Frack to the Future

North Dakota’s blueprint for permitting success

Introduction

North Dakota is typically known for the Badlands, agriculture, Fargo (thanks, Coen brothers), cold weather, and its flat landscape. Yet, due to technological advancements and exploratory success, oil has also become an integral part of the identity of the Peace Garden State. By harnessing directional drilling and hydraulic fracturing, North Dakota’s Department of Mineral Resources has kept permitting inexpensive, fast, and straightforward. State agencies have been transparent in regard to production, regulation, planning, and creating a public oil spill database. This has resulted in significant benefits to the state, including reduced local tax burdens and increased funding for infrastructure, education, and property tax relief.

Fracking ramps up

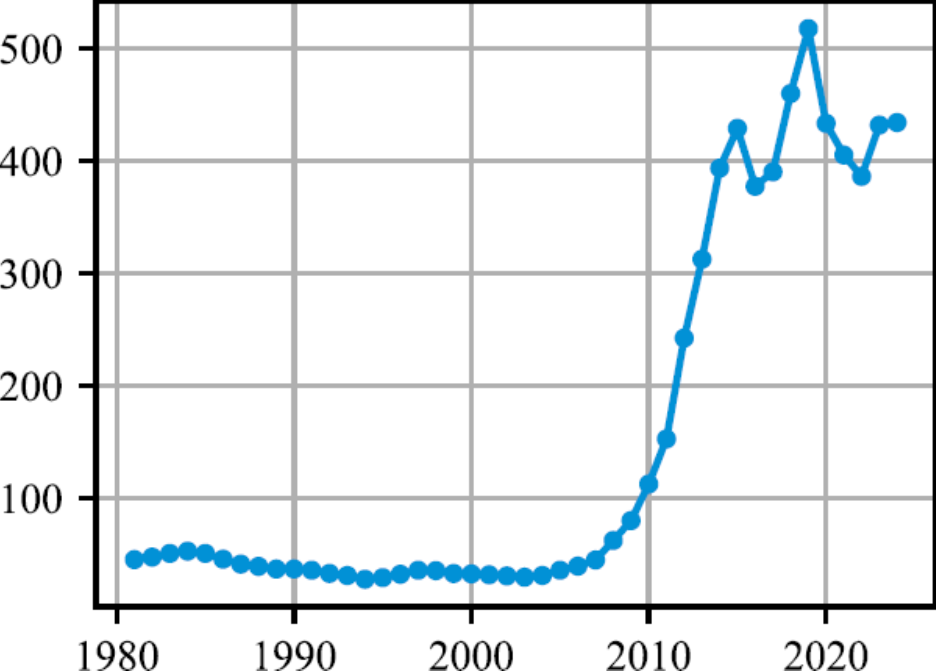

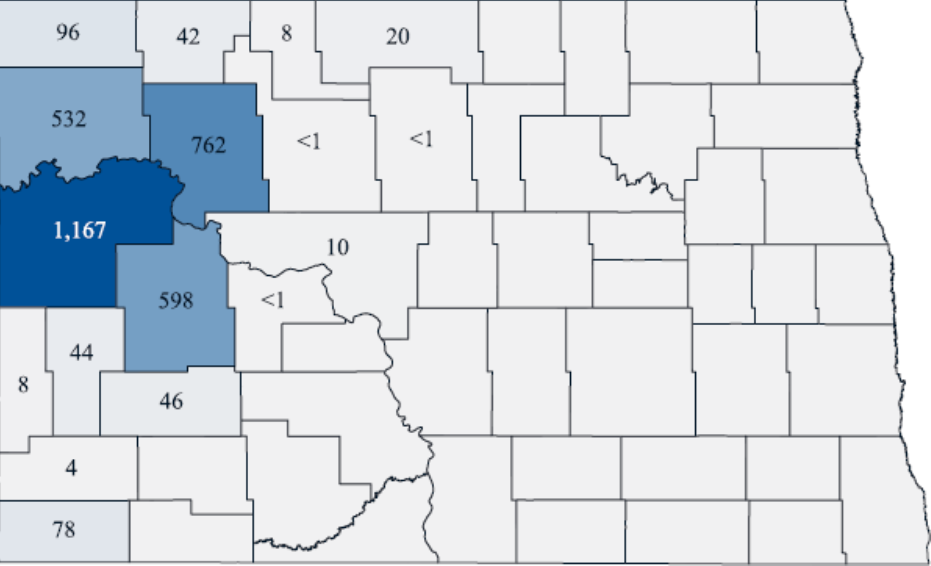

The technological developments of horizontal drilling and hydraulic fracturing unearthed unprecedented amounts of oil in North Dakota, most notably from the Bakken Formation. From 2010 to 2023, the state produced 5,042,994,000 barrels of crude oil, second only to Texas during the same period. Pairing horizontal drilling with hydraulic fracturing was key to achieving economically feasible extraction, as the state had previously produced only modest amounts of oil. The results of these changes in oil extraction methods are evident in Figures 1-3, as oil activity increased in and around Williston beginning in 2008.

