Blog

Australia Needs an Administrative Procedure Act

In the United States, there is an intellectual movement going on the likes of which have not been seen in nearly a century. The administrative…

Blog

Commonsense New Debt Collection Rule from Consumer Financial Protection Bureau

The Fair Debt Collection Practices Act (FDCPA) was passed in 1977, over forty years ago, at a time when telecommunication technology was in its infancy…

Blog

Overhaul Internal Operations at Consumer Financial Protection Bureau

One of the most important, yet least visible, changes a new Consumer Financial Protection Bureau director could make is to reform the internal operations of…

Blog

Regulators Should Foster Financial Innovation

It is becoming increasingly apparent that financial technology, or “fintech,” like other forms of technology, can drastically improve consumers’ lives. Yet one of the most…

Blog

Consumer Financial Protection Bureau Should Acknowledge Its Unconstitutional Structure

The Consumer Financial Protection Bureau’s structure is unconstitutional. The agency’s leadership should recognize it as such.

Blog

Consumer Financial Protection Bureau Should Define ‘Abusive’

The Dodd–Frank Act was a mammoth overhaul of financial services regulation. Along with creating an entire new consumer protection agency, the Consumer Financial Protection Bureau,…

Blog

Prevent Another Mortgage Crisis: Let Qualified Mortgage ‘Patch’ Expire

Last month, the Consumer Financial Protection Bureau released its rulemaking agenda for Spring 2019. While there weren’t too many surprises in the agenda, which mainly…

Blog

Consumer Financial Protection Bureau Should Drop Flawed Enforcement Actions

While the Consumer Financial Protection Bureau’s role in enforcing consumer protection laws is important, there are times when it oversteps the mark and brings frivolous…

Blog

Narrowly Address Fair Lending Requirements to Spare Impact on Small Business

Section 1071 of the Dodd-Frank Act amended the Equal Credit Opportunity Act to require financial institutions to collect, report, and make public certain information concerning…

Blog

Reform Fair Lending Laws to Uphold Rule of Law

The CFPB’s new director, Kathleen Kraninger, assured the Senate Banking Committee in her confirmation hearing that she was committed to upholding the rule of law.

Blog

Regulators Should Rescind ‘Small-Dollar’ Loan Rule

The Consumer Financial Protection Bureau is one of the most controversial regulators in Washington, D.C. Since its founding in 2010 under the Dodd-Frank Wall Street…

Blog

Credit Card Interest Cap Would Create Consumer Credit Bread Lines

Last Thursday Rep. Alexandria Ocasio-Cortez (D-NY), and Sen. Bernie Sanders (I-VT) teamed up to introduce a bill that only two democratic socialists could have dreamed up.

Blog

Good and Bad of Government’s Debt Collection Proposal

Earlier this month, the Consumer Financial Protection Bureau released a much-anticipated proposal to revamp the Fair Debt Collection Practices Act (FDCPA), a forty-two year old…

Blog

Australian Government Tempts Mortgage Crisis

It seems that Australia’s political parties are suffering from collective amnesia. After spending the earlier half of the year criticizing banks for abrogating their responsible…

Blog

The Economic Illiteracy of a 36 Percent Interest Rate Cap

Earlier this week, the House Financial Services Committee held a hearing on a draft bill that proposes to set a national 36 percent annual percentage…

Blog

Will Reforming Consumer Finance Regulation Cause a Recession?

Will reforming consumer finance regulation cause a recession? That is the claim of a recent article in The Hill. Yet, the article provides little evidence to…

Blog

CEI Leads Coalition Supporting Reformed Payday Loan Rule

Today, the Competitive Enterprise Institute led a coalition of eighteen free market organizations in support of the Consumer Financial Protection Bureau’s decision to rescind portions of…

Blog

Reformed Consumer Financial Protection Bureau Can Be Free-Market Regulator

Earlier this week, The New York Times Magazine rolled out another edition of the tired old trope of how former acting Director Mick Mulvaney “destroyed”…

Blog

Restrictions on Debt Collection Impede Access to Credit

In a market economy that is based on private property and the rule of law, the efficient and effective enforcement of contracts is indispensable. Without…

Blog

Bank Regulators Must Correct Flawed Volcker Rule Proposal

As my colleague Devin Watkins discussed earlier this month, a number of federal administrative agencies are refusing to correctly implement a crucial piece of regulatory…

Blog

Fintech and the Future of Consumer Finance

Everyone understands the need for access to credit. No matter how well we budget, we occasionally come up short due to an unexpected circumstance or expense—a…

Blog

Financial Services ‘Regulatory Sandbox’ Is Win for Consumers

The comment period on a critical new initiative to promote innovation in financial services from the Consumer Financial Protection Bureau closed this Monday. My colleague…

Blog

Fintech: A Bipartisan Priority for the 116th Congress

While the 115th Congress did not achieve all that was hoped for with regards to financial services reform, it did make important progress to achieving…

Blog

Agenda for the 116th Congress: Banking and Finance

Perhaps one of the most under-appreciated aspects of our modern world is the fact that finance is fundamental to the operation of a free and…

Blog

Year in Review 2018: Consumer Financial Protection

2018 was a big year for the Consumer Financial Protection Bureau (also known, for a while, as the Bureau of Consumer Financial Protection). The past year…

Blog

Five Priorities for New BCFP Director

Kathleen Kraninger was confirmed as director of the Bureau of Consumer Financial Protection. She has promised to implement a free market reform agenda, focusing on…

Blog

Senate Democrats’ Report Misses Mark on Mulvaney

While President Trump’s nominee to head the Bureau of Consumer Financial Protection, Kathleen Kraninger, awaits a final confirmation vote in the Senate, Senate Democrats have…

Blog

Bureau of Consumer Financial Protection Needs to Rewrite Payday Loan Rule

Last week, I wrote a blog post on how the Bureau of Consumer Financial Protection could go about narrowly rewriting the payday loan rule. This would…

Blog

What Do the Midterms Mean for Financial Services?

Blog

How to Rewrite the Payday Loan Rule

Last Friday, the Bureau of Consumer Financial Protection announced that it will be reconsidering its’ controversial Payday, Vehicle Title, and High-Cost Installment Loan rule.

Blog

Promise and Pitfalls of Treasury Fintech Report

July 31st, 2018, was one of the most exciting days for financial technology regulation in recent memory. Around 10 a.m. that morning was when the…

Blog

The Financial Crisis 10 Years Later: What’s Changed?

Ten years ago, the United States plunged into a financial crisis that would bring the world economy to the brink of collapse. The housing bubble…

Blog

The Financial Crisis 10 Years Later: Restrictions on Housing Supply Makes Matters Worse

The broader financial crisis of 2007-2008 was the result of the U.S residential housing market collapse. That housing collapse itself was a consequence of an…

Blog

The Financial Crisis 10 Years Later: Fannie and Freddie Fueled the Subprime Mortgage Bubble

If anything symbolizes the American dream, it is homeownership—an asset that is viewed as part of a route from poverty and exclusion to independence and…

Blog

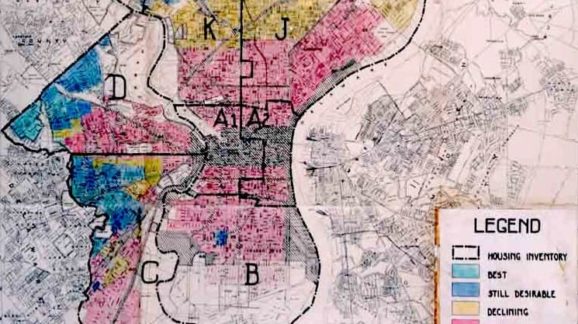

The Financial Crisis 10 Years Later: A Legacy of Racist Government Housing Policy

A decade ago this Saturday, the world shook as Lehman Brothers, the fourth-largest investment bank in the United States, filed for bankruptcy. Representing one of…

Blog

Democratic Attorneys General Wrong on Fair Lending Laws

On Wednesday, a coalition of fourteen Democratic attorneys generals wrote a letter to the Bureau of Consumer Financial Protection urging the acting director, Mick…

Blog

Securities and Exchange Commission Seeks to Liberalize ‘Accredited Investor’ Standard

Great news for middle-class investors and start-up businesses alike—on Thursday, the Securities and Exchange Commission Chairman Jay Clayton announced that the SEC is looking…

Blog

Australian Government Calls for Interchange Fee Ban

One would expect that years of failing policy would force policymakers to reconsider the wisdom of their actions. But not for the Australian Productivity Commission,…

Blog

California Supreme Court Rules Interest Rates May Be ‘Unconscionable’

Last Monday, the California Supreme Court ruled that interest rates on loans over $2,500 could be deemed ‘unconscionable’ even if usury laws permit them. In…

Blog

Finance Regulators Create New National Charter for Innovative ‘Fintech’ Companies

After years of speculation, the Office of the Comptroller of the Currency (OCC) announced Tuesday that it would begin considering applications for special purpose…

Blog

New York State’s Flawed Online Lending Report

Earlier this month, the New York Department of Financial Services (NYDFS) released a study of online lending, including findings and recommendations for changes in…

Blog

Appeals Court Rules Federal Housing Finance Agency Unconstitutional

Big news out of the Fifth Circuit Court of Appeals—the Federal Housing Finance Agency (FHFA) is unconstitutionally structured. The FHFA was created in the wake…

Blog

Five Questions for Bureau of Consumer Financial Protection Nominee Kathy Kraninger

Kathy Kraninger, President Trump’s nominee to head the Bureau of Consumer Financial Protection (formerly known as the Consumer Financial Protection Bureau, or CFPB), will…

Blog

Bureau of Consumer Financial Protection Must Define New Rulemaking Powers

When Congress passed the Dodd-Frank Act in 2010, there was an unprecedented allocation of power to the Bureau of Consumer Financial Protection (BCFP—previously known as…

Blog

Last Chance for the 115th: Bring Accountability to the Financial Regulators

In CEI’s “Free to Prosper: A Pro-Growth Agenda for the 115th Congress,” my colleagues John Berlau and Iain Murray made the enduring recommendation…

Blog

How to Improve Rulemaking at the CFPB

This week, the Competitive Enterprise Institute submitted comments to the Consumer Financial Protection Bureau, on how it could improve its rulemaking to provide a better…

Blog

Finance Regulators Pave Way for Banks to Reenter Small-Dollar Loan Market

Under the letter of the law, banks can now reenter the small-dollar lending space. On Wednesday, the Office of the Comptroller of the Currency (OCC)…

Blog

Consumer Financial Protection Bureau Reexamines Anti-Discrimination Enforcement

This week President Trump signed a resolution of disapproval overturning one of the Consumer Financial Protection Bureau’s most controversial regulatory actions—the inappropriate application of…

Blog

Ending Disparate Enforcement at Consumer Financial Protection Bureau

Just last week, Congress voted to overturn one of the Consumer Financial Protection Bureau’s most controversial regulatory actions—a guidance document that was used…

Blog

Post Office Payday Loans: A Stunningly Bad Idea

Like clockwork, every so often a new member of Congress will rehash an old, tired idea: having the United States Postal Service (USPS) make short-term,…