I, Pharmaceutical

The role of trade and tariffs in the drug industry

The global pharmaceutical industry is complex. This is true not only in the number of countries involved but the range of products, the sets of components, processing, and transportation needed to reach an end product for the patient. It is true as well in the many mechanisms by which governments price and distribute pharmaceuticals within different countries.

The current administration’s economic and trade policies are intended to, and will, disrupt this system. This disruption will create unknown effects in the supply chain and have knock-on effects in the American economy and on the health of Americans. The goal is to shift manufacturing to the United States, which protectionist measures typically achieve at great cost. The manner of the shift matters for Americans, as do the unintended and ancillary consequences.

What follows is an overview of the global pharmaceutical supply chain along with suggestions on how tariffs might be expected to affect that chain and what downsides they might engender.

What goes into pharmaceuticals

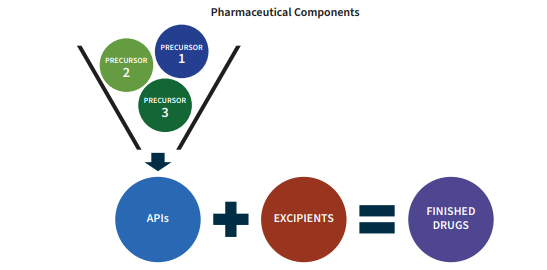

For most pharmaceuticals, the fundamental component is the active pharmaceutical ingredient (API). This is also widely known as the “active ingredient” which consumers will see listed on the container.

Lipitor is one of the most prescribed medicines in the US. The API that serves as its active ingredient is atorvastatin calcium. This molecule is what provides Lipitor its therapeutic effect, which reduces the risk of heart attack, stroke, and other blood vessel problems.

Atorvastatin is also the name of the class of generic drugs that competes with Lipitor. The generic drugs share the API in Lipitor, as these treatments are effectively the same.

The APIs are produced via complex chemical reactions at an industrial scale using precursors, otherwise known as intermediates or API intermediates. The precursors are also chemicals/molecules just as the APIs are. It is through their combination via chemical reactions that the final API is produced.

The other components of a medicine are known as excipients. These do not provide medicinal value to the pharmaceutical. Rather, they are inert substances that serve as a vehicle or a complement to the API. For example, they may help the APIs bind together into a pill form or slow down the absorption of the API into the body once taken. Excipients, like APIs and precursors, are produced mainly via chemical reactions and processes.

Current supply chain

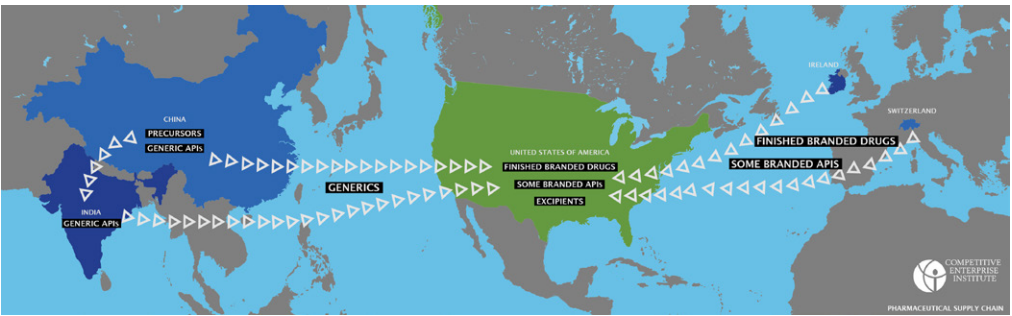

The pharmaceutical supply chain is extremely complex at a very basic level. One can imagine the supply chain for most pharmaceuticals as split into a generic side and a branded side.

On the generic side, China produces most of the precursors and some of the APIs which it exports to India, which produces most of the APIs and finished generic drugs. On the branded side, Switzerland and Ireland are producing most of the APIs and finished products, with the United States still producing some domestically. Excipients are produced mostly irrespective of the branded/generic distinction, as are precursors.

Finished drugs: A 2019 study investigated where the top 100 branded drugs consumed by American Medicare beneficiaries were produced, both in final form and in API form. The researchers found that about half were finished in Europe. Another third were finished in the US. Only 1 percent came from India and none from China.

For finished generic products, India produces 60 percent of finished drugs that are taken orally via tablet or pill while the US produces 22 percent. India and China typically produce antibiotics, blood pressure medications, and diabetes drugs, among others.