Figure 1: North Dakota field production of crude oil, 1981-2024 (millions of barrels)

Figure 2: Oil production by county, 2010-2019 (millions of barrels, non-confidential wells)

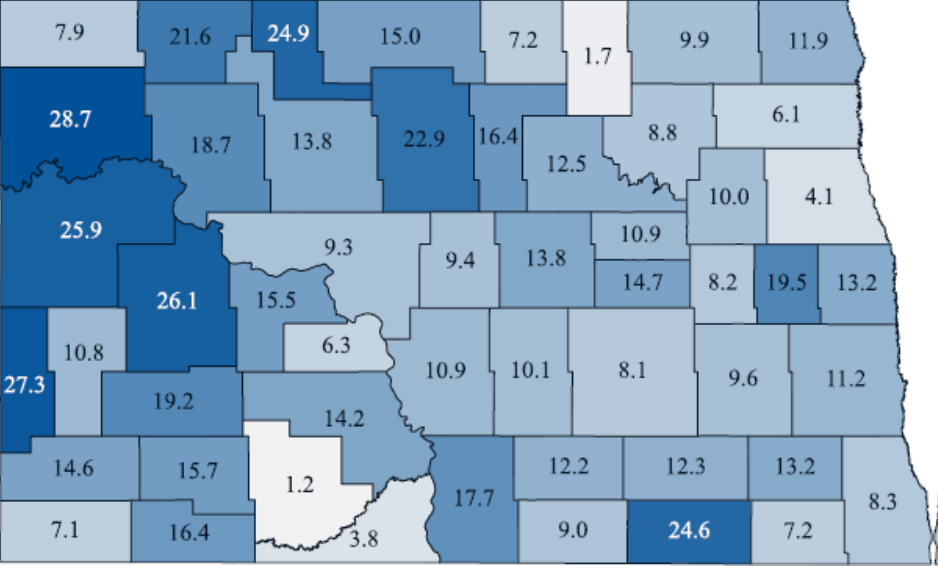

While this energy boom has led to greater fluctuations in GDP and state revenue, it has also improved economic conditions within the state, for local governments, and across industries nationwide. Figure 3 shows the change in real household income by county from 2005-2009 to 2014-2019. The western portion of the state, where oil activity is concentrated (see Figure 2), has experienced the greatest growth in median income. This boom has contributed to an economic environment characterized by low unemployment and rising GDP. In recent years, oil revenue has accounted for more than half of local government income, providing funding for conservation, education, property tax relief, and more. Lastly, because extraction increases the supply of oil (an input in many production processes), this activity has helped to lower energy prices and, in turn, reduce the cost of goods and services affected by transportation nationwide.

Shaking up permitting

Horizontal drilling and hydraulic fracturing are primarily responsible for the energy and corresponding economic boom in North Dakota. Still, the actions of North Dakota’s legislature and government agencies also deserve considerable credit. Some states have banned these extraction methods altogether, including Vermont (2012), New York (2015), Maryland (2017), Oregon (2019), Washington (2019), and California (2024).5 North Dakota, meanwhile, has not only welcomed these innovations but has also created a permitting process that is fast, easy to navigate, and relatively inexpensive compared to other places. As a result of productive oil extraction, North Dakota has generated billions of dollars in tax revenue. To drill, a company must register with the North Dakota Secretary of State, file an organizational report, pass a background check, be bonded for the potential costs of plugging and reclaiming a well, and pay a $100 processing fee for a drilling permit, which lasts one year and can be renewed for the same price of $100 each year. This can be compared against other states where fees for unconventional well permits routinely cost in the thousands of dollars. For example, in Pennsylvania, the fee is $12,500. Moreover, approval timelines for permits in North Dakota typically take just 20-30 days.

