Blog

Promise and Pitfalls of Treasury Fintech Report

July 31st, 2018, was one of the most exciting days for financial technology regulation in recent memory. Around 10 a.m. that morning was when the…

Blog

The Financial Crisis 10 Years Later: What’s Changed?

Ten years ago, the United States plunged into a financial crisis that would bring the world economy to the brink of collapse. The housing bubble…

Blog

The Financial Crisis 10 Years Later: Restrictions on Housing Supply Makes Matters Worse

The broader financial crisis of 2007-2008 was the result of the U.S residential housing market collapse. That housing collapse itself was a consequence of an…

Blog

The Financial Crisis 10 Years Later: Fannie and Freddie Fueled the Subprime Mortgage Bubble

If anything symbolizes the American dream, it is homeownership—an asset that is viewed as part of a route from poverty and exclusion to independence and…

Blog

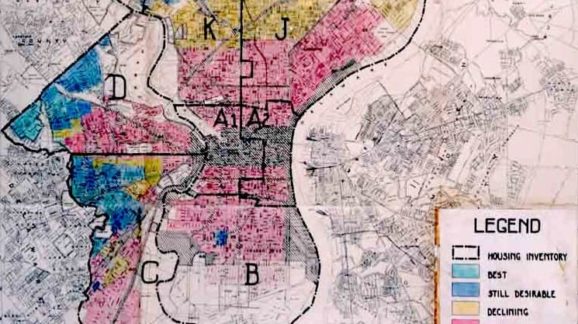

The Financial Crisis 10 Years Later: A Legacy of Racist Government Housing Policy

A decade ago this Saturday, the world shook as Lehman Brothers, the fourth-largest investment bank in the United States, filed for bankruptcy. Representing one of…

Blog

Democratic Attorneys General Wrong on Fair Lending Laws

On Wednesday, a coalition of fourteen Democratic attorneys generals wrote a letter to the Bureau of Consumer Financial Protection urging the acting director, Mick…

Blog

Securities and Exchange Commission Seeks to Liberalize ‘Accredited Investor’ Standard

Great news for middle-class investors and start-up businesses alike—on Thursday, the Securities and Exchange Commission Chairman Jay Clayton announced that the SEC is looking…

Blog

Australian Government Calls for Interchange Fee Ban

One would expect that years of failing policy would force policymakers to reconsider the wisdom of their actions. But not for the Australian Productivity Commission,…

Blog

California Supreme Court Rules Interest Rates May Be ‘Unconscionable’

Last Monday, the California Supreme Court ruled that interest rates on loans over $2,500 could be deemed ‘unconscionable’ even if usury laws permit them. In…

Blog

Finance Regulators Create New National Charter for Innovative ‘Fintech’ Companies

After years of speculation, the Office of the Comptroller of the Currency (OCC) announced Tuesday that it would begin considering applications for special purpose…

Blog

New York State’s Flawed Online Lending Report

Earlier this month, the New York Department of Financial Services (NYDFS) released a study of online lending, including findings and recommendations for changes in…

Blog

Appeals Court Rules Federal Housing Finance Agency Unconstitutional

Big news out of the Fifth Circuit Court of Appeals—the Federal Housing Finance Agency (FHFA) is unconstitutionally structured. The FHFA was created in the wake…

Blog

Five Questions for Bureau of Consumer Financial Protection Nominee Kathy Kraninger

Kathy Kraninger, President Trump’s nominee to head the Bureau of Consumer Financial Protection (formerly known as the Consumer Financial Protection Bureau, or CFPB), will…

Blog

Bureau of Consumer Financial Protection Must Define New Rulemaking Powers

When Congress passed the Dodd-Frank Act in 2010, there was an unprecedented allocation of power to the Bureau of Consumer Financial Protection (BCFP—previously known as…

