Bank Regulators Must Correct Flawed Volcker Rule Proposal

As my colleague Devin Watkins discussed earlier this month, a number of federal administrative agencies are refusing to correctly implement a crucial piece of regulatory reform known as the Economic Growth, Regulatory Relief, and Consumer Protection Act of 2018.

As my colleague Devin Watkins discussed earlier this month, a number of federal administrative agencies are refusing to correctly implement a crucial piece of regulatory reform known as the Economic Growth, Regulatory Relief, and Consumer Protection Act of 2018.

One key reform of that legislation was to tailor the “Volcker Rule,” a regulation that prohibits propriety trading by banks. However, the current proposed rule to implement EGRRCPA and revise the Volcker Rule is not faithful to the text of the law. Instead, it drastically limits the extent of reform.

This post will outline the basic flaws in the proposed rule recently issued by the agencies. For a more thorough examination of the issue, see CEI’s comments to the regulatory agencies, co-authored with my colleagues Devin Watkins, John Berlau, and Sam Kazman.

What’s Wrong With the Proposed Rule?

The most important place to start when looking at the scope of Volcker Rule reform is the text of the amending law. Section 203 of the EGRRCPA amended 12 U.S.C. § 1851(h)(1) to include the following:

The term “insured depository institution” does not include an institution-…

(B) that does not have and is not controlled by a company that has-

(i) more than $10,000,000,000 in total consolidated assets; and

(ii) total trading assets and trading liabilities, as reported on the most recent applicable regulatory filing filed by the institution, that are more than 5 percent of total consolidated assets.

Eliminating superfluous language and the double negative (“does not” and “does not have”), the statute says:

A regulated entity does not includes an institution-…

(B) that does not have and is not controlled by a company that has-

(i) more than $10 billion in total assets; and

(ii) total trading that is more than 5 percent of total assets.

Therefore, to be covered by the Volcker Rule, a bank must have more than $10 billion in total assets and more than 5 percent total trading assets.

Another way of restating this is to stay that to be exempt from the Volcker Rule, a bank must have less than $10 billion in assets or less than 5 percent total trading assets.

Nevertheless, this is not what has been proposed by the regulatory agencies that are attempting to implement the law.

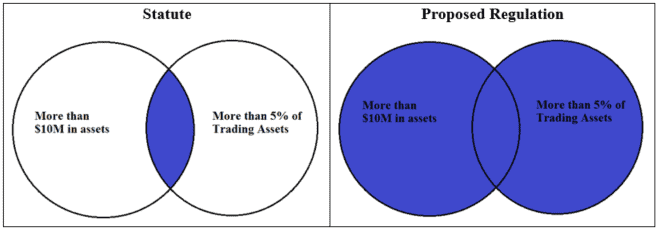

The proposed regulation states that in order to be exempt from the Volcker Rule, a bank must have less than $10 billion in assets and less than 5 percent in trading assets. As you can see from the Venn diagram, this conflicts with the statute:

The agencies’ proposal is incorrect. When the proposed rule changed the “more than” to a “less than,” logic demands that the “and” should be changed to an “or”—a principle known as “De Morgan’s Law,” which states that the proposition NOT (P AND Q) is equal to (NOT P) OR (NOT Q).

Instead, if a bank must be more than $10 billion in assets and more than 5 percent trading assets to be covered by the Volcker Rule, then any bank that is less than $10 billion in assets or any bank that is less than 5 percent in trading assets is exempt from the rule.

As described in our comments, a simple ice cream analogy can further demonstrate the error in the proposed rule:

We can analogize the situation to a hypothetical involving ice cream. Imagine that ice cream products, in general, have been an extensively regulated category, but then a new statute narrows that category to consist of only mint chocolate ice cream. Clearly, to fall into that new category, an ice cream must be both mint and chocolate. If an ice cream is not mint, or if it is not chocolate, then it is excluded from regulation under the statute’s new, narrower definition.

In short, the statute creates two alternative criteria for excluding certain types of ice cream from regulation: all ice cream that isn’t mint is excluded, and all ice cream that isn’t chocolate is excluded. But under the agencies’ proposal, there is only one exclusion criterion—ice cream that is neither mint nor chocolate. This is clearly contrary to the statute—the latter excludes both plain mint and plain chocolate from regulation, while the proposal includes them.

What About the Legislative History?

The text of the law remains the most important factor in implementing the revised Volcker Rule—and the text is clear. However, even when looking to the legislative history of the EGRRCPA, there is evidence to suggest that the more narrowly tailored reform was intended by both Congress and the president.

To start with, in 2017 the Treasury Department issued a report titled “A Financial System That Creates Economic Opportunities: Banks and Credit Unions.” The report repeatedly stated in clear terms that the Volcker Rule should be appropriately “tailored” to not apply in two separate situations—either in the case of low total assets or in the case of a low percentage of trading assets. For example, the report states:

Applying the Volcker Rule to firms whose failure would not pose risks to financial stability, or to firms that engage in little or no proprietary trading or covered funds activities, imposes substantial regulatory burdens but offers little benefit. Therefore, as described below, firms that are small or do not engage in significant proprietary trading should not be subject to the Volcker Rule. (Emphasis added.)

The Treasury Department report was produced 5 months in advance of the EGRRCPA being introduced in Congress. Congress adopted almost the exact same reform proposal outlined by Treasury, if only through awkward language.

Rep. Blaine Luetkemeyer (R-MO), the Chairman of the Subcommittee on Financial Institutions and Consumer Credit, also argues that the agencies’ interpretation of the law in the proposed rule is mistaken. In a letter sent to the regulatory agencies, he outlines that EGRRCPA was a compromise between the House, which had already passed a full repeal of the Volcker Rule as part of the Financial CHOICE Act, and the Senate, which sought a more limited reform. Critically, he wrote that their proposed rule “directly contradicts the statute,” specifically identifying the “and” in the proposed regulation as incorrect, noting that it should instead be an “or.”

Regulators Must Correct the Proposal

The Economic Growth, Regulatory Relief, and Consumer Protection Act was the first significant piece of financial reform since the Dodd-Frank Act of 2010. It is imperative that the regulatory agencies charged with implementing the statutory amendments do so in a way that is faithful to the mandates of Congress.

The interpretation advanced above would potentially exempt dozens, if not hundreds, of banks from the Volcker Rule, including not only large banks that engage in little trading, such as Capital One, but also much smaller “Main Street” banks such as Banner Bank in Walla Walla, Washington, or Heartland Financial in Dubuque, Iowa.

The relevant regulatory agencies should implement the correct statutory mandate: The Volcker Rule should cover only those banks that have both more than total consolidated assets of $10 billion and more than 5 percent trading assets, as the statute requires.

Competitive Enterprise Institute Research Associate Gabriel Greenspan contributed to this post.