Questions about EPA’s electric vehicle rule—some answered, some not

Photo Credit: Getty

The Environmental Protection Agency (EPA) last week posted the pre-Federal Register version of its de facto electric vehicle (EV) sales mandate rule. The rule sets tailpipe greenhouse gas (GHG) and conventional air pollutant emission standards for model year (MY) 2027-2032 passenger cars and pickup trucks. The EPA proposed the rule in May 2023. This post attempts to answer several questions about the final rule and how it differs from the proposed rule.

Q: Are the final tailpipe GHG standards less stringent than the proposed standards, and if so, by how much?

By my calculation, the final passenger car GHG standards are 3.7 – 17.1 percent less stringent than the proposed standards during MYs 2027-2031. The final truck standards are 9.0 – 21.7 percent less stringent. In MY 2032, the final passenger car standard is identical to the proposed standard—73 grams of carbon dioxide per mile (73 g CO2/mi). The final truck standard is 90 g CO2/mi, which is 1.1 percent less stringent than the proposed standard (89 g CO2/mi).

Cars Trucks Combined Fleet

MY Proposed Final Proposed Final Proposed Final

| 2027 | 134 | 139 | -3.7% | 163 | 184 | -12.9% | 152 | 170 | -11.8% |

| 2028 | 116 | 125 | -7.8% | 142 | 165 | -16.1% | 131 | 153 | -16.8% |

| 2029 | 99 | 112 | -13.1% | 120 | 146 | -21.7% | 111 | 136 | -22.5% |

| 2030 | 91 | 99 | -8.8% | 110 | 128 | -16.4% | 102 | 119 | -16.7% |

| 2031 | 82 | 96 | -17.1% | 100 | 109 | -9.0% | 93 | 102 | -9.7% |

| 2032 | 73 | 73 | 0.0% | 89 | 90 | -1.1% | 82 | 85 | -3.7% |

Q: Does the EPA expect those reductions in regulatory stringency to reduce overall EV market share?

No, if anything, the final rule projects a slightly larger market share for EVs in MY 2032. However, before getting into the details, let’s sort out the key vehicle classifications and their often similar-sounding abbreviations.

- A zero-emission vehicle (ZEV) is a vehicle powered solely by batteries or fuel cells.

- A battery electric vehicle (BEV) is a car powered solely by batteries.

- A plug-in hybrid electric vehicle (PHEV) is a car that can run on either a rechargeable battery or an internal combustion engine.

- BEVs and PHEVs are both plug-in electric vehicles (PEVs), which the EPA also calls “electrified vehicles” and “vehicles with powertrain electrification.”

- The EPA additionally classifies PHEVs as “near zero-emission vehicles.”

- In common parlance, PEVs (BEVs + PHEVs) and fuel cell vehicles are also called electric vehicles (EVs).

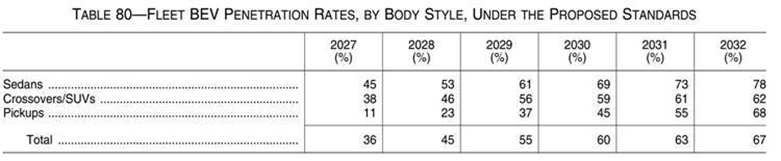

In the proposed rule, BEV market share reaches 67 percent in MY 2032 (Table 80).

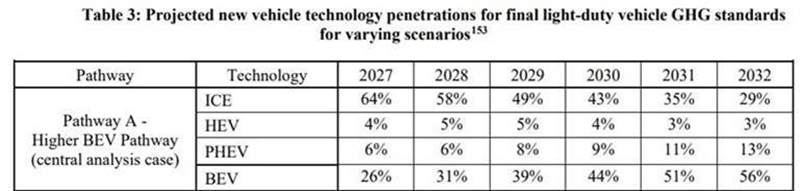

In the final rule, PEV market share reaches 69 percent, with BEVs and PHEVs capturing 56 percent and 13 percent of the market, respectively (Table 3).

Curiously, the proposed rule and Draft Regulatory Impact Analysis (DRIA) provide no market-share projections for PHEVs. We may reasonably infer that, in the proposed rule, the EPA expected PHEV sales to be negligible in 2032. Now, only 11 months later, EPA expects PHEVs to capture 13 percent of the market in eight years.

