The Middle Class Crisis That Wasn’t

Recently billionaire philanthropist Eli Broad called for a wealth tax in The New York Times and fellow billionaire Ken Fisher responded in USA Today with a challenge that wealthy Americans (and the rest of the country) would be better off with the very wealthy investing their money in further for-profit enterprises. That’s a pretty stark contrast, and one that shows off two very different attitudes toward wealth and prosperity in America.

Recently billionaire philanthropist Eli Broad called for a wealth tax in The New York Times and fellow billionaire Ken Fisher responded in USA Today with a challenge that wealthy Americans (and the rest of the country) would be better off with the very wealthy investing their money in further for-profit enterprises. That’s a pretty stark contrast, and one that shows off two very different attitudes toward wealth and prosperity in America.

Broad’s op-ed highlights issues including “the shrinking middle class, skyrocketing housing and health care costs.” His assumption seems to be that more money, taxed from the wealthy and spent by Congress, is going to be the solution to these ostensible problems. That seems unlikely.

Let’s take just his first concern. As it turns out, we do not have a middle class economic crisis in America. But we may have an inability-to-understand-economic-dynamism problem. As Brad Schiller, an emeritus professor of economics at American University wrote in the Los Angeles Times earlier this year:

As proof, proponents of [the shrinking middle class] view point to government data showing that the median household income (adjusted for inflation) fell from $60,002 in 2000 to only $58,476 in 2015.

But in fact, the whole notion of a shrinking middle class is a myth. Here’s why.

When you compare household incomes over time, you have to look at identical households. The census defines a household as one or more persons living in the same abode. Fifty years ago, only 15% of all U.S. households had a single occupant. By 2017 that percentage had nearly doubled, to 28% percent. In just the last 10 years, the percentage has increased by three points. So, the typical household today is much smaller.

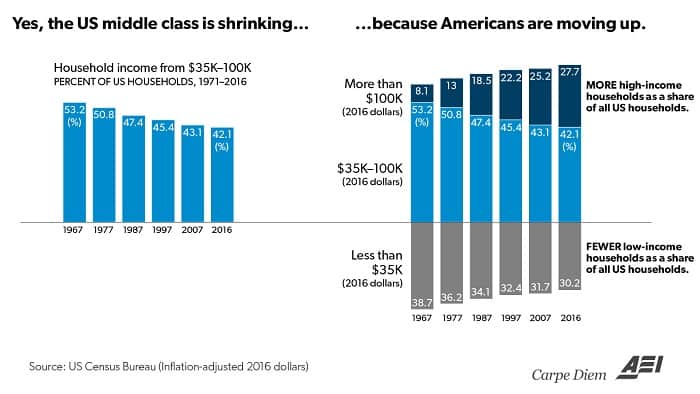

There’s more to the myth of the shrinking middle class than that, but Schiller’s op-ed is a great start. It’s true that, as a statistical construct, fewer people are in the middle class that in previous decades, but that’s because many of them have joined the upper class. The American Enterprise Institute’s Mark Perry blogged about these trends earlier this year, specifically in regards to home ownership:

America’s middle class has been shrinking over time, from 61% of US households in 1971 to only 50% in 2015, when middle class is defined as households earning between two-thirds and twice the median household income. And that middle-class shrinkage apparently implies that there is a “widening gap between what people earn and the housing that is affordable to them”…

However, there are at least two serious issues and questions that need to be addressed: a) if the middle class did shrink, where did they go? and b) is housing really becoming less affordable for Americans?

It will no doubt surprise Broad and his fellow tax-us-rich-folks-more friends that most of the vanished middle-class actually ascended the economic ladder than slipped down it.

The analysis debunking the “disappearing middle class” didn’t all accumulate over the last year, either. A 2012 article by the Brookings Institution’s Ron Haskins points to a misleadingly narrow focus (looking at just the top 1%, rather than income by quintile) as well as a dishonestly narrow definition of “income” (ignoring the value of non-monetary work benefits and government transfer payments). If we include the value of government benefits and payments to low-income Americans, the problem of income inequality begins to look very different:

What about those at the bottom, supposedly floundering? Based only on their market income, the bottom 20 percent lost about one-third of its income between 1979 and 2007. But when [economist Richard] Burkhauser calculates the impact of government transfers, the value of health insurance not paid for by households and the decline in household size, the bottom 20 percent had about 25 percent more income in 2007 than 1979. Even the bottom is moving up.

It’s true that we, as a nation, could and should be doing even better. Economic growth and real wages should be growing even more robustly. But trying to create an imaginary crisis in opposition to real data is not the way to get there. Nor, the evidence suggests, is more government spending and regulation. When it comes to middle-class Americans being squeezed by rising costs of important household items, the industries in which we’ve seen the greatest prices increases have been precisely those that are the most highly regulated. Again, from AEI’s Mark Perry: