Chapter 9: Federal regulations affecting small business

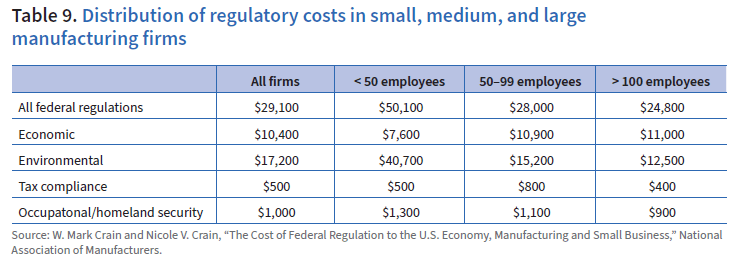

The aforementioned National Association of Manufacturers (NAM) report found that average annual per-employee regulatory costs to firms vary by firm size in a way that overly affects small businesses. The smaller the firm, the larger the per-employee regulatory costs, particularly in manufacturing. As shown in Table 9, the NAM found that per-employee regulatory costs for firms with fewer than 50 workers can be far greater than those for larger firms—$50,100 for smaller firms, compared with $24,800 for larger ones.

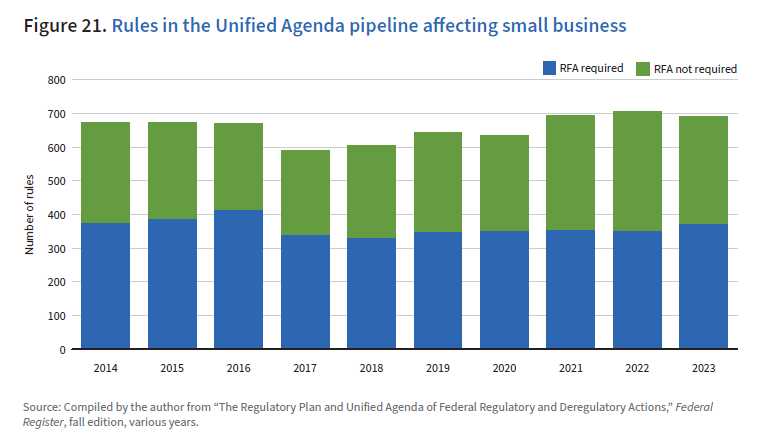

The Regulatory Flexibility Act (RFA) directs federal agencies to consider their rules’ effects on small entities. Figure 21 depicts rules in active, completed, and long-term stages in the fall Unified Agenda that require regulatory flexibility analysis, as well as rules that presumably do not rise to the level of requiring an RFA but are nonetheless anticipated by agencies to affect small businesses. Of the 690 rules affecting small business in 2023, 370 required an RFA, a 6 percent increase. Although Figure 21’s 2023 tally does exceed the levels under Obama depicted there, counts did occasionally exceed 800 under Obama. The count fell to 590 in 2017 in the Trump administration.

Recognizing that overlap occurs in transition years following elections, here are calendar-year averages of the number of rules requiring regulatory flexibility analysis during recent administrations:

- George W. Bush (eight years): average 377 rules requiring small-business RFA per year

- Barack Obama (eight years): average 406 rules per year

- Donald Trump (four years): average 341 rules per year (included dozens deemed deregulatory)

- Joe Biden (first three years): average 358 rules per year

Table 10 breaks out the fall 2023 Unified Agenda’s 690 rules affecting small business by department, agency, and commission. The top five—the Federal Communications Commission (FCC); the Departments of Health and Human Services, the Treasury, and Commerce; and the multiagency federal acquisition rules that now include a rule on “Disclosure of Greenhouse Gas Emissions and Climate-Related Financial Risk”—are the standouts, accounting for 351 rules, or 51 percent of the 690 rules affecting small business.

The FCC alone contributes 80 long-term rules deemed to require RFA analysis. The overall proportion of total rules affecting small business in the Unified Agenda stands at 19 percent but varies widely among agencies. Of the 690 rules affecting small business, 105 are deemed Section 3(f)(1) Significant, which is broken out at the bottom of Table 10. The Agenda’s “active” rules subset as they pertain to small business again could be of particular interest to policymakers.

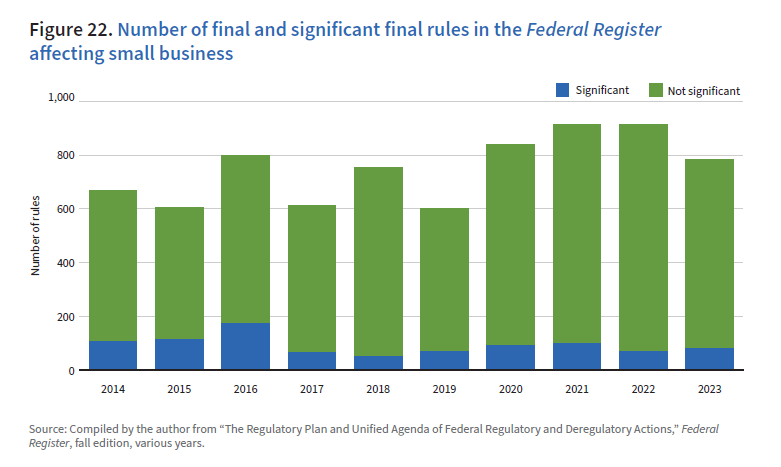

To complement the fall Unified Agenda snapshots, we return for a moment to the Federal Register and its broader depiction of small-business rules. Figure 22 depicts the larger universe of final rules and the “significant” subset completed in the Federal Register deemed to affect small business since 2014. Overall counts stand above pre-Trump levels, whereas at the moment the significant subset stands below. However, again rules costing between $100 million and $200 million are no longer regarded as significant by the dollar-cost criterion. As it stands, the 2023 Federal Register contained 80 significant final small-business rules, which might be compared with the 16 completed small-business rules in the fall Agenda recognized as S3F1 Significant (bottom of Table 10).

Recognizing that overlap occurs in transition years, here are calendar-year averages of the number of final and final significant rules in the Federal Register affecting small business during recent administrations:

- Barack Obama (eight years): average 694 rules per year affecting small business, 117 significant

- Donald Trump (four years): average 701 rules per year, 70 significant (include deregulatory)

- Joe Biden (first three years): average 870 rules per year, 83 significant

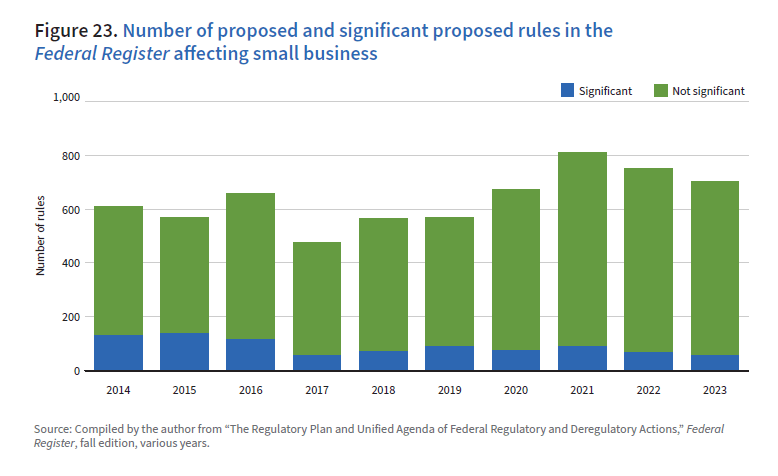

Biden is taking the averages higher for total final rules affecting small business, and he is doing the same for proposed rules. Proposed rules in the Federal Register affecting small business recently peaked at 812 in 2021. Despite dropping to 704 in 2023, proposed rules stand well above Obama-era levels, as seen in Figure 23. The overall count stands 15 percent higher than the 2000–“teens” average of 590. Whereas the significant small-business proposed rule component stands below pre-Trump levels as it does for final rules, it is noteworthy that 75 active rules affecting small business are deemed S3F1 Significant in the fall 2023 Unified Agenda (bottom of Table 10).

Recognizing that overlap occurs in transition years, here are calendar-year averages of the number of proposed and significant proposed rules affecting small business during recent administrations:

- Barack Obama (eight years): average 612 proposed rules per year affecting small business, 128 significant

- Donald Trump (four years): average 572 proposed rules per year, 72 significant (includes deregulatory)

- Joe Biden (first three years): average 756 rules per year, 71 significant

The legislative foundations of regulations affecting small business are without doubt substantial. Appendix K presents a partial list of non-sector-specific laws whose regulations affect growing businesses.