Thus, although less stringent, the final rule is projected to achieve slightly more EV penetration (69 percent) than the proposed rule (67 percent). Internal Combustion Engine (ICE) vehicle sales decline to 29 percent of the market by 2032. In the proposed rule, vehicles with advanced ICE technologies are projected to capture 32 percent of the market in 2032 (88 FR 29330).

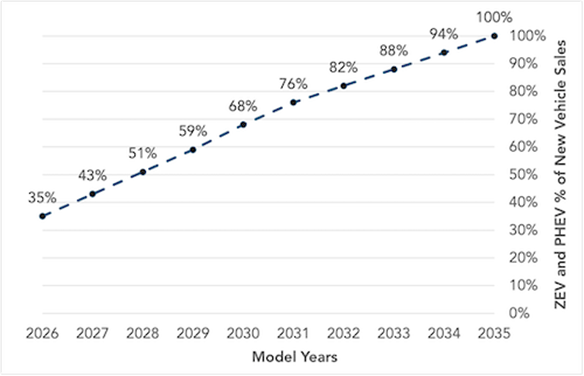

Q: How does the EPA’s vehicle electrification program compare to California’s ZEV sales mandate program?

California’s program is more aggressive than the EPA’s GHG standards. By 2032, 82 percent of new vehicle sales in California must be ZEVs and PHEVs.

However, keep in mind the “but for” causality relationship between the EPA and California’s ZEV program. California cannot implement its ZEV standards without receiving a waiver of Clean Air Act preemption from the EPA. So, although the EPA has its own GHG standards, which force vehicle electrification, the agency is also California’s enabler.

Q: How will the reduction in regulatory stringency affect automakers’ technology costs?

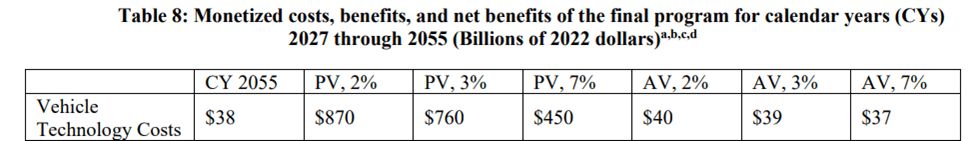

Although the final standards are significantly less stringent through the first five years of the 2027-2032 compliance period, the EPA is now projecting much larger manufacturer technology costs.

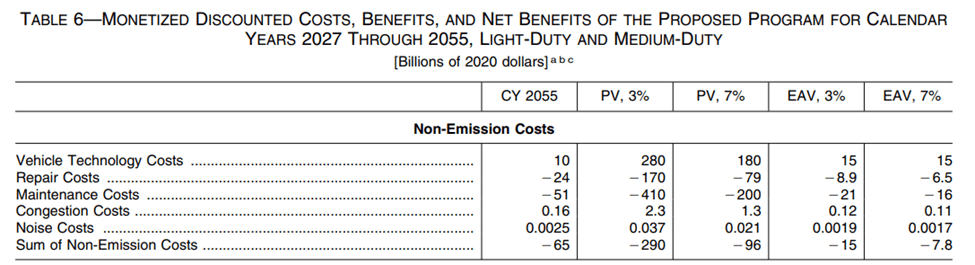

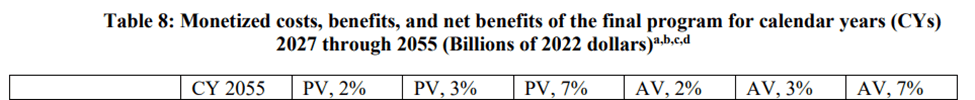

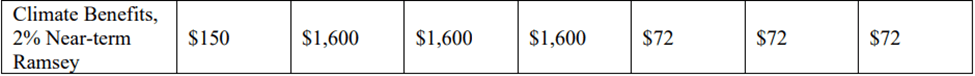

With a 3 percent discount rate, the present value of the cumulative vehicle technology costs through 2055 is $760 billion (Table 8). Even after adjusting for inflation, those costs exceed the compliance costs of any prior EPA motor vehicle rule (Final Rule, p. 182).

