Supreme Court agrees to hear Moore v. U.S., consider constitutionality of tax on unrealized income

Photo Credit: Getty

The Supreme Court announced today that it will hear arguments in Moore v. U.S., a challenge to a provision of the 2017 Tax Cuts and Jobs Act called the Mandatory Repatriation Tax. This provision taxes U.S. citizens on certain accumulated earnings of foreign corporations going back 30 years, even if the earnings have not been distributed.

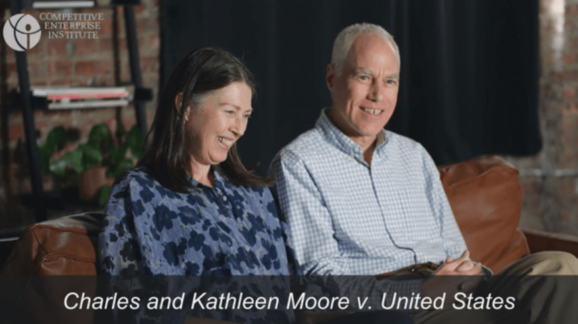

The case was brought by the Competitive Enterprise Institute and Baker Hostetler on behalf of Kathleen and Charles Moore, a married couple residing in Washington state. The Moores argue that the tax violates the Constitution’s requirement that direct federal taxes must be apportioned among the states.

At issue are the Moores’ shares in KisanKraft, a foreign company founded by a friend that provides agricultural equipment to underserved small farmers in India. The couple has owned the shares for more than a decade. They have never received any income from the shares, because the company reinvested all its profits in its business.

As the Moores explained in a recent Competitive Enterprise Institute video, the tax left them with a bill of almost $15,000 for their share of KisanKraft’s reinvested profits—money that they never received and that isn’t even available at this point. The Act, however, declared that money to be the Moores’ “income” and then taxed them on it, based on the fact that they owned shares in the company.

“The Constitution does not allow Congress to point at any pot of money and call it ‘income’ and then income-tax it,” said Baker Hostetler’s Andrew M. Grossman, the Moores’ lead counsel. “‘Income’ means the same thing now that it did when the Sixteenth Amendment was ratified: gains that have been realized by the taxpayer. We are confident that the Supreme Court will vindicate that fundamental principle and confirm that Congress’s power to tax is not unlimited.”

“The Supreme Court’s decision to hear Moore v. US is very good news for Americans,” said CEI general counsel Dan Greenberg. “A century of precedent shows that – in order to be taxed – income requires realization: this means that income taxes can only be levied on realized income. We hope that, when the Supreme Court considers Moore, it insists that its own precedents on this issue must be followed.

“As the judges who dissented from the lower court’s ruling wrote: ‘Divorcing income from realization opens the door to new federal taxes on all sorts of wealth and property.’ That’s why advocates of new, higher taxes in Congress and the White House have been watching this case carefully. We hope the Justices will overrule the lower court’s opinion: by doing so, the Court will show respect both for the rule of law and for the settled plans and expectations of every property owner in the nation.”

Oral arguments in Moore v. US will be heard in the upcoming Supreme Court term.

Visit CEI’s Moore v. U.S. case page to read proceedings and orders:

https://cei.org/court_case/charles-and-kathleen-moore-v-united-states/

Read more:

- Video: Kathleen and Charles Moore on Why the Supreme Court Should Hear their Challenge to Tax on Unrealized Gains

- Andrew Grossman and David Rivkin for the Wall Street Journal: Can Congress Tax Wealth by ‘Deeming’ It Income?

- More on Moore: A History of Direct Taxes and their Application to Moore v. United States