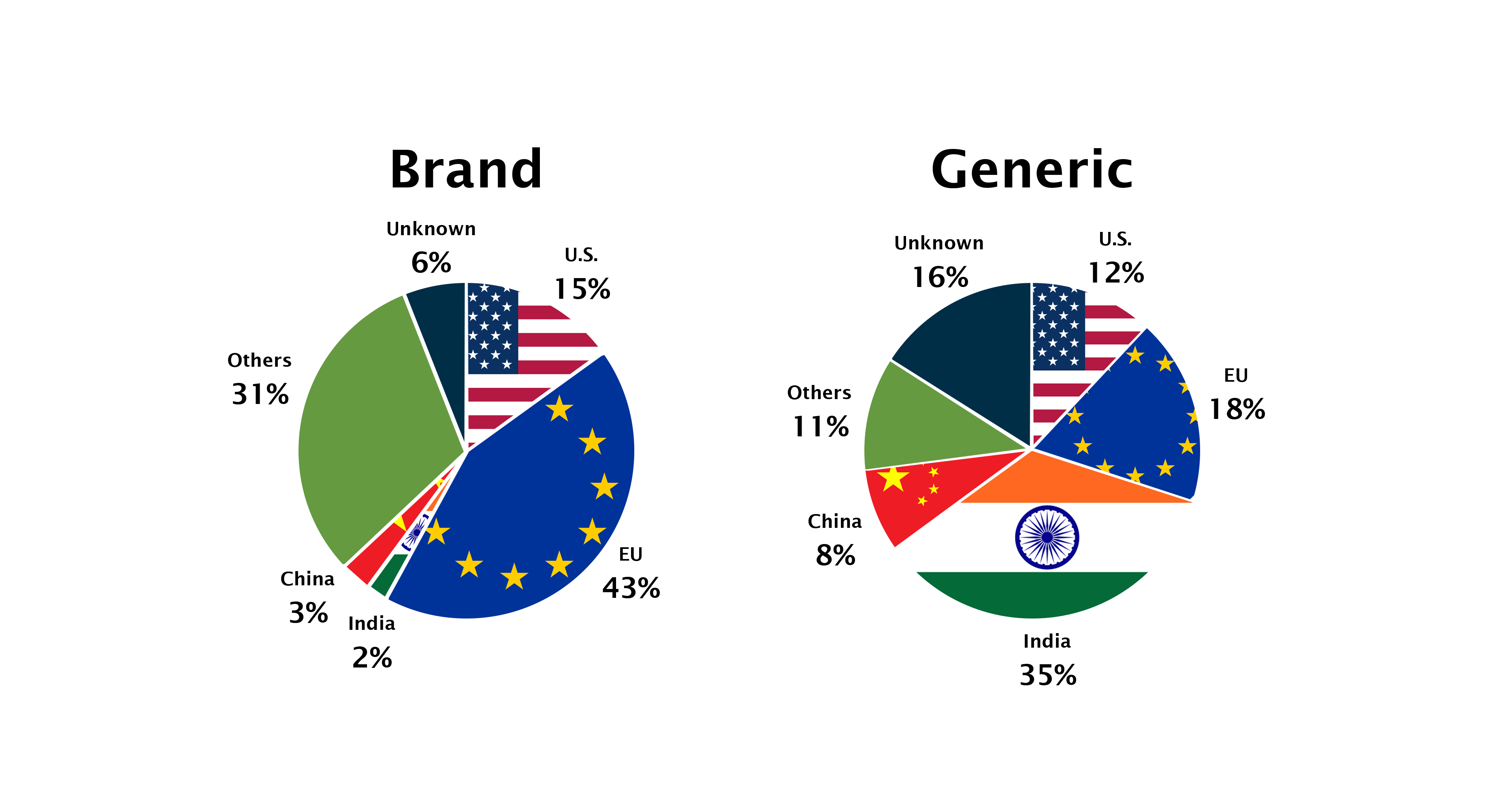

APIs: Not unlike the finished drugs, the majority of branded Active Pharmaceutical Ingredients are also produced in Europe and North America. Seventy-eight percent of APIs of top 100 brand-name drugs come from the US or allies; China and India produce only one API each.