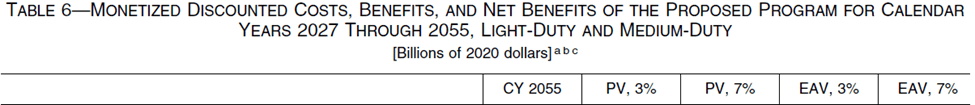

According to the proposed rule (88 FR 29344), “Vehicle technology cost increases for light-and medium-duty vehicles through 2055 are estimated at $260 billion to $380 billion (7 and 3 percent discount rates).” So, vehicle technology costs in the final rule ($760 billion) are double the projected costs in the proposed rule ($380 billion).

However, that $380 billion estimate may be a typo. According to Table 6 of the proposed rule, cumulative technology costs through 2055 total $280 billion. Other passages in the proposed rule and DRIA also report vehicle technology costs of $280 billion. That means the final rule’s projected vehicle technology costs exceed those of the proposed rule by $480 billion or 171 percent.

An obvious question leaps to mind: How do significantly less stringent emission standards add $480 billion to manufacturers’ technology costs? Neither the final rule nor the final Regulatory Impact Analysis (RIA) directly addresses that question.

My guess is that the EPA dramatically underestimated technology costs in the proposed rule. Were it not for the reductions in regulatory stringency, the final rule’s projected technology costs would exceed $760 billion.

Q: How will the increase in estimated vehicle technology costs affect consumers?

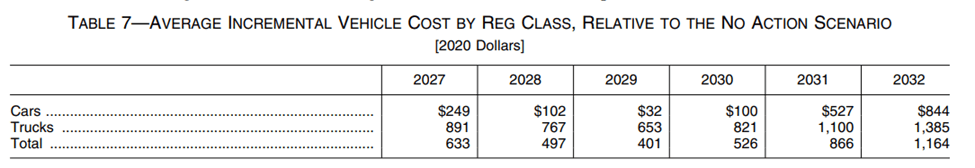

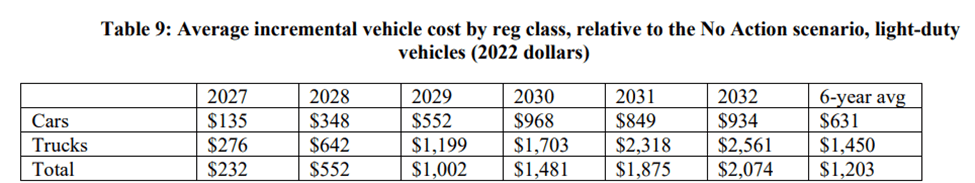

Since vehicle technology costs in the final rule are 171 percent higher than in the proposed rule, average incremental vehicle costs are also higher, although not proportionately so.

The proposed rule projected an increase of $1,164 in average vehicle cost in 2032 compared to the no action scenario (Table 7), implying a six-year average price increase of $681. The final rule estimates an increase of $2,074 in average vehicle cost in 2032, with a six-year average increase of $1,203 (Table 9). Thus, compared to the proposed rule, the final rule MY 2032 incremental vehicle cost is 78 percent higher and the six-year average incremental vehicle cost is 77 percent higher.

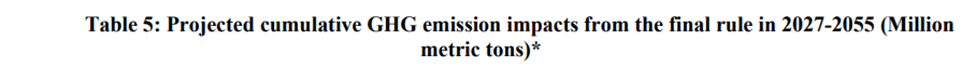

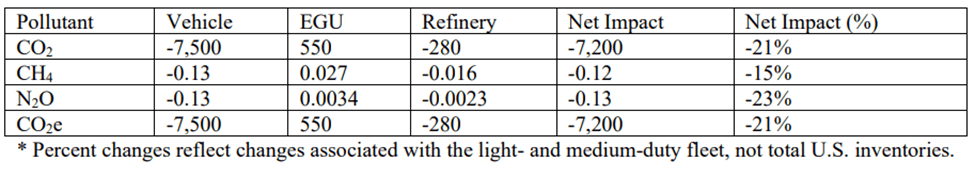

Q: How many tons of CO2 emissions will the final rule reduce?

The final rule projects a cumulative reduction in CO2 emissions of 7.2 billion tons during 2027-2055 (Table 5)—1.3 percent less than the proposed rule’s projected reduction of 7.3 billion tons (Table 3).

Q: What climate benefits will the final rule achieve?