A recent innovation in North Dakota’s permitting system has been the introduction of the online permit portal, NorthSTAR.11 Hydraulic fracturing simply requires submitting an electronic form within 24 hours after operations begin.

Transparent results

Beyond the streamlined permitting, transparency in the production process is also high in state government. There were updates on energy incidents and production levels from the prior month provided by the former director of the North Dakota Department of Mineral Resources (NDDMR), Lynn Helms, for almost every month from September 2012 to his final report in June 2024. Mark Bohrer, assistant director, has continued these presentations following Helms’s retirement. A database exists detailing the permits, companies, and production of wells in North Dakota. Past public hearings are available on the NDDMR YouTube channel, and future and past dockets can be accessed on the agency’s website. Oil spills have garnered due concern and media attention in North Dakota and nationally. While most of the larger spills have been the result of pipelines from Canadian extraction, North Dakota’s state agencies have responded with measured regulatory requirements. The NDDMR and the North Dakota Department of Environmental Quality (NDDEQ) collaborate to track and report all chemical spills, which are publicly available on a database. Once evidence of a spill surfaces (such as an incident on a rig, lost pipeline pressure, report by residents, etc.), immediate verbal reporting to NDDMR is required. Additionally, online initial notification forms must be filed within 24 hours. A field inspector will visit the location, discharge fluids must be removed, and contamination must be remediated.

Historical spill data can be found on the NDDEQ website, and more recent spills can be found on the Unified Spill Reporting Page. Additionally, the Unified Spill Reporting Page features instructional videos and a PDF outlining the steps companies must follow in the event of a spill.

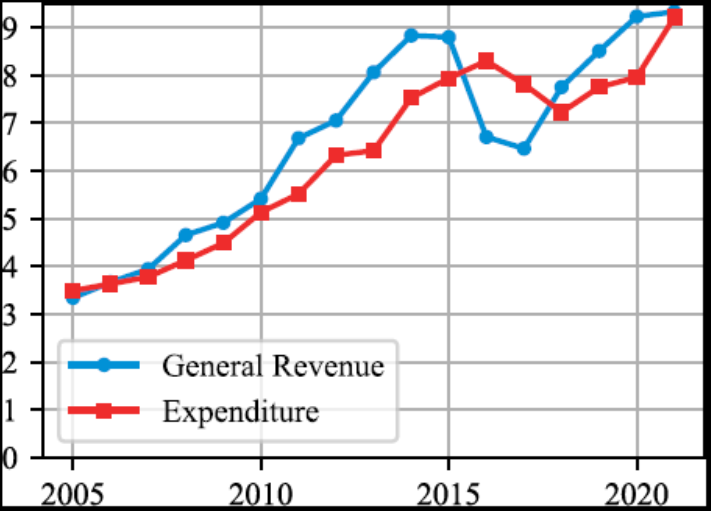

State fracking revenues

In recent years, the North Dakota government has typically maintained an annual fiscal surplus. Figure 4 shows the state general revenue and expenditure from the Census Bureau’s Survey of State Government Finances. When tax revenue has been less than expected at times, as in 2016 (largely due to decreased oil extraction), legislators have responded by reducing spending. The state’s ability to utilize its natural resources while keeping spending within budgetary constraints has enabled it to remain well-funded, even as it maintained the nation’s largest growth in the school-age population from 2010 to 2020.

Figure 4: North Dakota state government annual general revenue and expenditure, 2005-2021