In Europe, many of the highest-profile drugs are produced either in Ireland or Switzerland, as these countries contain factories for some of the largest pharmaceutical companies—Pfizer, Novartis, and Roche—which supply expensive medicines such as biologics, insulin, and medicines for cancer treatment to the US.

Because brand-name drugs are generally more expensive than generic, Europe represents a disproportionate amount of the value of drug imports for the US. Ireland itself accounts for 38 percent of the total value of pharmaceuticals and only 3 percent of the volume. Ireland produces antiviral therapies, insulin, and other biologics.

Production of Active Pharmaceutical Ingredients

The US itself produces 12 percent of total API volume domestically, such as High-Potency Small-Molecule APIs (HPAPIs) and biologic APIs (monoclonal antibodies, recombinant proteins, etc.) and even higher percentages of IV fluids. These are produced more in the United States because the manufacturing process is more delicate and specialized and requires higher levels of care. It’s worth noting that even though Europe, India, and the US produce significant amounts of APIs, China still provides many of the necessary constituents for API production.

While APIs for brand-name drugs are primarily produced in Europe and North America, APIs for generic drugs are predominantly produced in Asia, and India in particular. India produces 35 percent of the world’s generic API supply (by volume). The EU produces 18 percent while China produces only 8 percent.

China’s role is larger than the share numbers would suggest. For one, China is the sole source of APIs for certain essential generic medicines. In addition, China is a major supplier of precursors.

The shares above break down API production by volume, but it is important to keep in mind that because drugs vary widely by price, a different picture emerges when shares are calculated by dollar value. When using this metric, a majority of the APIs in drugs that reach US consumers is produced in the US.

This highlights an important fact about international trade. While the US may offshore production and import large quantities, this has tended to allow US manufacturers to focus on producing higher-value products, creating a global trade system where the US is at the top of the value pyramid and imports the basics from less developed manufacturing economies. This is one way in which trade makes everyone better off, through distributing manufacturing efficiently.

While the pharmaceutical supply chain shifted to producing more generics in Asia and even many brand drugs in Europe, US employment in pharmaceutical manufacturing actually increased. It is up by about 75,000 jobs since 2011, rising three times as quickly as the US population overall. Since 1987, the employment in pharmaceutical manufacturing has risen twice as fast as the population. People often make the mistake of thinking that increased imports mean fewer jobs for Americans, but it often means just different (and better) jobs. It doesn’t always mean more jobs in an industry, either, but it happens more than one would expect.

Precursors/Intermediate APIs: Though China does not dominate API production for either brand or generic APIs, Chinese firms play a significant role in producing the materials necessary for API production. According to the European Economic and Social Committee, China produces the “vast majority” of the world’s precursors. Some estimates attribute as much as 80 percent of the world’s active pharmaceutical ingredients production to China.

Excipients: The other components of medicines, excipients, unlike APIs and precursors, are produced mostly in North America (35 percent), then Europe (25 percent), then Asia (20 percent), according to Growth Insights. Other market analysis groups, like Grand View Research, say Europe has a small lead.

Current state of tariffs

Amid the Trump trade upheaval, pharmaceutical products have so far received different treatment from many other US imports. Pharmaceuticals are treated differently for reasons such as their distinct global dynamics, supply chain, and their political importance.

| 2023 Rank | Category | Total value of imports (in billions) |

| 1 | Electrical machinery | $477.1 |

| 2 | Machinery | $475.9 |

| 3 | Vehicles and automobiles | $329.6 |

| 4 | Minerals, fuels, and oil | $322.7 |

| 5 | Pharmaceuticals | $165 |

| Total | $3,826.9 |

In total, across all product categories, pharmaceutical products are the fifth largest category of goods by value that the US imports.

Tariffs to date

Fortunately, pharmaceuticals have escaped much of the tariff whirlwind, so far. As part of the president’s Liberation Day tariff announcement, pharmaceuticals were explicitly exempted., Two weeks after the initial barrage of tariffs, on April 14, the administration announced an investigation into the national security implications of pharmaceutical imports, which is separate from his broader tariffs. These investigations give the administration 270 days to determine the national security implications for specific products and produce a course of action. This will allow Trump administration officials to set tariff rates for pharmaceuticals at whatever level they deem necessary for national security. Consequently, through August, pharmaceutical products have been left largely untouched by the tariff rates. For two of the largest producers of APIs—India and China—both subject to multiple tariff surges, the pharmaceutical products have remained exempt.

