Federal government waves goodbye to ‘economically significant’ regulations

Photo Credit: Getty

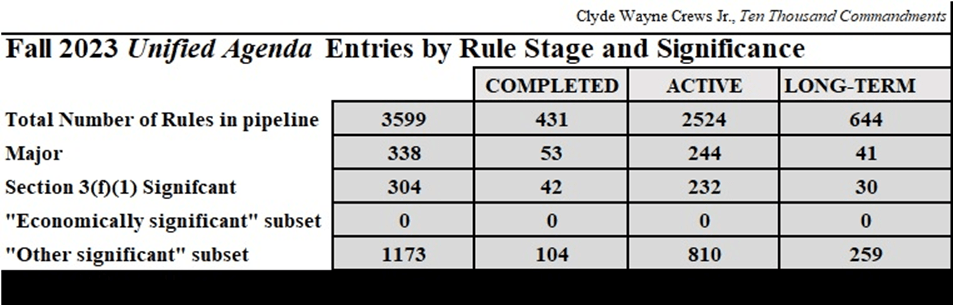

Last week, the Fall 2023 edition of the White House’s Unified Agenda of Federal Regulatory and Deregulatory Actions appeared. It features the administration’s regulatory priorities, depicting 3,599 rules at the pre-rule, proposed, final, recently-completed and long-term phases. The breakdown is as follows.

- Active (pre-rule, proposed and final rules): 2,524

- Recently completed: 431

- Long-term: 644

Federal agencies issue thousands of rules, regulations and guidance documents every year compared to the relative handful of laws enacted by Congress. The twice-yearly Agenda is where priorities, often costly ones, get showcased. Most rules appearing in it are not brand new. This time around, 320 of the Active actions are appearing for the first time.

Regulations on climate change, financial rules related to climate disclosures, water and air quality rules, chemical standards, energy efficiency directives, and transmission grid rules are prominent.

This is markedly different from the prior administration, which used the Unified Agenda to boast of successes in regulatory streamlining. Now, the emphasis is on working with regulatory agencies to finalize a series of progressive economic, environmental, and social policy priorities.

A substantial transformation in the Agenda has materialized since the Spring 2023 edition. That volume had been the first following Joe Biden’s Executive Order 14094 of April 2023. E.O. 14094 raised the threshold for a “significant regulatory action” from $100 million in annual impact to $200 million (to inch upward still further with changes in GDP).

Also, the longstanding “Economically Significant” category of regulation was replaced in E.O. 14,094 by the less-catchy “Section 3(f)(1) Significant” designation for the newer elite class of $200 million rules.

For comparison with today, economically significant rules stood at 297 overall back in the Spring 2023 Agenda’s birth-to-completion pipeline, as follows:

- Active: 225

- Competed: 26

- Long-term: 46

Even then, the category was referred to in the past tense. We now know the administration meant business, since the economically significant rule category is gone completely. In Spring 2023, 18 rules bore the “Sec. 3(f)(1) distinction alongside the 297 economically significant ones. Now, we find instead 304 rules appearing in the new “Section 3(f)(1) Significant” category and none at all with the economically significant designation, as the chart below shows.

As observers contemplate the trajectory of former “economically significant” rules still winding their way to completion in relative obscurity, we might make a few broad observations at this stage:

- Of the 232 Active 3(f)(1) rules, 21 are appearing in the Agenda for the first time.

- The new 3(f)1) category exceeds the overall economically significant count of the past two years’ Agendas, despite showcasing a subset of weighty regulations that ostensibly obscures those falling between $100 million and $200 million in annual effects.

- Of 224 economically significant actions from Spring 2023 that were in the “Active” (pre-rule, proposed, and final) phase, 31 appear among the Completed rules in the Fall 2023 Agenda (as traced by “RIN,” or Regulation Identifier Number).

- Of these 31, all but two (both IRS rules) were re-labeled with the new 3(f)(1) designation.

- In addition, among 46 Long-term economically significant actions from Spring 2023, two are now completed in the Fall 2023 edition. Both were redesignated Sec. 3(f)(1).

At this point, there remain 193 rules in the Active pipeline that were once regarded as significant, economically so. While policymakers will naturally be inclined to zero in on the 3(f)(1) category, during this transitory phase, they might consider monitoring this population of rules as they progress toward completion.

For those interested in contemplating it, the full list of 304 Sec. 3(f)(1) Significant rules and regulations is broken down here by department and agency, and by rulemaking stage.

That list implies targets for Congressional Review Act (CRA) resolutions of disapproval, and is in a sense definitive. Biden is trying to complete rules by early next year so that they are not vulnerable to being overturned in 2025, and this new Agenda has the inventory of what to expect. The forthcoming Spring 2024 Agenda will come too late for its costly or controversial rules to avoid being caught within the CRA’s 60-legislative-day window for potential repeal in the 119th Congress in the event of a change in administration to one somewhat more inclined toward regulatory streamlining.

The federal government in the year 2023 waves goodbye to economically significant regulations, and ushers in their Section 3(f)(1) big brothers. Should this costly class of rules make a nuisance of itself, we may see new clamoring for regulatory reforms in 2024. Stay tuned.