Strangely, although the final rule achieves less emissions reduction than the proposed rule, it projects dramatically higher climate benefits—$1.6 trillion (Table 8) vs. $330 billion (Table 6), assuming a 3 percent discount rate.

What actual changes in climate-related impacts can we expect from automakers’ $760 billion investment in emission-reduction technology? Specifically, what impacts will the final rule have on global warming and sea-level rise?

The EPA isn’t telling. Both the proposed and final rules contain this disclaimer:

While EPA did not conduct modeling to specifically quantify changes in climate impacts resulting from this rule in terms of avoided temperature change or sea-level rise, we did quantify the climate benefits by monetizing the emission reductions through the application of the social cost of greenhouse gases (SC–GHGs) … [88 FR 29350; Final Rule, p. 765].

By “conduct modeling,” the EPA simply means plugging a few numbers into the US government’s standard climate policy impacts calculator, a model called MAGICC. Running MAGICC is a fairly simple exercise for an agency that has been doing it for years, indeed decades. The modeler selects a baseline emission scenario, types in the tons of emissions projected to be reduced, selects the assumed equilibrium climate sensitivity, and then clicks “go.” MAGICC does the rest. Instantly.

So, why doesn’t the EPA simply use MAGICC and give us the answer? As my colleague American Enterprise Institute economist Benjamin Zycher points out, even if MAGICC is run with a very high equilibrium climate sensitivity, reducing US cumulative CO2 emissions by 7.2 billion tons averts only 0.0065°C of warming by 2100. That change is far too small for scientists to detect or for people to experience.

Undetectable, non-experiential effects are “benefits” in name only. Whether estimated at $330 billion or $1.6 trillion, such benefits are illusory.

Q: Why are projected climate benefits so much larger in the final rule than in the proposed rule?

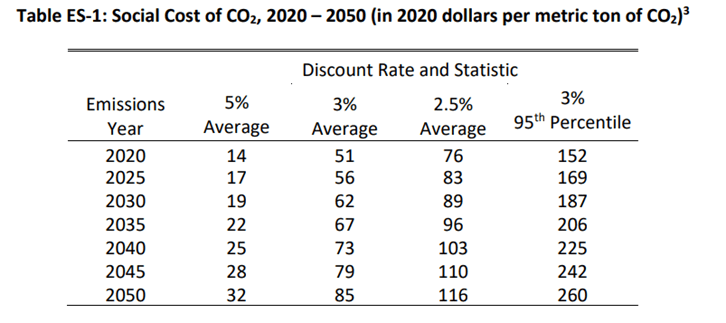

The proposed rule was published in May 2023. The EPA used the social cost of carbon (SC-CO2) estimates published by the federal government’s Interagency Working Group (IWG) in February 2021. The EPA is itself a key IWG member, and has been since the IWG’s creation in 2009.

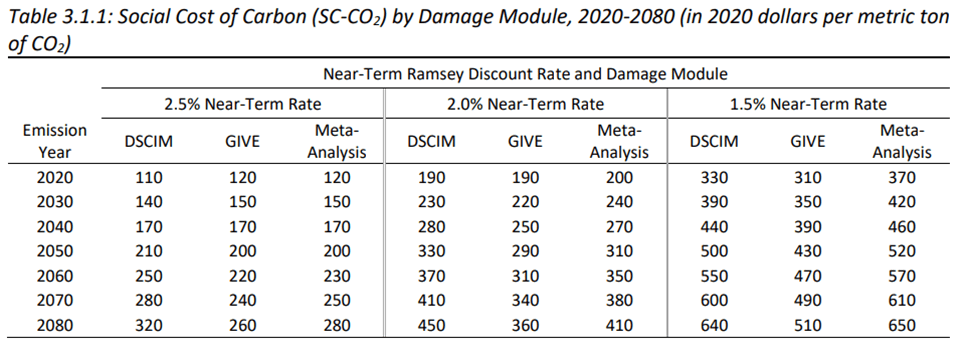

The IWG’s February 2021 estimates were “interim” estimates. Final estimates were expected by February 2022. Those were never published. Instead, the EPA in November 2023 published its own revised SC-CO2 estimates based on various changes in assumptions, methodology, and data inputs. The EPA determined that the SC-CO2—the putative social damage due to an incremental ton of CO2 emissions—is more than three times larger than the IWG’s estimate. In other words, the EPA determined that the climate benefit of reducing a ton of CO2 emissions is more than three times larger than it previously believed.