| Country | Baseline rate | Rate on pharmaceuticals | Notes |

| India | 50 percent | 0 percent | Exempted from IEEPA / Liberation Day tariffs |

| China | 30 percent | 0 percent | Exempted from IEEPA / Liberation Day tariffs |

| Japan | 15 percent | TBD | Fall under WTO agreement |

| UK | 10 percent | 0 percent | Subject to further negotiation |

| EU | 15 percent | 15 percent | 15 percent for branded drugs; generic drugs TBD |

| Switzerland | 39 percent | 0 percent | Pharmaceuticals exempted |

| South Korea | 15 percent | TBD | “not treated unfavorable compared to other countries”; Fall under the WTO agreement |

| Canada | 0 percent for USMCA goods; 35 percent for others | 0 percent | Covered under USMCA |

| Mexico | 0 percent for USMCA goods; 25 percent for others | 0 percent | Covered under USMCA |

| Brazil | 50 percent | ? | Pharmaceuticals not exempted from the 40 percent emergency tariff. Unclear whether reciprocal 10 percent rate includes them. |

This might help explain why, while overall prices across all goods and services have risen by 1 percent in President Trump’s first six months in office, prescription drug prices have fallen by 0.8 percent.

The table above summarizes the state of tariffs for the countries that are most noteworthy as especially entangled in the tariffs. Several of these countries are parties to a 1994 World Trade Organization (WTO) agreement to eliminate tariffs on pharmaceuticals. For these countries, the final tariff rate will likely be the same for all of them, under the WTO’s reciprocity rules, but will also likely be determined by the Section 232 investigation which will set global pharmaceutical tariffs at the sectoral level instead of country-by-country. The European Union has announced that even after the Section 232 investigation, tariffs on drugs exported from the European Union to the United States will not exceed 15 percent.

Effects of tariffs on pharmaceuticals

In the short run, as with other products, when there’s not enough time for the supply chain to adapt, the immediate outcome is that the importers pay the government the tariff based on the value of the import. That added cost on the importer would be expected to pass through to the consumer and result in higher prices.

If the drug enjoys competition between branded and generic products, the price increase may not be quite as high because consumers would switch to the generic product. As the supply chain adjusts, however, the results are harder to predict. In all cases, we can expect a reduction in supply of whatever is being produced and an increase in price.

Would production shift to the United States, though? And if so, which production? Generic manufacturing is very low margin because it’s commodified and simple and highly competitive. A tariff that raises the sales price would tend to put some manufacturers out of business, reduce their competitiveness, and reduce the quantities manufactured. Given the continued competition from abroad, we would expect profits to remain low, and the US would be unlikely to produce more generic products domestically. The only result of the tariffs, all other things being equal, would be increased cost to domestic consumers. How much costs go up will be hard to disentangle from the complicated nature of American health care, where insurance companies and PBMs are negotiating prices and creating delivery networks and also in light of President Trump’s developing Most-Favored-Nation drug price policy.

Branded drugs have higher margins, and US manufacturers could shift production to the US. By doing this, they could reduce the price somewhat, since they would not need to pay the tariff anymore. US production may expand. On the surface, that appears to be a beneficial outcome, but one must always be aware of the unseen tradeoffs.

To produce more in the US requires factory space, managers, chemists, chemical engineers, and all manner of workers. With the US close to full employment, additional employees would need to be pulled from other products, other industries, or into the workforce. If pulled from other products, this is hardly beneficial to consumers. The company has switched to an inferior, less profitable, and less valuable medicine because of arbitrary tariff policy. Recipients of the medicine previously manufactured may suffer as a consequence.

The other possibility is the company hires more people and/or builds another plant. Again, on the surface this seems great, but labor in the United States is not an unlimited resource. There are only so many workers available–even more so when they’re highly specialized. Pulling employees from other industries will have similar effects as pulling from other pharmaceutical products. Whatever those employees were producing before was more highly valued by consumers. It could also lead to the need to import more of the goods that used to be produced in the US, negating any benefit from the onshoring pharmaceuticals.

Investments: Several drug companies have announced investments in the US in the wake of the tariffs. Johnson & Johnson ($55 billion), AstraZeneca ($50 billion), Roche ($50 billion), Bristol Myers Squibb ($40 billion), Eli Lilly ($27 billion), Novartis ($23 billion), and many more. In total, drug companies have announced $374 billion in investment in US manufacturing.

