Letter of Support on the Small Business Regulatory Reduction Act and the POST IT Act

Photo Credit: Getty

Dear Members of the House Committee on Small Business,

We write to you today ahead of the committee’s markup on 07/18/23 to express our support for H.R. 3995, the Small Business Regulatory Reduction Act and the Providing Opportunities to Show Transparency via Information Technology (POST IT) Act. Both bills would shed light on federal regulatory intervention and help stop excessive small business regulation.

The Small Business Regulatory Reduction Act from Rep. Van Duyne (TX-24) would require the Small Business Administration (SBA) to ensure that the net yearly regulatory costs and burdens of new federal rulemaking on small businesses is at or below zero dollars. The bill also requires the SBA to report on all the regulations issued by federal agencies that are expected to have an impact on small businesses.

The slew of major federal spending brought on from COVID and post-COVID legislative packages is likely to spur an unforeseen number of mandates on small businesses. As evidenced in the Federal Register, we are already seeing an upward trend in both final and proposed rules expected to impact small businesses.

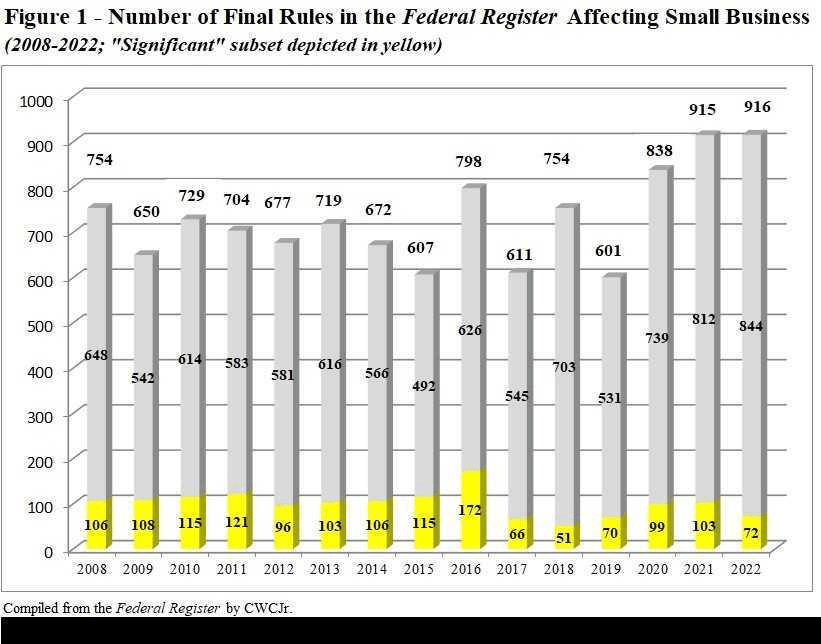

The following figure shows the yearly number of final rules listed in the Federal Register deemed to affect small businesses.

While the acknowledged “significant” subset has not quite attained heights that would cause alarm at this juncture, the Biden administration’s overall counts for 2021 and 2022 clearly stand well above both the Trump and Obama administrations.