Blog

Last Chance for the 115th: Bring Accountability to the Financial Regulators

In CEI’s “Free to Prosper: A Pro-Growth Agenda for the 115th Congress,” my colleagues John Berlau and Iain Murray made the enduring recommendation…

Blog

How to Improve Rulemaking at the CFPB

This week, the Competitive Enterprise Institute submitted comments to the Consumer Financial Protection Bureau, on how it could improve its rulemaking to provide a better…

Blog

Finance Regulators Pave Way for Banks to Reenter Small-Dollar Loan Market

Under the letter of the law, banks can now reenter the small-dollar lending space. On Wednesday, the Office of the Comptroller of the Currency (OCC)…

Blog

Consumer Financial Protection Bureau Reexamines Anti-Discrimination Enforcement

This week President Trump signed a resolution of disapproval overturning one of the Consumer Financial Protection Bureau’s most controversial regulatory actions—the inappropriate application of…

Blog

Ending Disparate Enforcement at Consumer Financial Protection Bureau

Just last week, Congress voted to overturn one of the Consumer Financial Protection Bureau’s most controversial regulatory actions—a guidance document that was used…

Blog

Post Office Payday Loans: A Stunningly Bad Idea

Like clockwork, every so often a new member of Congress will rehash an old, tired idea: having the United States Postal Service (USPS) make short-term,…

Blog

Congress Should Axe Backdoor Auto Finance Rule

This week, Congress has a unique opportunity to repeal one of the Consumer Financial Protection Bureau’s worst regulatory actions. Using the Congressional Review Act (CRA),…

Blog

Acting Director Asks Congress for Reform of Consumer Financial Protection Bureau

On Monday, the Consumer Financial Protection Bureau released its first semi-annual report to Congress under its new Acting Director, Mick Mulvaney. A routine procedure…

Blog

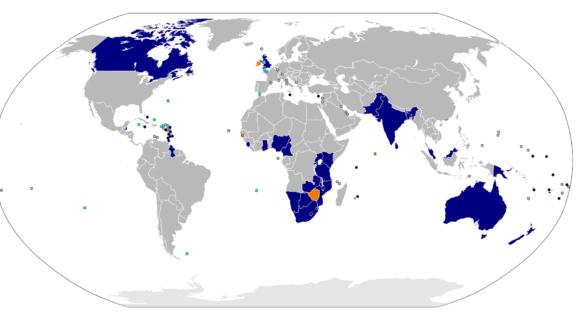

Commonwealth Nations Beating America on FinTech Regulation

While the United States continues to have healthy development of financial technologies—thanks predominately to unparalleled access to capital and technology—it is at risk of falling…

Blog

Arizona Becomes First State to Establish FinTech Sandbox

As the only state where all four North American deserts reside, it’s fitting that Arizona became the first state to establish a “sandbox” for financial…

Blog

3 Proposals to Temper the Federal Payday Loan Rule

When the Consumer Financial Protection Bureau finalized a rule regulating payday loans in October last year, I wrote that this could be the end…

Blog

3 Reasons the Senate Should Pass Financial Reform

The Senate is expected to vote on its first major piece of financial reform this week since the Dodd-Frank Act of 2010. A bipartisan bill…

Blog

The Government Killed Free Checking—Can Amazon Save It?

Amazon's move into banking services spells good news for currently under-served consumers, who often rely on relatively expensive financial services such as payday lending or…

Blog

If the Payday Lending Rule Stays, Ability-to-Repay Does, Too

Many in the financial services industry seem to believe the CFPB's ability to replay rule doesn’t impact them and it’s not worth fighting. That is…

Blog

Government Not Only Source of Regulation for Finance

One of the most misunderstood and underappreciated aspects of free market economics is the idea of private or “self” regulation. Up until recently, private enterprises…

Blog

The Myth of Independence at the Consumer Financial Protection Bureau

The myth of Consumer Financial Protection Bureau independence invalidates the Bureau’s protection from the President and Congress. The extreme insulation is predicated on protecting the…