While investment in American production is typically worth celebrating, one should ask several questions about government-celebrated economic news. For one, how much of this investment is new? The first announcement provided occurred in March 2025, before the reciprocal tariffs had even been announced, let alone put into place. Johnson & Johnson also pointed out that it was already investing 75 percent of this before Trump became president. This also includes an investment in North Carolina that was unveiled last October.

The second question is, what will companies be investing in? Because brand-name drugs are more expensive and offer better margins, one could assume they’d invest in those. This would tend to move production from Europe more than from Asia, and leave the generic supply chain intact.

Lastly, as with all government policy, one should ask about the tradeoffs. What is being given up by shifting production to the US? Drugs will be more costly, even if they are being produced domestically. If it was less costly to produce in the US, these companies would already be doing so and would not need tariff policy to change. Where would the additional money have been spent if not invested in the US? One answer is research on new drugs. Where will the new employees come from? They could come from other drug manufacturers or other industries, which could lead to labor shortages and unmet consumer demand (and therefore higher consumer prices) in the affected industries. There are always tradeoffs, and one should understand them before determining whether a policy is beneficial or harmful.

Early investigation into the investments made by pharmaceutical companies thus far seems to corroborate this analysis. The entire scenario just shows that trying to engineer solutions from the top will lead to inferior performance of the economy and worse outcomes for workers, consumers, and American businesses.

What comes next?

On top of individual trade deals announced with other countries, a significant factor in pharmaceutical tariffs will be the resolution of the Section 232 investigation. While the deadline to resolve would be 270 days after its initiation, which would be in January 2026, Trump has indicated that he will make an announcement much sooner than that.

The outcome of this investigation could set a tariff rate for pharmaceuticals higher than the 10 percent or 15 percent baseline he has embraced for all goods. If that is the case, then the signatories of the WTO agreement would expect to be subject to the lowest tariff rate of the other signatories. Currently, the highest potential tariff for pharmaceuticals for these countries seems to be 15 percent, as per the EU agreement. It is, however, plausible that the administration will renege on either deal or manufacture a justification for imposing higher tariffs.

Countries that didn’t sign the WTO agreement will face whatever tariff rates President Trump determines through the 232 investigation. The rates may be uniform, may be country-specific, or might be determined by individual trade deals. President Trump has also indicated that the outcome of the 232 investigation will call for a gradual ramping up of tariffs over several years, perhaps ultimately climbing as high as 250 percent, a figure with no clear precedent in US history. Even the most protectionist acts only set tariff rates at around 50 percent.

After any tariff rates are determined either through negotiation or investigation, those rates will likely end up in the courts. Other countries may challenge the tariffs via the WTO, although given the non-functional state of the WTO’s appellate process that will certainly stall out. There are already ongoing lawsuits for the Liberation Day tariffs that challenge the basis for imposing those tariffs. Section 232 tariffs will use different powers and may be subject to their own set of lawsuits. In addition to countries and domestic purchasers, the pharmaceutical companies may sue the government as well.

In addition to the tariffs, Trump is pursuing his Most-Favored-Nation policy, in which he is compelling drug companies to sell drugs in the US at prices no greater than they sell them for in other developed countries. Based on further details released as the US and EU continue negotiations, this policy would apply not to brand-name drugs, where the price differential is greatest, but to generics, where the US enjoys lower prices than Europe., This would mean that the MFN drug policy would have little effect, if any, on drug prices, as Trump’s MFN policy seeks to reduce domestic prices of drugs to the lowest prices in certain developed countries. Because domestic prices for generics are already lower, and it is with the branded products that American prices are higher, restricting MFN policy to generics would have little effect on prices overall.

Congress, too, is looking at drug prices. It is considering greater regulation of Pharmacy Benefit Managers (PBMs), whose primary mission is to keep drug prices low. While many people believe that PBMs are actually driving prices up, in the last 10 years, drug prices have risen more slowly (1.65 percent per year) than other goods (3 percent per year). Additional regulation will likely only serve to increase costs overall.

Given all the pressures being put on the drug industry right now—the tariffs, the Most-Favored-Nation executive order, the assault on PBMs—the price-increasing pressures will likely offset any price decreasing effects. While drug prices have risen more slowly than the rest of goods and services over the past 10 years, this is a trend that is unlikely to continue through the end of Trump’s second term, and American consumers will be left with even more expensive medicine, and less access to the drugs they need.