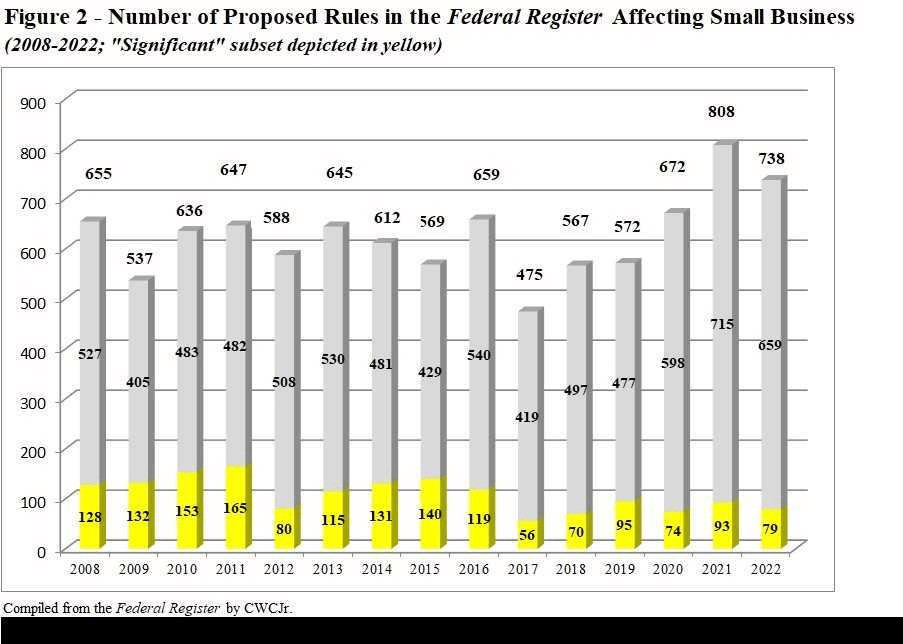

Figure 2 shows the yearly number of proposed rules listed in the Federal Register that affect small businesses.

Proposed rules affecting small business hit a recent peak of 808 in 2021. Despite dropping to 738 under Biden in 2022, this still exceeds Obama-era levels and far exceeds those under President Trump.

It should be noted that while the number of rules acknowledged to affect small businesses in both figures generally show a substantial drop under President Trump, the true numbers are likely even lower given that getting rid of a rule tends to require writing a new one – thus inflating the final count. Similarly, a number of Trump-era rules were also deemed to be “deregulatory” in nature, yet are still included in the final count, too.

Actions have consequences, and the legislative enactments of the past three years have been some of the most substantial the country has ever undertaken. This uptick in final and proposed rules expected to impact small businesses is likely to increase in the coming months and years as recent federal spending and regulatory interventions make their full effects known.

Rep. Van Duyne’s Small Business Regulatory Reduction Act would do much to halt this impending regulatory onslaught and ensure into the future that small businesses are protected from overzealous and overreaching bureaucrats.

In a similar vein, Rep. Molinaro’s (NY-19) POST IT Act would require agencies to post a follow-up guidance after issuing a rule expected to have significant impact on small businesses.

Mom-and-pop shops across the nation do not have the same resources as large companies to hire legal experts and compliance officers to make sure they are following every minute dictate and decree in the Code of Federal Regulations. Well-meaning small business owners often make every attempt to follow the letter of the law, but regulations are often needlessly complex and obscure. And no one wants to get on the wrong side of the federal government and experience the wrath of regulatory enforcers. The simple requirement in the POST IT Act that agencies post follow-up guidance would help busy, hard-working small business owners comply with the law without costing them much time or money.

It is also significant that the bill requires agencies to post guidance documents to the SBA’s National Ombudsman website. As it stands, there is no single place where the public can access guidance documents and other forms of regulatory dark matter. President Trump created a portal back in 2019 for all these documents, but President Biden revoked that via executive order his first day in office. The SBA website requirement is important as it establishes a centralized location on the web where all interested parties can easily access these guidelines and helps in part to restore a semblance of Trumps regulatory guidance portal.

Together, the Small Business Regulatory Reduction Act and Providing Opportunities to Show Transparency via Information Technology (POST IT) Act would do much to protect America’s small businesses from undue red-tape and promote better disclosure and transparency. In the 1990s, members of both parties worked together to advance a wide slate of regulatory reform proposals. Chief among them was a small business regulatory relief bill, the Small Business Regulatory Enforcement Fairness Act. Given the economic struggles faced by many in the small business community and the recent increase in rules impacting small businesses, regulatory relief in this space is much needed. Now is the time to advance these bills as the economy is expected to stay sluggish and as we await the deluge in new regulatory intervention.

Clyde Wayne Crews Jr.

Fred L. Smith Fellow in Regulatory Studies

Competitive Enterprise Institute

Ryan Young

Senior Economist

Competitive Enterprise Institute

Matthew Adams

Senior Government Affairs and Coalitions Manager

Competitive Enterprise Institute