mining operations will be sourced from renewables, including solar or wind.40 Blockfusion and US Bitcoin Corp. (the latter of which recently merged with the large crypto mining firm Hut 8) are two mining companies that opened locations in Niagara Falls, New York, citing the region’s clean and plentiful hydropower as a primary reason for setting up operations there.41 (Strangely, the Biden administration also complains about noise pollution and water usage by crypto firms,42 but has only chosen to target a tax at the electricity use of the industry.)

Other conservation examples include the productive use of natural gas produced as a byproduct of oil production that would otherwise be burned by flaring or vented into the atmosphere. Crypto mining firms are preventing these wasteful practices by locating facilities near oil fields and capturing the natural gas as it is produced.43

Even if one excludes fossil fuels from energy sources conventionally defined as “sustainable,”—a categorization that the Competitive Enterprise Institute has in the past disputed44—there is evidence crypto is nevertheless “sustainable.” When including the use of both natural gas byproducts and renewable energy sources, one study estimated that 52.6 percent of Bitcoin’s energy mix comes from sustainable sources of energy.45

Nuclear energy generation, which emits no greenhouse gases, is also rapidly becoming a power source for cryptocurrency mining, a development that could improve overall financial stability for the nuclear sector. Early in 2023, the Bitcoin mining firm TeraWulf opened the first crypto mining facility in the US to be powered 100 percent by nuclear power.46 The energy startup firm Oklo, which plans to build the first advanced-fission compact nuclear power plant in the US, announced in 2021 a 20-year commercial partnership with Bitcoin mining firm Compass Mining.47

Crypto pundits Drew Armstrong and AJ Scalia wrote in Bitcoin Magazine that cryptocurrency mining’s constant demand for a reliable power source, coupled with its ability to locate near nuclear projects, “offers a path forward” for nuclear energy. They believe that crypto mining firms can spur new nuclear power projects to be built, because the utilization for mining will “shorten payback periods and make underwriting new nuclear projects less risky for potential investors, reducing their cost of capital and leading to more nuclear generation.”48

To the extent crypto electricity comes from renewable sources, capture of natural gas byproducts, or nuclear energy, a crypto electricity tax won’t offer much in the way of reducing greenhouse gas emissions and could even increase emissions if renewable projects become less profitable or gas byproducts at oil fields are once again flared or vented instead of used to power crypto mining. Likewise, mining companies may respond to the DAME tax by moving to other jurisdictions, such as to foreign countries where energy production is more heavily dependent on fossil fuels. This is not unrealistic given how intensely competitive the crypto mining industry is.

Conclusion

Cryptocurrency mining, notably associated with the PoW model used by Bitcoin, requires a substantial amount of electricity. However, this energy use is not unusual when compared to the energy demands of other global industries and activities. Moreover, significant strides have already been made within the cryptocurrency industry to develop more energy-efficient mining hardware and the industry is increasingly trending toward renewable energy sources. When placed in context, the energy consumption of the cryptocurrency industry is unremarkable and non-concerning.

A tax such as the DAME tax proposed by President Biden in his Fiscal Year 2024 budget blueprint may have unintended consequences. It could lead to less productive uses of energy, as well as potentially increased greenhouse gas emissions by reducing the demand for renewables and nuclear, while pushing crypto miners overseas to countries that rely more on fossil fuels.

The DAME tax can also be seen as discriminatory, picking winners and losers and distorting an innovative market in its early stages of development. Despite PoS being less energy intensive today, it is telling that not all cryptocurrencies are transitioning to the PoS model in the same manner as Ethereum. This suggests that some networks don’t think the costs of transition are worth it.

Some critics associate crypto with speculative and in some cases criminal activity, and to be fair, the industry has had its share of challenges. Nevertheless, it continues to move in the direction of being a stable and recognizable part of the mainstream financial system. Some of the US’s largest financial firms – including Blackrock, Fidelity, and Invesco – are competing to sell exchange-traded funds tied to Bitcoin’s price.49 A new tax could end up crushing this innovative market to the detriment of the public and institutional investors. Just as every fledgling industry must prove its value to customers or else retreat from the marketplace, the crypto industry should be given the time and breathing room it needs to find its footing in the global financial landscape.

Finally, a cryptomining electricity tax may simply be the first step of a plan for a comprehensive tax on electricity usage. A federal tax on electricity would be a punitive measure that would penalize Americans for simply wanting to power their lives. It is a strange step to be taking at a time when the Biden administration is trying to electrify other sectors of the economy, such as the automobile market.50 Further, by failing to discriminate between the myriad sources of electricity, it may not even have the intended effect of reducing emissions.

Rather than make the public and industry feel guilty about their energy use, policy makers should refocus their efforts on removing government- imposed obstacles that make it difficult to generate electricity. After all, Americans rightfully expect the lights to come on when they flick the switch, and absent government interventions that restrict electricity production, there would be little risk that this expectation would not be met. A cryptocurrency electricity tax is not necessary to safeguard electricity supply or affordability. Indeed, it would be counterproductive to those objectives by further politicizing electricity markets.

The nation’s electricity grid can support the continued growth of novel industries, while simultaneously promoting the innovation and dynamism that is vital to ensuring not just rising living standards, but improved conservation efforts as well.