A Surge in Small Business Burdens May Propel Regulatory Reform

Photo Credit: Getty

Given heavy post-COVID spending and regulation, sentiments against expanding government have not been as strong as those in favor of Washington’s growth. It remains unclear what, if anything, might trigger a wave of permanent regulatory reform.

Even the pandemic-related relaxations of certain rules and regulations were generally not permanent. Unfortunate reinstatements may be in the cards, as we observe the Biden administration rethinking telehealth and trucking regulatory relaxations.

This is not new; permanent “deregulatory stimulus” like that urged by CEI and others going back to the 2008 financial crisis generally does not rule the day. One needs to go back to the mid-1990s Clinton years for the major transformations (not that their strictures are necessarily enforced today). These included the Small Business Regulatory Enforcement Fairness Act, Unfunded Mandates Reform Act, Congressional Review Act, and Regulatory Right-to-Know Act.

What might shake things up and induce better oversight of both rulemaking and sub-regulatory guidance documents? It would take frontal regulatory excesses that even the most passive local officials cannot ignore. That might be in the form of a surge in small business regulatory burdens given the wave of COVID spending and new programs. If an upswing continues, the concerns of small business, backed up by the state and local governments, may yet again rise to the forefront as they did in the 1990s.

Thus far, growth has been difficult to detect in the numbers of Federal Register pages and rule counts. That changed when it became apparent in a National Archives pdf—figures still not disclosed in the online Federal Register database—that overall final rules in 2021 jumped 45 percent over those of 2020.

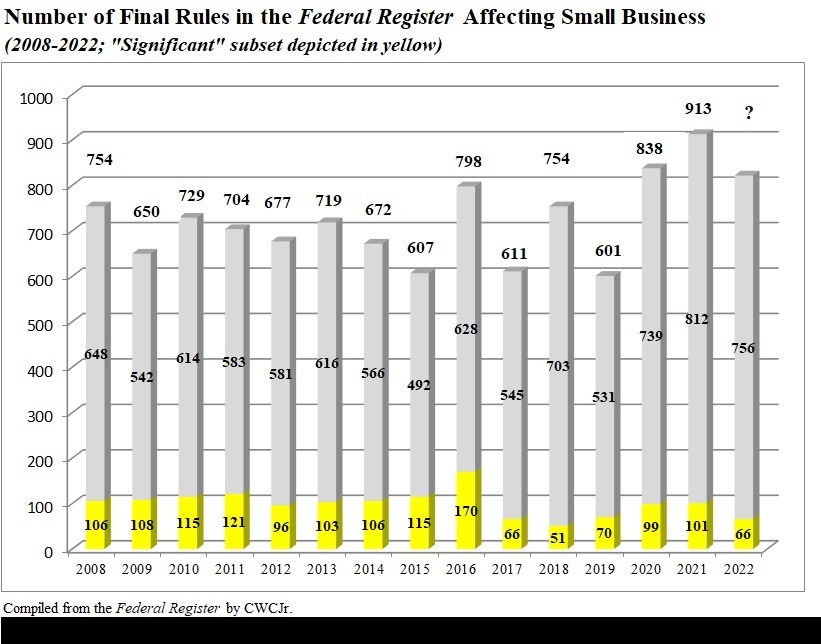

Regulations affect ing smaller enterprises are up too. The figure below depicts ordinary rules and their “significant” subset (generally, as defined in 1993’s Executive Order 12866) for which the federal government acknowledges small business effects. These stood at 812 and 101, respectively, for a 2021 total of 913. (At least for the moment; the underlying database numbers have been observed to change at times as unexplained reclassifications occur.)

The overall count is higher than at any time shown in the chart and a 9 percent increase over Trump’s last year and its 838 rules (a number of which were classified “Deregulatory”). Biden’s significant rule tally of 101 compares to 99 depicted for Trump, whose counts were “overstated” to the extent rules intended as “Deregulatory.” While Biden’s as-yet-unfinished 2022 tally of 822 has not caught up to 2021, it is still higher than anything else seen in the interval apart from Trump’s last year (surges in both Obama’s and Trump’s final years are known as the “midnight rules” phenomenon). What will bear watching in particular is the “significant” subset as new rulemakings materialize in coming months and years.

While not as well known as the Federal Register, the Regulatory Flexibility Act (RFA) “requires that agencies publish semiannual regulatory agendas in the Federal Register describing regulatory actions they are developing that may have a significant economic impact on a substantial number of small entities.”

That publication is the twice-yearly Unified Agenda of Federal Regulatory and Deregulatory Actions, which covers not just final rules but also proposed rules and recently completed ones. The Agenda flags rules requiring the RFA and others not requiring an RFA but that are nonetheless anticipated by agencies to affect small businesses.

The number of rules acknowledged to affect small business dropped substantially under Trump, with those numbers “inflated” by the need to write a rule to get rid of a rule. Under Biden, the Fall 2021 count stood at 693, of which 354 required RFA analysis with another 339 deemed to affect small business to a lesser extent. (For details see the 2022 edition of Ten Thousand Commandments). The count in the Spring 2022 Agenda (not shown) is 717, approaching pre-Trump levels.

The big impetus for past regulatory reforms was pressure from governors, mayors, and small business concerns. Legislation like the “Innovation,” “Infrastructure,” and “Inflation Reduction” Acts will result in new rulemakings with monetary strings attached. These can significantly raise the cost of doing business and escalate headaches for those outside the Beltway.

The Biden-era regulatory increase is too early to dub a trend yet, but such an outcome seems almost preordained. Launching regulatory relief agenda may yet be in the cards, but it will take motivated small business and state and local governments to drive some permanent changes.