Is this just another case of “worse than we thought” climate messaging? No. It is a notable and perplexing case.

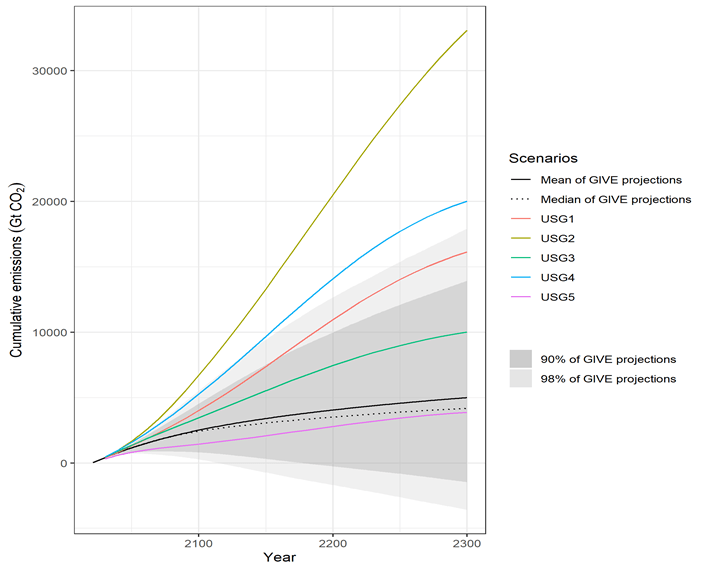

Why? Because the EPA purports to find more than three times the climate damages from less than one-third the quantity of projected emissions. Specifically, the EPA replaces the IWG’s baseline emission scenarios, which on average project 17,195 gigatons of CO2 emissions during 2000-2300, with an updated baseline that projects 5,000 gigatons. Despite that huge decrease in projected emissions, the EPA’s new central SC-CO2 estimate for 2050 is $310 per ton, compared to $85 per ton in the IWG’s February 2021 estimates. See the figures below.

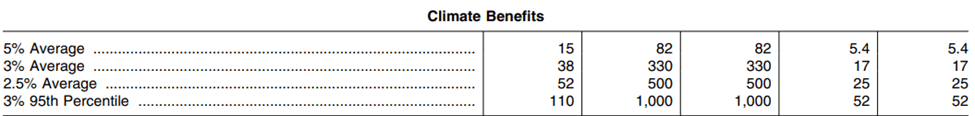

Here are the IWG’s February 2021 SC-CO2 estimates. The central estimate for 2050 is $85/ton.

Here are the EPA’s November 2023 SC-CO2 estimates. The central estimate for 2050 is $310/ton.

That dramatic reductions in projected emissions lead to dramatic increases in estimated climate change damages is paradoxical, to say the least. However, far from explaining this perplexity, the EPA’s November 2023 report takes no notice of it. Unsurprisingly, the final rule sheds no light on it either.

There is no “need” for the EPA’s vehicle electrification program if most consumers actually want what the agency will force automakers to sell. But most consumers do not want to buy an EV, which is why unsold EVs are piling up on dealer lots despite significant federal, state, manufacturer, and dealer incentives.

EVs have several well-known drawbacks compared to ICE and hybrid vehicles. EVs cost more. They have inferior range. Charging an EV takes much longer than filling a gas tank. There are far fewer charging stations than gas stations. EVs have inferior towing capacity. Cold weather further limits EV range. EVs are less likely to provide lifesaving mobility in blackouts caused by natural or manmade disasters.

Policy analyst Joel Kotkin warns that the EPA’s EV push will turn back the clock on millions of Americans, making new cars a luxury for the rich. He also calls the EPA’s program a Midwest “job shredder,” because “the current EV market cannot sustain the unionized, Detroit-centered auto industry that depends overwhelmingly on trucks, SUVs and traditional gas cars.”

“Replacing a massive $3 trillion industry with a singular technology represents a severe economic threat under any circumstances, but ramming through changes just as EV sales are slowing is nothing less than madness,” Kotkin warns. In short, he opines, the Biden administration’s EV policy path is an election-year road to ruin. We shall see.