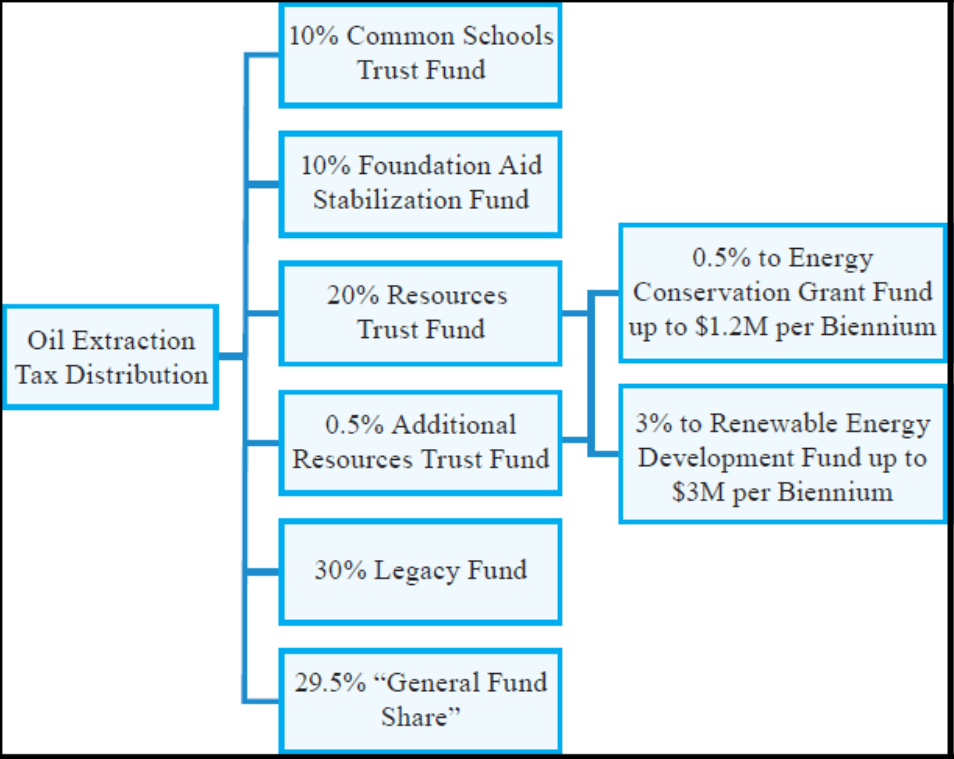

North Dakota imposes an Oil Extraction Tax of 5 percent and an Oil and Gas Gross Production Tax of 5 percent on the gross value at the point where oil is extracted from the earth (generally, a total of 10 percent). The Oil Extraction Tax is required to be dispersed to specific funds, as shown in Figure 5. The Common School Trust Fund (10 percent of oil extraction revenue), in addition to funding public universities and other projects, will distribute $2,160 per pupil to public K-12 education for the 2023-2025 biennium.

The Foundation Aid Stabilization Fund (10 percent) can be used for budget shortfall relief in retirement obligations or for education-related purposes. The Resources Trust Fund (20.5 percent) is to be used for the construction of water-related projects and programs for energy conservation. Since the 2017-2019 biennium, the Legacy Fund (30 percent) has transferred earnings to the General Fund at the end of each biennium. As of early 2025, it had a value of $11.5 billion with $601 million already earned for the 2023-2025 biennium. The General Fund (29.5 percent), is the primary cash account for the state, but the “General Fund Share” only partly goes towards the General Fund, and has other specified allocations, such as towards the Social Services Fund, Budget Stabilization Fund, Lignite Research Fund, State Disaster Relief Fund, Strategic Investments and Improvements Fund, PERS Retirement Plan, Municipal Infrastructure Fund, County & Township Infrastructure Fund, and Airport Infrastructure Fund.

Figure 5: Distribution of oil extraction and gross production tax revenue, FY 2020-2025

Conclusion

North Dakota has always been rich with natural resources, but technology and a uniquely efficient bureaucracy provided the means to harness those resources and ensure their benefits for future generations. Agencies like the NDDMR and the NDDEQ have a history of transparency, along with fast and streamlined permitting. These governing bodies have used transparency to establish legitimacy with their citizenry. Energy issues on the horizon for the state include permitting for carbon dioxide pipelines and wells, as well as how the state will utilize the growing gas-to-oil ratio from existing wells.

In the future, North Dakota is expected to produce a greater amount of natural gas, which may be harnessed at a low cost for use in data centers.28 Hopefully, as new challenges and opportunities arise, the state’s legacy of pragmatism and innovation can continue to foster a regulatory environment that harnesses its productive capacity while benefiting North Dakotans.

About the authors

Ricky Feir is a research specialist at the Challey Institute for Global Innovation and Growth. His work focuses on workforce development, immigration policy, childcare regulation, and education. He holds a master’s degree in Applied Economics from North Dakota State University. Prior to his current role, he taught high school economics, government, and history. His research aims to highlight issues affecting the Midwest and inform policy discussions with data-driven insights.

James Broughel is an adjunct fellow at the Competitive Enterprise Institute. He is an accomplished economist whose expertise lies in regulatory institutions and the effects of regulations on economic growth. Broughel is author of the book Regulation and Economic Growth:

Applying Economic Theory to Public Policy. This research was conducted with the support of the Hoover Institution’s State and Local Governance Initiative’s Small Business Regulation Visiting Fellowship.